Our Q3 FY22 letter to shareholders

An update to customers, stakeholders, and shareholders on our mission to unleash the potential in every team.

Fellow shareholders,

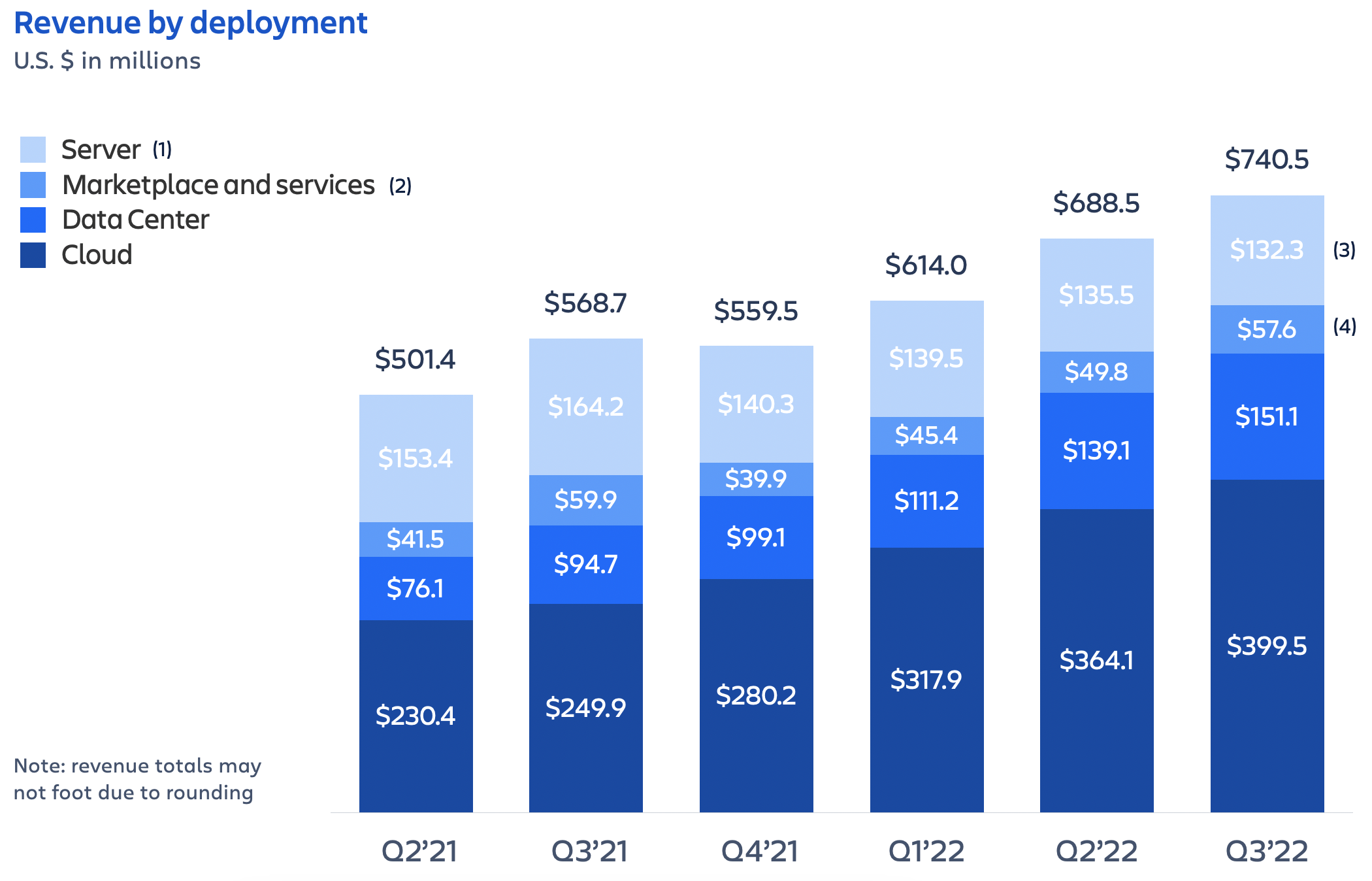

Atlassian delivered a strong quarter once again. Subscription revenue grew 59% year-over-year, with Cloud revenue growing 60% year-over-year. We continue to see a high level of demand for our products across all of our three markets, which highlights the significant opportunities in front of us.

We’re fresh off an amazing Team ‘22 in Las Vegas and are more energized than ever. We spoke with customers at every opportunity and learned more about how Atlassian can meet their needs, which we’ll share throughout this letter. If you missed us at our Investor Day event held at Team ’22, you can view all the materials and watch a recording on our investor relations site. We’d love for you to learn more about our massive market opportunities, platform, strategic bets, and future trajectory.

Investor Day 2022 at a glance

Before anything else, however, we want to acknowledge that we let our customers down when an outage disrupted service for 775 customers earlier this month. This was not a result of a cyber-attack and there was no unauthorized access to customer data. Although the incident affected a tiny fraction of our 200,000+ cloud customer base, even one disrupted customer is one too many. All affected customers were fully restored, and in the spirit of our “open company, no bullshit” ![]() value, we will publish a full post-incident review at the end of this week.

value, we will publish a full post-incident review at the end of this week.

Operational excellence is all about continuous learning and improvement. Ultimately, we’ll be stronger because of this experience. We fully understand what caused the problem from a technical and operational standpoint, and how to prevent similar incidents in the future. We now have more robust incident response and communications processes in place. And we’re open to learning more as we speak with affected customers individually about how we can rebuild trust.

Cloud-first things first

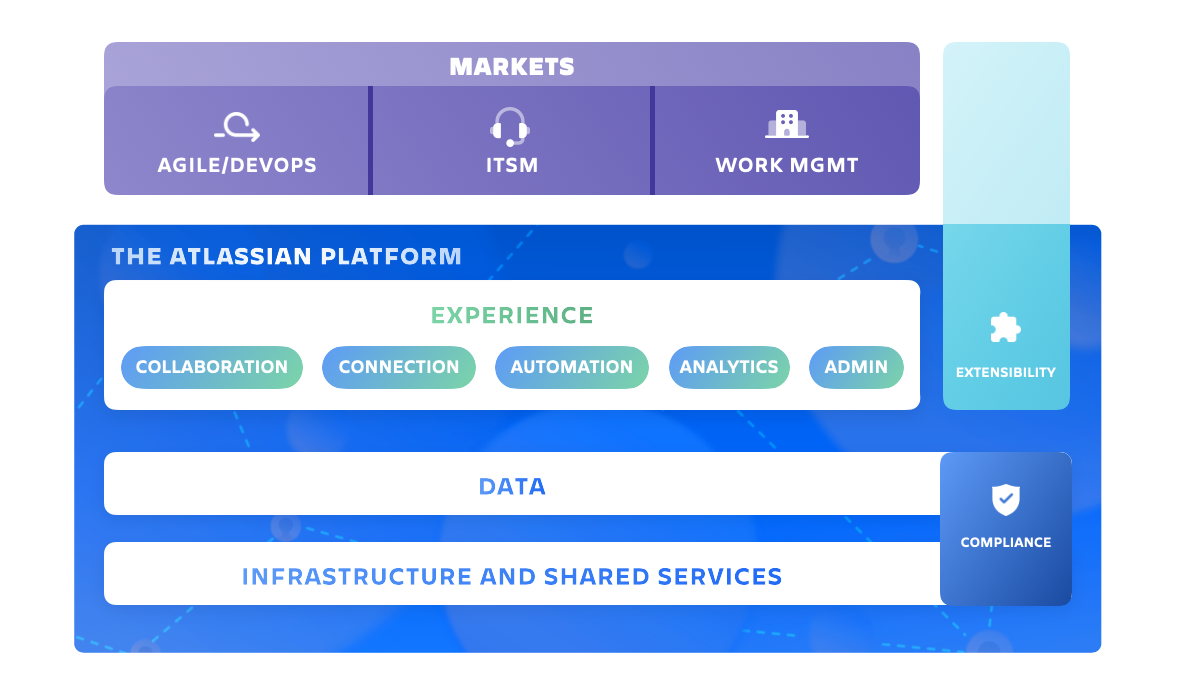

Atlassian’s world-class platform allows us to meet the diverse needs of customers across the global agile/DevOps, IT service management (ITSM), and work management markets.

