How to leverage competitive analysis in marketing

By Molly Grant

To make smart decisions about your strategy, it’s helpful to understand how your brand fits in the marketplace compared to other brands. A brand and competitive analysis will help unearth marketing opportunities that will influence how you target your audience, launch date, campaign channels, and more.

That’s why every marketer should make sure that they’re keeping tabs on their competition with an in-depth competitive analysis: a place where they can track all the details of competing products. Once you have a comprehensive idea of what your competition is doing, you’ll not only be able to better sway their customers to your product — you’ll also have a clearer idea of where you stand in your industry and what opportunities are available.

Here’s a step-by-step guide on how you can use competitive analysis to stay one step ahead in your industry.

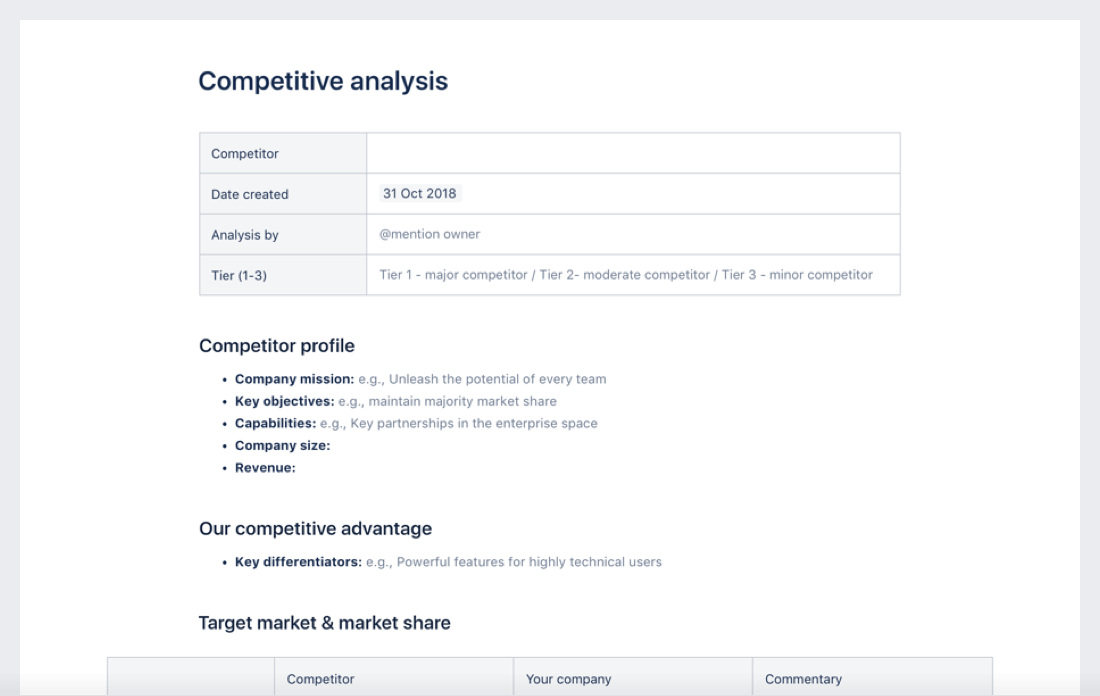

Bonus: Learn how to organize your findings using a simple competitive analysis example template in Confluence.

Step 1

Define your objectives

Before you jump into a competitive analysis, you want to have a clear idea of what you’re aiming to get out of it.

Ask yourself:

- Do you want to start appealing to new markets?

- Do you want to increase your brand’s perceived authority?

- Do you want to target the customers of one competitor in particular?

Set a clear goal that will keep you focused as you set out to do a deep dive into the marketing practices of your competitors.

It’s important to know that as you learn more about your competitors' own strengths and weaknesses, your goals may change— and that's okay! This initial goal should just be a kick-off point to help you get started.

Step 2

Develop a list of competitors

Which competitors you choose to analyze should be heavily based off of what you hope to get out of your competitive analysis. For example, if a lot of customers recently switched from your product to a different one, you may want to just focus on an extremely in-depth analysis of your one top competitor.

Most of the time, however, if you want to be known as a leader in your industry, keeping an eye on all of your competitors is considered best practice. This guide will focus on what to do if you’re taking a broader approach to competitive analysis.