Because our platform lets us build functionality once, then surface it everywhere, we multiply the ROI we get from every hour spent on product development and are able to deliver new innovations faster than ever before. For example, we achieved HIPAA compliance for Jira Software and Confluence Cloud in Q3, with compliance for Jira Service Management on the near-term horizon. This comes right on the heels of compliance for the EMEA financial services industry in Q2 and expanded data residency options in Q1.

With every evolution of our platform, an increasing number of our Server and Data Center customers are able to begin their Cloud migration journey. We’ve now migrated over one-third of our Server user base, and more customers complete their migration every day. And not just from Server products, but from Data Center as well.

Looking ahead, we expect Cloud revenue to grow approximately 50% year-over-year for FY23 and FY24, with approximately 10 points of Cloud revenue growth to be driven by migrations.

[Thanks to Atlassian Cloud products], our team can focus on innovation that serves our clients. This ultimately supports Fugro’s vision to unlock insights from Geo-data for a safe and liveable world.

– Scott Carpenter, Global Cloud Architect at Fugro

Driving innovation in three global markets 💡

As we spoke with customers at Team ’22, one thing we heard over and over was how challenging it can be to give teams the freedom they need to move quickly, while still keeping everyone pointed in the same direction.

We believe the secret is to create a culture of autonomy and alignment. The more an organization shares an understanding of what problem needs to be addressed and why, the more teams can work independently and collaborate freely with each other to find the best solution. That’s why Atlassian products bring all types of teams together, empowering them to work, communicate, and celebrate in whatever way works best for them.

Additionally, we learned from our Executive Customer Advisory Board (CAB) that prioritization is a constant concern. How do companies make sure teams are working on the highest-value projects? How can they address capacity issues or help teams that are struggling?

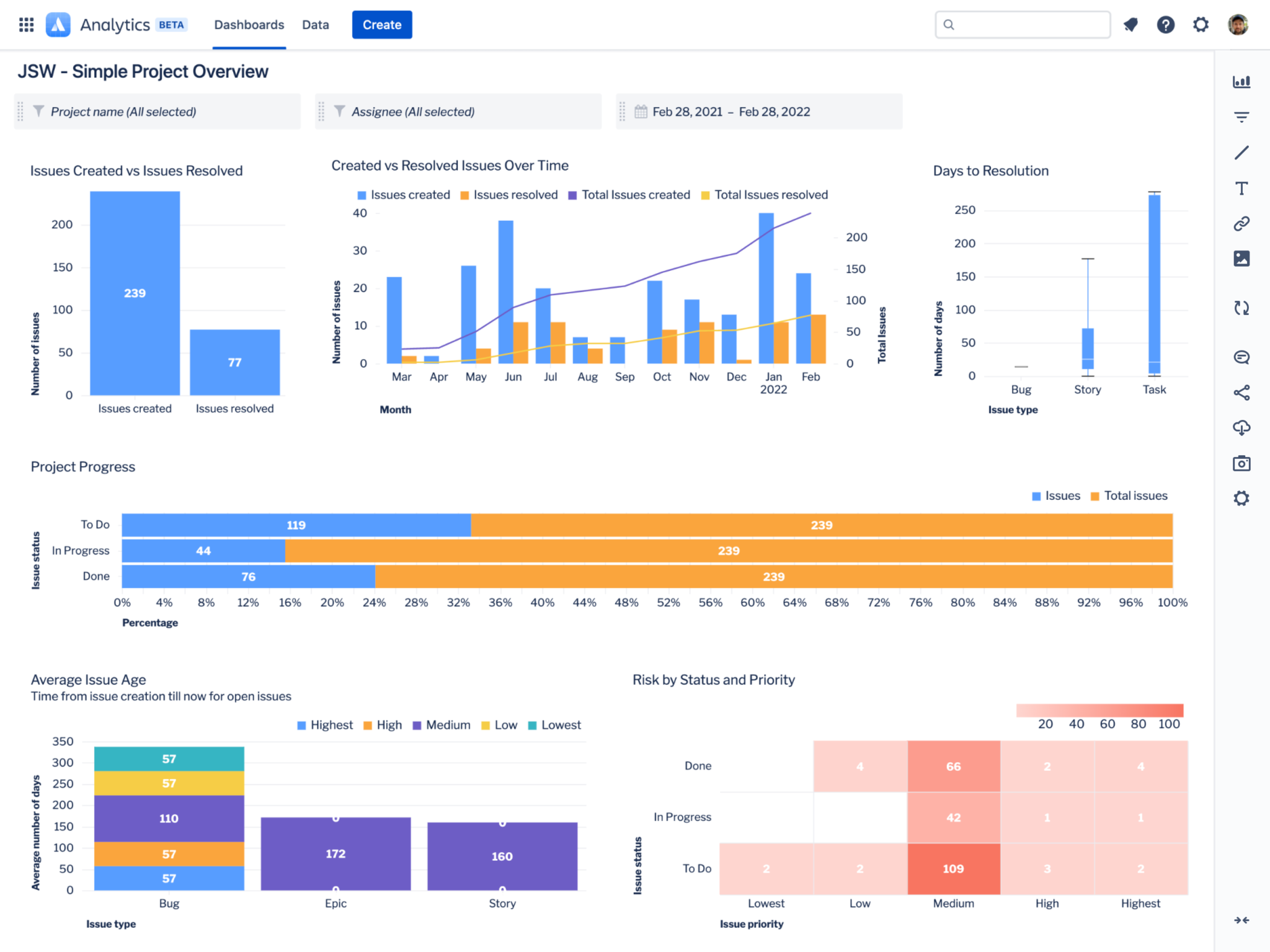

Enter Atlassian Analytics, a data visualization tool built on our recent acquisition of Chartio. It lets customers build custom dashboards to track things like release readiness and team capacity so they know where to allocate resources. Atlassian Analytics is powered by the Atlassian Data Lake and currently pulls in data from Jira Software and Jira Service Management, with support for more Cloud products coming soon. It can even incorporate data from other business intelligence systems to provide a more comprehensive view.

Across our three massive (and increasingly interconnected) markets, Atlassian products connect people to projects and strategies, as well as to each other. In other words, we make work visible. And that goes a long way toward aligning priorities across the organization so teams can decide for themselves how best to contribute, then go get it done.

Agile and DevOps

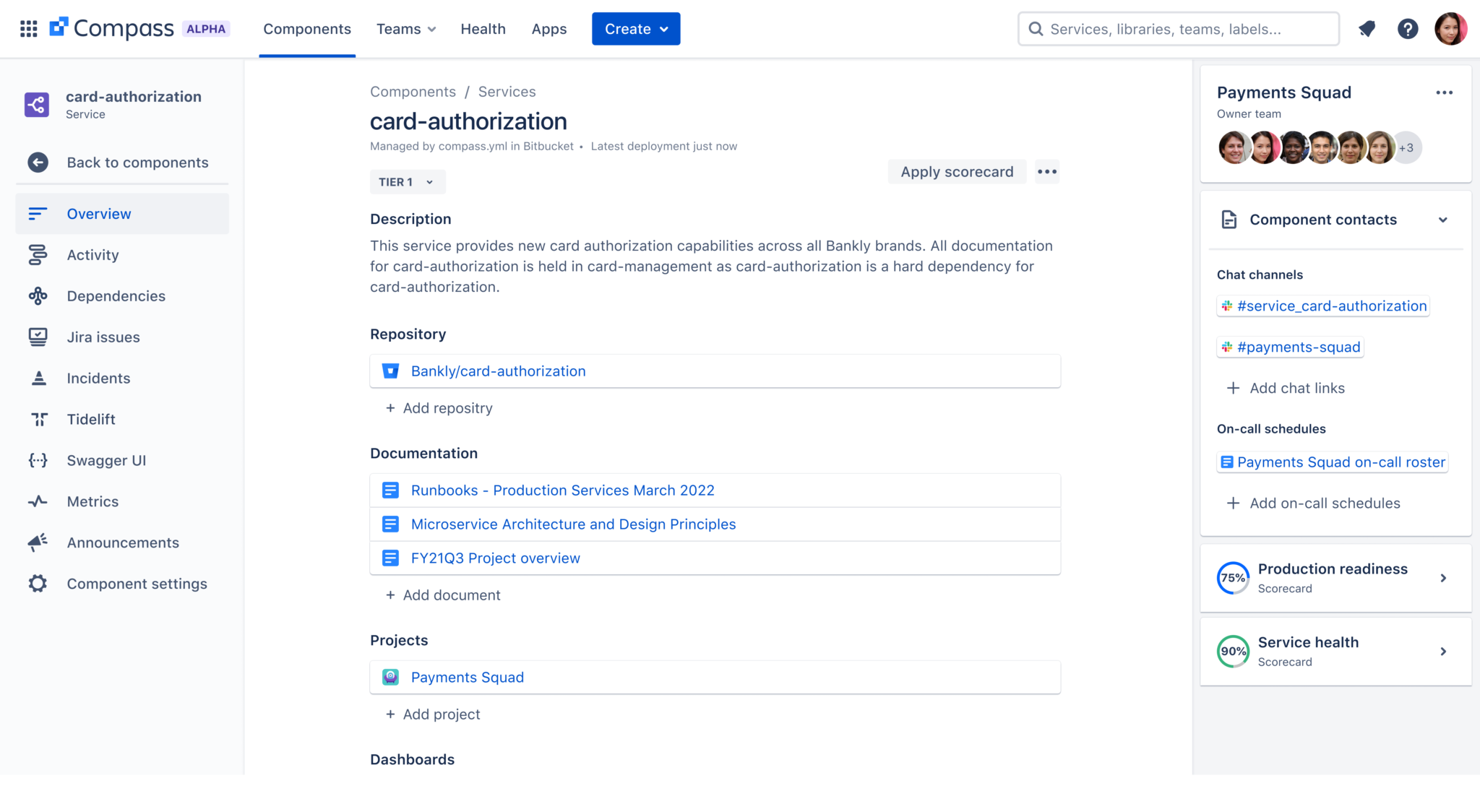

According to Atlassian’s recent State of the Developer Survey, 54% of developers say the number of tools they use in their role is increasing, and a majority of developers whose toolchains are expanding say this makes their jobs more complex – especially those whose toolchains are growing and inflexible. Plus, in a DevOps culture, software teams are increasingly involved in the operations side, necessitating even more tools to get the job done. When left unmanaged, this becomes unwieldy over time.

As we announced at Team ‘22, Compass is Atlassian’s answer to this problem, offering developers a unified view of the components and the teams that collaborate on them. Compass is currently available to select customers through our early access program, with an eye toward making it generally available later this calendar year.

Atlassian has an incredible opportunity to become a strategic partner for our customers as they navigate increasing competition and embrace emerging technologies. For software teams, thriving in this environment means adopting agile and DevOps practices. And while tools alone can’t make a team agile, products like Jira Software and Jira Align can help – especially when agile and DevOps transformations are happening at enterprise scale.

In a total economic impact (TEI) study released this month, Forrester found that for organizations with approximately 2,000 developers and product managers, Jira Align delivers a cumulative net benefit of roughly $20 million over three years based on improved productivity, reduced waste due to better investment decisions, and incremental revenue from faster time-to-market. Forrester also found that our Open DevOps framework saves developers 1.5 hours per day and delivers an ROI of more than 350% over 3 years. Atlassian has always strived to deliver more value than we charge for and it’s gratifying to see our success in that regard confirmed by an independent source.

IT service management

The way our customers are running internal service and support teams has changed forever, especially those who’ve transitioned to digital-first mode just within the past couple of years. With “desk drive-bys” a thing of the past, service teams need to make getting help simple and lightning fast. With that in mind, we are now shipping a Confluence-powered knowledge base as part of Jira Service Management at no extra charge.

With a native knowledge base, it’s easy for support agents to create articles on common topics that facilitate employee self-service, right within Jira Service Management. And thanks to our platform’s “build once, run everywhere” architecture, knowledge base articles feature all the rich content and formatting options Confluence has to offer, such as macros, inline comments, emojis, embedded media…the works.