How to ID your competition

Most marketers already have a pretty good idea of who their company’s top competitors are, but just to make sure you’re covering your bases, you should turn to Google. Try searching:

- The name of your product

- The name of your competitors' products

- A brief description of your product

- The name of your industry

This ensures that you have a good idea of who your competitors are – even new up-and-comers. You can also try talking to customers, industry leaders, and co-workers to double check that you’re not forgetting anyone important. You never know, you might be surprised to find out who your peers consider a respected player in the industry.

What are competitors’ strengths and weaknesses?

Start by collecting some basic information for each competitor about who they are and where they are positioned in your industry. This should include:

- Company mission

- Key objectives

- Capabilities (Key partnerships, etc.)

- Company size

- Revenue

- Target Market

- Market share

For private companies, financial information will be hard to come by, so you’ll have to deal in estimates. According to the founder of Saastr, one way to get an accurate estimate of a private company’s revenue is as follows:

1. Find the company size on LinkedIn’s company profile page.

2. Multiply the number of employees by $100,000 if the company is heavily-funded, $150,000 if the company is well-funded, or $200,000 if modestly funded for a ballpark estimate.

In general, for more qualitative information such as company mission, objectives, or capabilities, relevant information can often be found in press releases, stock reports, or even straight on the company website.

Rank by importance

Once you have a good idea of who your competition is, you should start to rank their importance. Separate competitors into three separate tiers, with tier 1 consisting of major competitors. The tiers will help you to assess your priorities, so that you can focus your time and energy where it’s most needed.

Remember that it’s not just about industry respect. You also have to take into account just how similar your products are, and if you’re both targeting the same audience.

Sometimes, even if a competitor is a huge force in your industry, they may not be a threat to your business if your products are different enough that they could complement each other, or be used simultaneously.

Step 3

Explore their product and marketing

Now to the fun part: you get to be a bit of a detective. Do a deep dive into your competitors' product and marketing strategy. You’ll end up using the details that you find to draw conclusions about the kind of audience your competitors might be targeting next or what direction they may be moving.