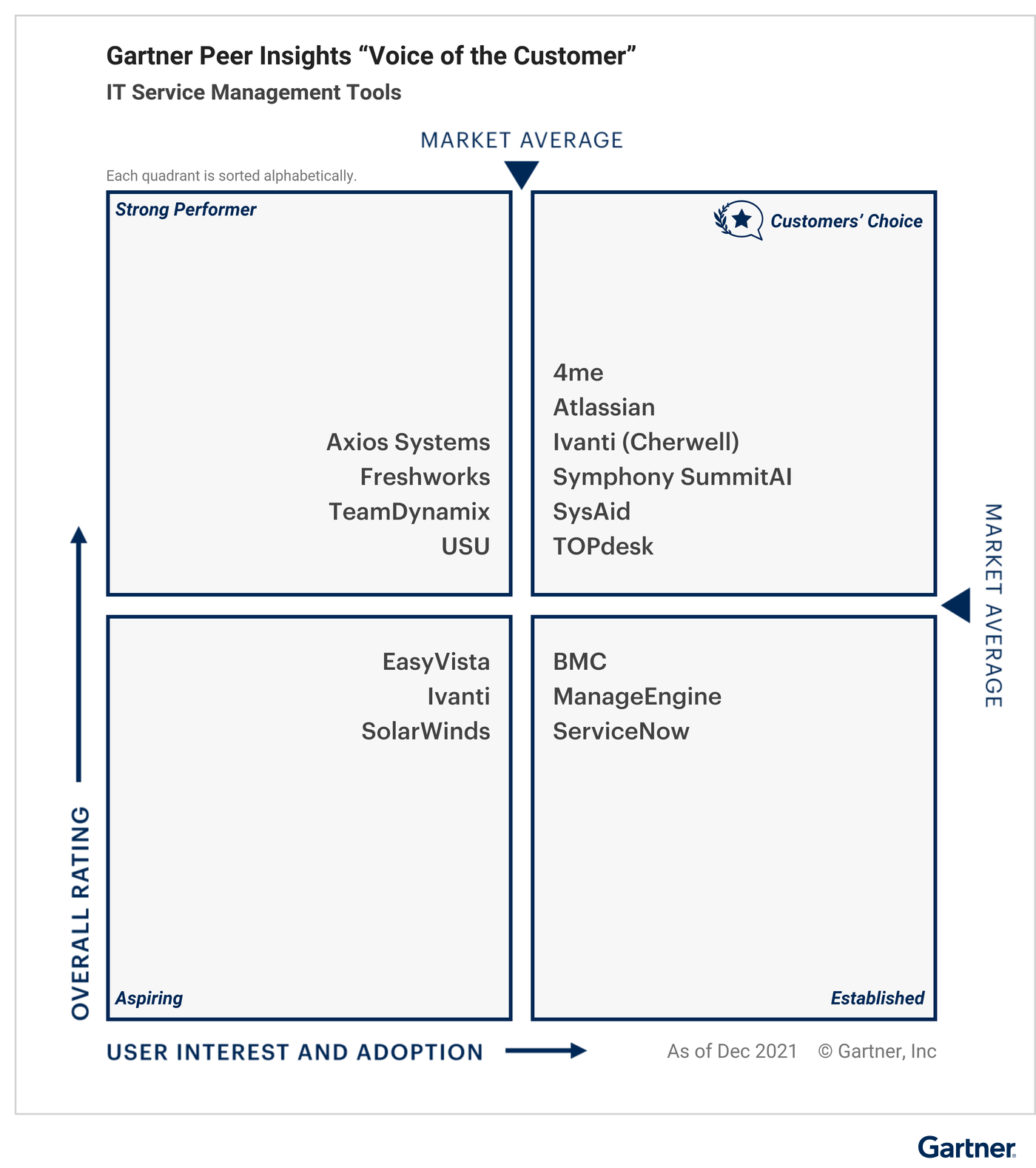

A native knowledge base is yet another example of the value Jira Service Management delivers and why it’s so beloved by customers. In fact, we’re delighted to share that Atlassian was recognized with the Customer’s Choice distinction in the Gartner Peer Insights “Voice of the Customer” IT Service Management Tools report.

With 40,000 customers and counting, Jira Service Management is Atlassian’s fastest-growing product at scale. We’ll keep investing here to deliver new capabilities that unleash more of IT teams’ potential.

Work management

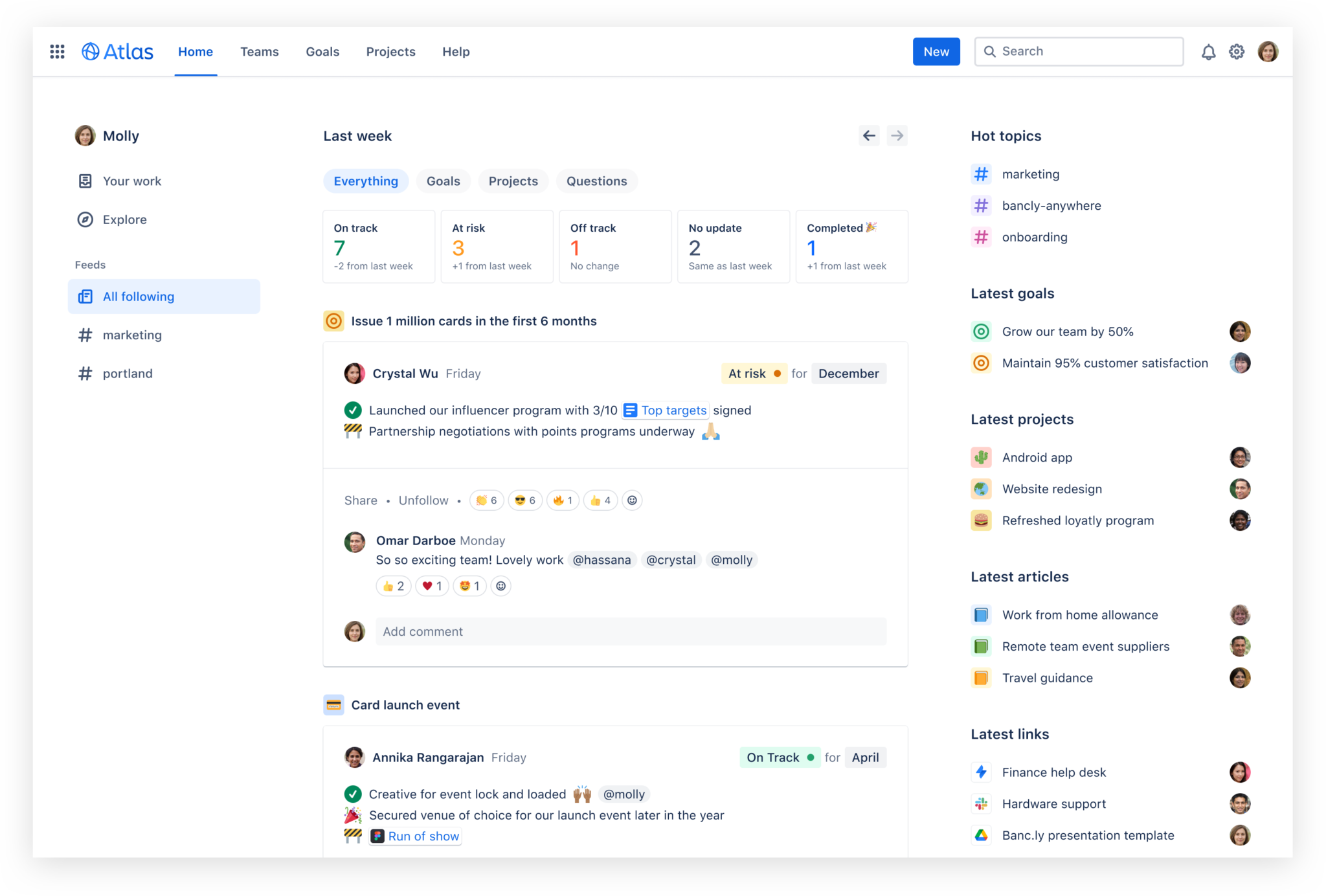

As cross-functional collaboration takes root inside more companies, teams are discovering that it can be challenging to keep tabs on all the projects that matter to them. Our latest offering in the work management space, Atlas, changes that.

Atlas surfaces progress updates and dependencies with other projects to help avoid bottlenecks. Organizations can also use Atlas to establish goals (think KPI targets or the “O”s in Objectives and Key Results), then link them to all the projects and people contributing to each goal so it’s easy to see how everybody’s work is connected. And because it’s built on the Atlassian Cloud platform, collaborative features like comments, @mentions, and reactions are baked right in.

In Q3, Trello launched one of its most powerful features yet, which allows teams to track a customized portfolio of work across multiple cards and multiple boards. Dashcards are a special type of Trello card that summarizes key metrics on the card cover and can be opened to reveal the component cards and their metrics. With Dashcards, teams have easier visibility into all their workstreams while still enjoying the flexibility Trello is famous for.

When it comes to managing individual projects, Confluence has always been the place to lay out detailed plans that link out to tasks tracked in Jira or Trello. Now we’ve flipped the script with a new integration that surfaces project plans and related pages inside Jira, putting all the information teams need at their fingertips – no matter which product they happen to be in.

And if they happen to be in Jira Work Management, they’ll now be able to see updates to a task’s status, assignee, due date, and more in real-time with the new multiplayer mode. Multiplayer improves visibility and turns Jira Work Management into the place work happens – not just where it’s tracked.

Jira, or it didn’t happen.

– Jade Melcher, Program Management Lead at Sprout Social

Supporting Ukraine and protecting our customers

Atlassian watched in horror as Russia invaded Ukraine this quarter. While we do not have any direct employees in Russia or Ukraine, we took immediate action to support the safety of our Ukrainian contractors and are providing ongoing support for Atlassians with family and friends in Ukraine. People are at the heart of what we do, meaning their well-being comes first. Always.

To enhance the protection of our customer data, we updated our network infrastructure to ensure customer data doesn’t flow through the affected regions. We remain in close contact with our partners in Ukraine to provide both direct and indirect support. Atlassian has also paused new sales within Russia and Belarus, and suspended licenses owned by the Russian government and businesses supporting the war. That said, we continue to honor the obligations we have to our other existing customers in Russia. We believe cutting ties with the perpetrators of this war while still supporting customers who are uninvolved is the best way to live our mission and values. Our public statement on Russia’s invasion of Ukraine can be found here: Atlassian stands with Ukraine – Work Life by Atlassian.

Atlassian has a new Chief Technology Officer 🎉

We are thrilled to announce that Rajeev Rajan will join Atlassian as our new Chief Technology Officer (CTO). Rajeev brings a wealth of knowledge and experience in scaling global technology companies, having spent nearly five years at Meta, most recently as Vice President and Head of Engineering for Facebook and Head of Office for Meta in the Pacific Northwest Region. Prior to that, Rajeev spent over two decades at Microsoft across multiple products from Exchange to SQL Server to Active Directory, culminating in Office 365. We’re excited to welcome Rajeev to Atlassian on May 19, 2022.

As previously announced last quarter, Sri Viswanath, Atlassian’s current CTO, will be leaving the company at the end of fiscal year 2022.

We are as excited as ever to pursue the massive opportunities in front of Atlassian. Here’s to the road ahead, and to unleashing the potential of every team.

– Mike and Scott

The bottom line

- Atlassian continues to deliver innovative new products and features across the agile/DevOps, ITSM, and work management markets. And we can do it faster than ever, thanks to our cloud platform.

- This month’s outage revealed areas where we can improve the way we serve customers and we’re already incorporating the lessons learned.

- Atlassian stands with the people of Ukraine and took immediate action to protect our contractors there, as well as our customers’ data.

Customer highlights

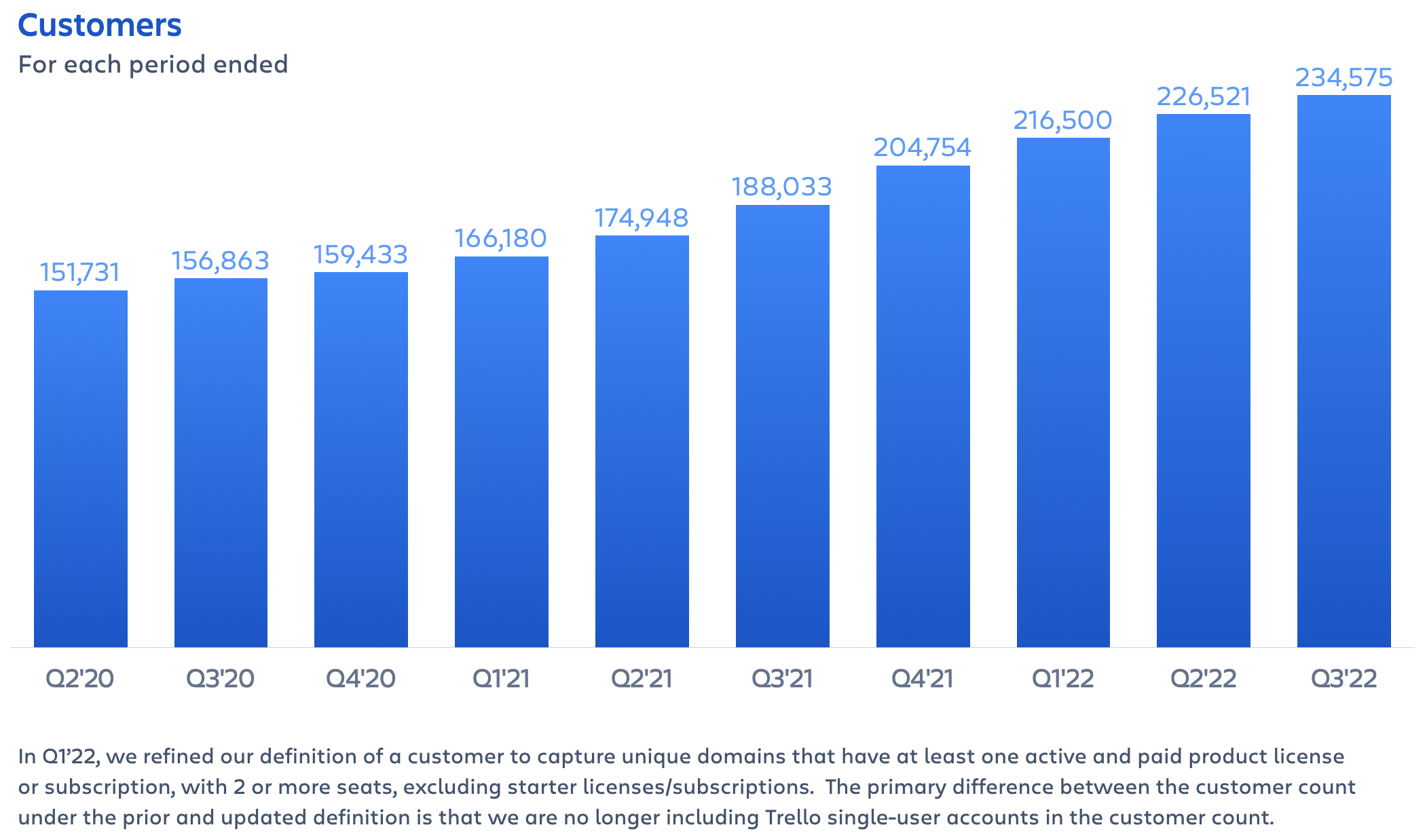

We ended Q3 with a total of 234,575 customers, a net increase of 8,054 from Q2. During the quarter, our overall customer count was reduced by approximately 1,800 due to Russia-based customers dropping out of our total. Some were suspended and others are unable to pay us, owing to sanctions levied on their payment networks.

Seeing so many customers and investors in person at Team ‘22 was fantastic after two years of Zoom-only interactions. More, please! We welcomed thousands of customers, partners, and Atlassians to the event in Las Vegas, and an additional 12,000+ people joined virtually from around the world. If you missed the event, be sure to take advantage of the on-demand streaming content, as well as the recording and written materials from Investor Day.

For me, getting to meet directly with customers through events like our Executive CAB session and Technical Account Manager Day is always my favorite part of the conference. Customers were more enthusiastic about Atlassian than I’ve ever seen in my 10 years here. Several of our Solution Partners told me that they can’t hire fast enough to keep pace with the increasing demand for our products.

Hearing customers describe the difference Atlassian has made in terms of visibility and clarity – and the ripple effects on their well-being in and outside of work – reminds all of us why we do what we do.

Whether it’s inflation, wars, or pandemics, many of our customers are contending with situations they’ve never seen before. However, in every conversation, it’s clear that having Atlassian behind the scenes supporting them as they navigate these challenges and grow their businesses is critical. And we see this manifest in our customers’ loyalty.

We provide the glue between the teams. We help customers be agile, learn, and adapt quickly. We owe it to them to continue learning from our own experiences, whether wins or losses, and help them realize their full potential. When we say we make software with humans at the center, we mean it.

– Cameron

The bottom line

- Customer growth remained strong this quarter, despite the loss or suspension of approximately 1,800 Russia-based accounts.