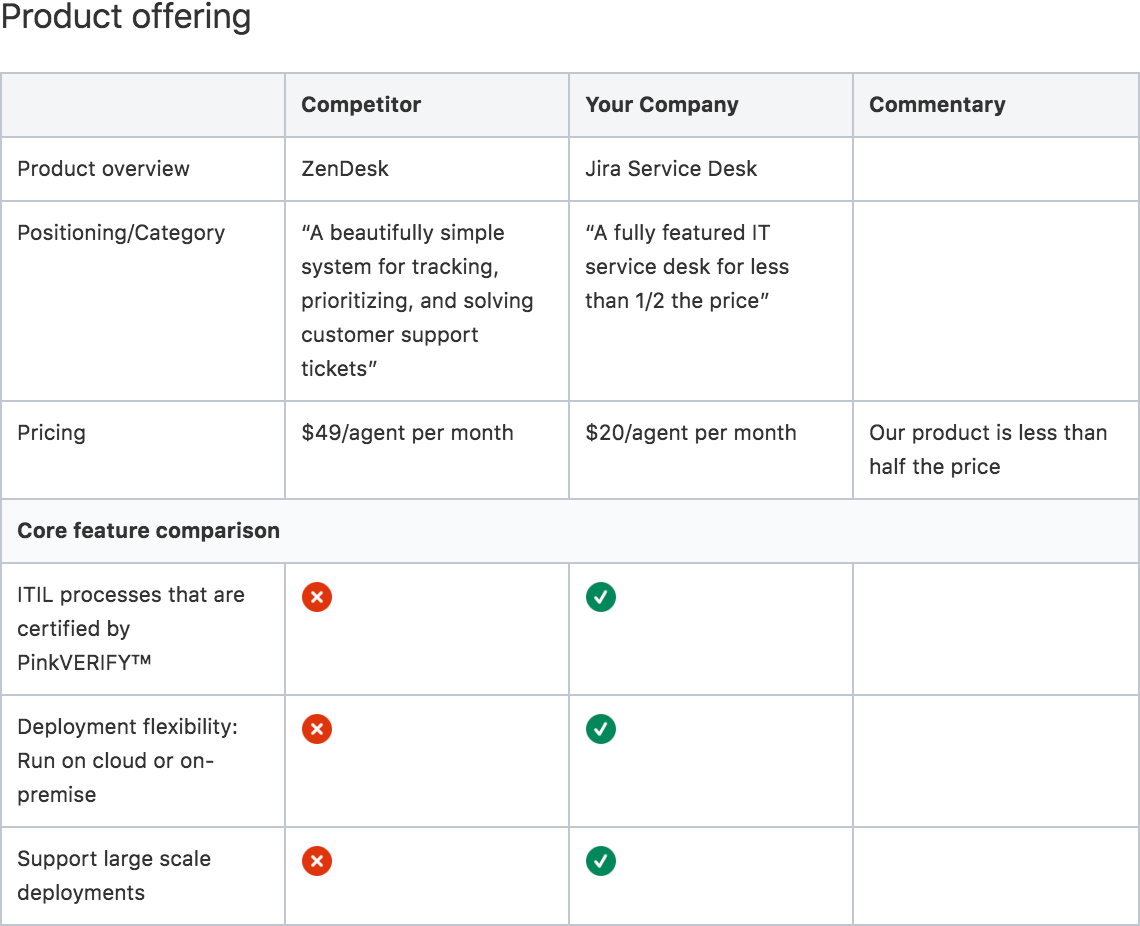

Fill in the product offering table in the Confluence competitive analysis template for an easy view of what they have that you don’t — and vice versa.

You should start off with a firm understanding of what your competitors' product does, and how it stacks up to your own.

Conduct an audit of the core features of each competing product and start to compare them against your own.

You should also take note of each product’s pricing and try to write a brief overview of what each product does. This way, all the basics are documented for reference.

What does your competition’s content look like?

From here, things get a little bit trickier. You’ll want to start analyzing marketing strategy, but unlike product information, you can’t find it in one neat little spot on a website. Instead, a company’s marketing materials are often distributed far and wide.

In particular, you should be examining assets like:

- Website

- Messaging and positioning

- Social media accounts

- Blog

- Landing pages

- Online ads

- Offline ads

- Videos and webinars

- Major events

- Customer resources

- Press releases

- Partnerships and investments

One helpful tool is Moat Analytics, which allows you to search for a brand and find all of their online ads in one place.

As you collect all of this information, make sure you organize it in a way that’s highly visible and easy to compare against your own product. You can use the built-in table for this in Confluence’s competitive analysis template.

Once you have everything laid out, start to look for patterns:

Strategy

What do these pieces of evidence tell you about their overall marketing or SEO strategy?

Targeting

What customers do they seem to be targeting?

Direction

What does their current advertising tell you about the direction this company seems to be moving?

Now’s your time to start drawing some conclusions from all the data you’ve collected.

Get inside customers' heads

Now that you have a pretty solid idea of your competitors and their strategies, it’s time to find out what customers think. The best way to do this, of course, is to talk to them.

In particular, you should try to get in touch with customers who have switched from your product to a competitor’s and customers who have switched from a competitor’s product to yours. This way you’ll be able to talk with people who have perspective on both products' strengths and weaknesses.

Check out the customer interview play in the Atlassian Playbook for tips on how to talk to customers.

In addition to talking to customers, review sites can be a great way to gauge how customers feel about your competitors' products as well.

Step 4

Conduct a SWOT analysis

You’ve done all the work and collected all the data. Now all that’s left to do is be honest about how you stack up.

A SWOT Analysis, where you take account of you and your competitor’s strengths, weaknesses, opportunities, and threats is a good way to think about what you can do to become a stronger force in your industry.

Ask yourself, what are the strengths and weaknesses about their:

- Features?

- General marketing strategy?

- Messaging?

At this point, it’s easy to get wrapped up in everything that your competition is doing well. Still, that doesn’t mean that you should try to be them. You can take inspiration from their features, messaging, or general marketing strategy, but it’s important that you remain committed to your product’s unique brand.

This exercise should also open your eyes to key markets or needs that your competitors aren’t focused on, where you have the opportunity to thrive.

Step 5

Regularly update your competitive analysis

And with that, you’re done! For now, at least.

It’s vital that you don’t lose track of what your competitors are doing moving forward. As you probably already know, products, marketing strategy, and brand perception change all the time. You should be updating your competitive analysis about once a fiscal quarter. That way, you can be sure that no competitors will catch you by surprise.

Set yourself up for success with this collection of page templates for Confluence. Not a Confluence user? No worries: they’re available in PDF form, free of charge.