- Team ‘22 in Las Vegas was a huge success. In-person attendance and online viewership numbers demonstrate how much our customers value Atlassian.

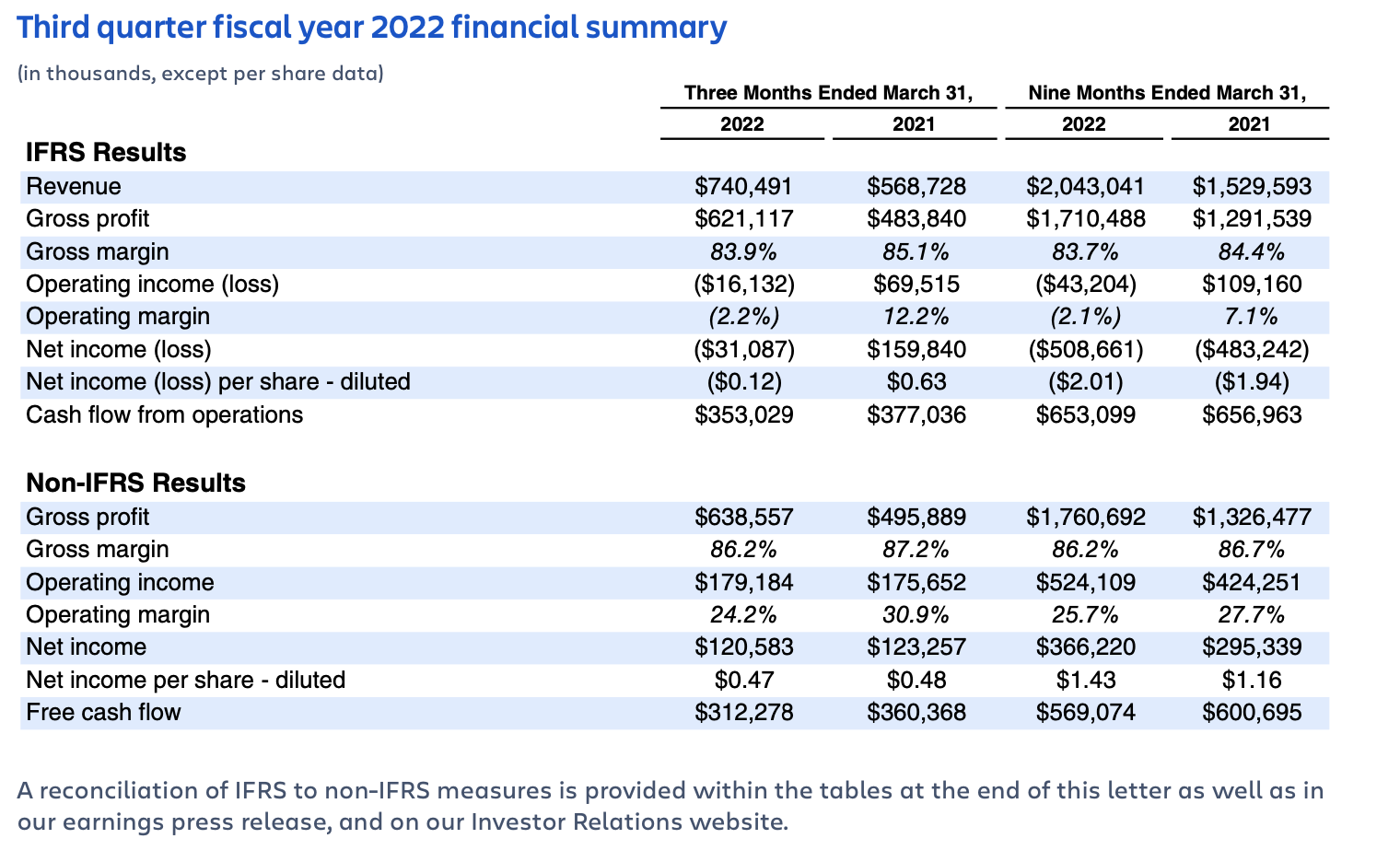

Financial highlights

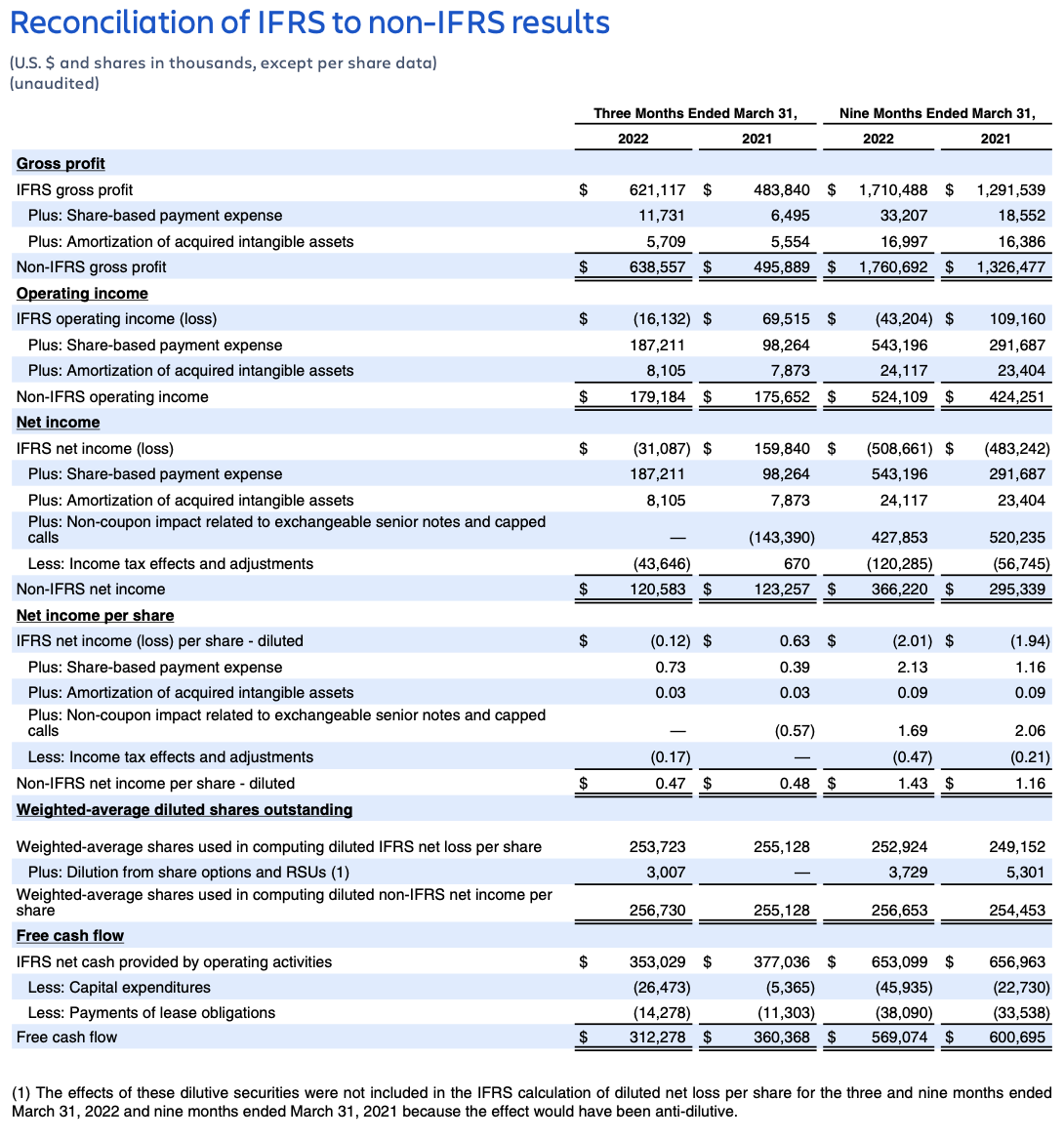

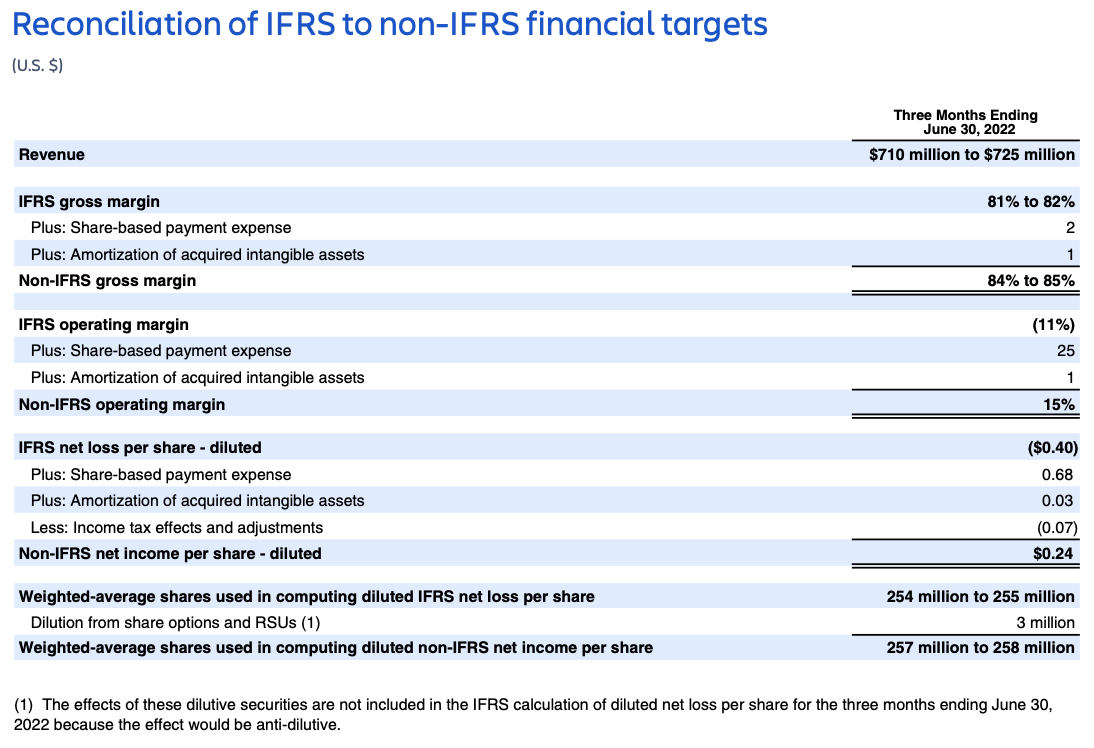

A reconciliation of IFRS to non-IFRS measures is provided within the tables at the end of this letter as well as in our earnings press release, and on our Investor Relations website.

Third quarter fiscal year 2022

Q3’22 was another quarter of strong execution from Atlassian. We continue to see strong demand for our products and steady progress with Cloud migrations.

Highlights for Q3’22 include:

- Subscription revenue grew 59% year-over-year. Cloud revenue grew 60% year-over-year while Data Center revenue grew 59% year-over-year.

- Free cash flow totaled $312.3 million, representing a 42% free cash flow margin.

- In Q3’22, we added 791 net new Atlassians, our largest sequential headcount growth quarter on record. We will continue to invest in top-tier talent wherever they are around the globe to drive durable growth across our three core markets.

Recall that during Q3’21 our financial results saw accelerated short-term demand for on-premises products as a result of customers purchasing ahead of the discontinuation of new Server license sales and price changes to on-premises products. The significant, event-driven purchasing seen in Q3’21 created a tough compare for Q3’22 total revenue growth.

Revenue by geography was consistent with expectations across all geographies. Recall that in Q3’21, we saw significant short-term, “event-driven” on-premises demand that was primarily driven by partners in EMEA, and to a lesser extent APAC. Q3’22 did not see the same magnitude of event-driven behavior. This made for a particularly tough compare in EMEA, and to a lesser extent APAC, which is reflected in the Q3’22 revenue by geography growth rates.

In Q3’22 we did not observe any changes in the demand environment in EMEA. In Q3, the proportion of total revenue generated in EMEA increased sequentially to 39% in Q3’22 from 38% in Q2’22.

While it’s still early in Q4’22, to date, we have not seen any material changes in demand levels specific to Europe and we continue to see strong growth around the world.

Headcount

Total employee headcount was 8,179, an increase of 791 employees since the end of Q2’22. We hired across all major functions, with the largest number being added in R&D.

Financial targets

Fiscal year 2022 outlook

Revenue

For FY22, we expect to see the following trends:

Subscription revenue

- We now expect subscription revenue growth year-over-year to be in the mid-50s % range for FY22, versus our prior expectation of approximately 50% growth.

- We expect our year-over-year subscription revenue growth rate to be lower in the second half of FY22 relative to the first half.

- Recall, our subscription revenue in Q3’21 benefited from a strong Data Center revenue growth rate, driven by accelerated demand resulting from the discontinuation of new Server license sales and customers purchasing ahead of both Server and Data Center price increases that went into effect during Q3’21.

- For Data Center revenue, a portion is recognized up-front as subscription revenue in the period that the contract is signed, while the remainder is recognized ratably over the life of the contract.

- In addition, it is important to note that Q4’21 continued to see strong Data Center revenue growth, as it benefited from ratable revenue rolling off of our deferred revenue balance. Our deferred revenue balance also benefited from the event-driven purchasing observed in Q3’21, as noted above.

- For FY22, we expect our Cloud revenue growth rate to accelerate relative to FY21.

Maintenance revenue

- We expect maintenance revenue to slowly contract over the remainder of FY22 as customers continue to migrate to our subscription products. In Q4’22, we expect maintenance revenue to decline to approximately $115 million.

Other revenue

- We expect Marketplace revenue, which is reflected in other revenue and the primary driver of this line item, to be approximately flat relative to FY21.

- Recall, Marketplace revenue will be impacted by the lowered Marketplace take rates on the sales of third-party Cloud apps which are designed to incentivize further Cloud app development.

- Note that revenue on the sale of third-party Marketplace apps is recognized in the period the product is purchased.

- As noted previously, upgrades of existing licenses are no longer offered, and as a result, we do not expect any material level of perpetual license revenue in Q4’22 or beyond.

Profitability

We expect to further ramp our hiring plans in Q4’22 and beyond. As noted above, hiring and the retention of our talented team is the key to Atlassian’s future. We will continue to hire talent from across the globe with the majority in R&D.

Our investments will focus on platform advancements, new Cloud features and products in each of our three core markets, and bolstering the ecosystem around us.

We expect the following in FY22:

- Gross margin will decline in FY22 relative to FY21 due to our investments to support our Cloud migrations and the shift from Server to Cloud. These investments include migration-focused personnel costs as well as increased cloud hosting costs.

- Operating margin is expected to decline as we continue to invest in innovation, hiring, and retaining top-tier talent.

- Free cash flow is expected to see variability as a result of the business mix shift to the Cloud as well as the impact of any event-driven customer purchasing activity related to price changes, loyalty discount reductions (effective July 1, 2022), and the end of Server upgrades. The reduction in operating margin in FY22 noted above will also impact our free cash flow margin in FY22.

The above trends reflect our commitment to our long-term strategy and the massive market opportunities in front of us that we are well equipped to tap.

Share count

We expect share-based compensation (SBC) expense to be significantly higher in FY22 versus FY21 as we invest in hiring and retaining our team. Recall that we report our financial statements in accordance with IFRS. SBC is recognized on a more front-loaded schedule compared to U.S. GAAP. SBC is also impacted by a number of variables each of which are inherently difficult to forecast. We are targeting approximately 1-2% share count dilution in FY22. Despite the expected increase in SBC expense in FY22, our comparable share dilution will still be ranked in the lower half of our peer company set.

Redomiciling from the United Kingdom to the United States

As we noted at Investor Day, we are exploring redomiciling our parent holding company from the United Kingdom to the United States.

We believe moving our parent entity to the United States will increase our access to a broader set of investors, support inclusion in additional stock indices, improve financial reporting comparability with our industry peers, streamline our corporate structure, and provide more flexibility in accessing capital.

We do not anticipate significant operational or business model changes as a result.

We also do not expect our overall corporate income tax rate to change materially. Our income tax rate is primarily driven by our operations in the U.S. and Australia. This would not change after we redomicile. Redomiciling to the U.S. would lead us to change our accounting standards from IFRS to U.S. GAAP.

This transaction is subject to final approval, including by our Board of Directors and shareholders. We’re continuing to work on this initiative in preparation for a final Board review. If we secure Board approval, we would submit the proposal for shareholder approval. Pending all required approvals, we would aim to close the transaction early in fiscal year 2023 and begin reporting under U.S. GAAP for Q1’23.

FORWARD-LOOKING STATEMENTS

This shareholder letter contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, which statements involve substantial risks and uncertainties. All statements other than statements of historical fact could be deemed forward looking, including risks and uncertainties related to statements about our products, customers, anticipated growth, infrastructure, platform, proposed redomiciliation, outlook, technology and other key strategic areas, and our financial targets such as revenue, share count, and IFRS and non-IFRS financial measures including gross margin, operating margin, and net income (loss) per diluted share.

We undertake no obligation to update any forward-looking statements made in this shareholder letter to reflect events or circumstances after the date of this shareholder letter or to reflect new information or the occurrence of unanticipated events, except as required by law.

The achievement or success of the matters covered by such forward-looking statements involves known and unknown risks, uncertainties, and assumptions. If any such risks or uncertainties materialize or if any of the assumptions prove incorrect, our results could differ materially from the results expressed or implied by the forward-looking statements we make. You should not rely upon forward-looking statements as predictions of future events. Forward-looking statements represent our management’s beliefs and assumptions only as of the date such statements are made.

Further information on these and other factors that could affect our financial results is included in filings we make with the Securities and Exchange Commission from time to time, including the section titled “Risk Factors” in our most recent Forms 20-F and 6-K (reporting our quarterly results). These documents are available on the SEC Filings section of the Investor Relations section of our website at: https://investors.atlassian.com.

ABOUT NON-IFRS FINANCIAL MEASURES

Our reported results and financial targets include certain non-IFRS financial measures, including non-IFRS gross profit, non-IFRS operating income, non-IFRS net income, non-IFRS net income per diluted share, and free cash flow. Management believes that the use of these non-IFRS financial measures provides consistency and comparability with our past financial performance, facilitates period-to-period comparisons of our results of operations, and also facilitates comparisons with peer companies, many of which use similar non-IFRS or non-GAAP financial measures to supplement their IFRS or GAAP results. Non-IFRS results are presented for supplemental informational purposes only to aid in understanding our results of operations. The non-IFRS results should not be considered a substitute for financial information presented in accordance with IFRS, and may be different from non-IFRS or non- GAAP measures used by other companies.

Our non-IFRS financial measures include:

Non-IFRS gross profit. Excludes expenses related to share-based compensation and amortization of acquired intangible assets.

Non-IFRS operating income. Excludes expenses related to share-based compensation and amortization of acquired intangible assets.

Non-IFRS net income and non-IFRS net income per diluted share. Excludes expenses related to share-based compensation, amortization of acquired intangible assets, non-coupon impact related to exchangeable senior notes and capped calls, the related income tax effects on these items, and a discrete tax impact resulting from a non-recurring transaction.

Free cash flow. Free cash flow is defined as net cash provided by operating activities less capital expenditures, which consists of purchases of property and equipment and payments of lease obligations.

Our non-IFRS financial measures reflect adjustments based on the items below:

- Share-based compensation.

- Amortization of acquired intangible assets.

- Non-coupon impact related to exchangeable senior notes and capped calls:

- Amortization of notes discount and issuance costs.

- Mark to fair value of the exchangeable senior notes exchange feature.

- Mark to fair value of the related capped call transactions.

- Net loss on settlements of exchangeable senior notes and capped call transactions.

- The related income tax effects on these items, and a discrete tax impact resulting from a non-recurring transaction.

- Purchases of property and equipment and payments of lease obligations.

We exclude expenses related to share-based compensation, amortization of acquired intangible assets, non-coupon impact related to exchangeable senior notes and capped calls, the related income tax effects on these items, and a discrete tax impact resulting from a non-recurring transaction from certain of our non-IFRS financial measures as we believe this helps investors understand our operational performance. In addition, share-based compensation expense can be difficult to predict and varies from period to period and company to company due to differing valuation methodologies, subjective assumptions, and the variety of equity instruments, as well as changes in stock price. Management believes that providing non-IFRS financial measures that exclude share-based compensation expense, amortization of acquired intangible assets, non-coupon impact related to exchangeable senior notes and capped calls, the related income tax effects on these items, and a discrete tax impact resulting from a non-recurring transaction allow for more meaningful comparisons between our results of operations from period to period.

Management considers free cash flow to be a liquidity measure that provides useful information to management and investors about the amount of cash generated by our business that can be used for strategic opportunities, including investing in our business, making strategic acquisitions, and strengthening our statement of financial position.

Management uses non-IFRS gross profit, non-IFRS operating income, non-IFRS net income, non-IFRS net income per diluted share, and free cash flow:

- As measures of operating performance, because these financial measures do not include the impact of items not directly resulting from our core operations.

- For planning purposes, including the preparation of our annual operating budget.

- To allocate resources to enhance the financial performance of our business.

- To evaluate the effectiveness of our business strategies.

- In communications with our Board of Directors and investors concerning our financial performance.

The tables in this shareholder letter titled “Reconciliation of IFRS to non-IFRS Results” and “Reconciliation of IFRS to non-IFRS financial targets” provide reconciliations of non-IFRS financial measures to the most recent directly comparable financial measures calculated and presented in accordance with IFRS. We understand that although non-IFRS gross profit, non-IFRS operating income, non-IFRS net income, non-IFRS net income per diluted share, and free cash flow are frequently used by investors and securities analysts in their evaluation of companies, these measures have limitations as analytical tools, and you should not consider them in isolation or as substitutes for analysis of our results of operations as reported under IFRS.

ABOUT ATLASSIAN

Atlassian unleashes the potential of every team. Our team collaboration and productivity software helps teams organize, discuss and complete shared work. Teams at more than 225,000 customers, across large and small organizations – including Redfin, NASA, Verizon, and Dropbox – use Atlassian’s project tracking, content creation and sharing, and service management products to work better together and deliver quality results on time.

Learn more about our products, including Jira Software, Confluence, Jira Service Management, Trello, Bitbucket, and Jira Align at https://atlassian.com.

Investor relations contact: Martin Lam, IR@atlassian.com

Media contact: Marie-Claire Maple, press@atlassian.com