Our Q4 FY21 letter to shareholders

An update to customers, stakeholders, and shareholders on our mission to unleash the potential in every team.

Fellow shareholders,

We entered FY21 staring down uncertainty and bracing against headwinds. We exit it in a stronger position than ever. Over the past year, we took swift, bold action to continue our evolution into a cloud-first company and further our mission of unleashing the potential of every team. And it’s paying off.

Q4 was a great quarter – a “ripper,” as we Aussies would say. 🏄🏾♀️ We generated $560 million in revenue, up 30% year-over-year, and achieved subscription revenue growth of 50% year-over-year. We added over 23,000 net new customers and the pace of cloud migrations continues to build, increasing more than 2x year-over-year. There’s still a lot to get after on this multi-year journey, but we finished FY21 proud of our resilience and what we’ve accomplished together as a team.

Those accomplishments include surpassing 200,000 customers and $2 billion in revenue, adding over 1,500 new Atlassians to the team, and building five new products on top of our rapidly advancing cloud platform. Plus, we’re launching into FY22 equipped with a full ladder of cloud editions – Free, Standard, Premium, and Enterprise – designed to meet the needs of virtually any customer.

There’s a lot to celebrate, but we won’t pause to party. Our sleeves are rolled up and we’re keen to keep putting in the hard yards 🇦🇺 to seize the massive opportunities in front of us. Our job in FY22 is to keep building on our cloud migration momentum, invest to further strengthen our offerings so we can keep winning in our three addressable markets, forge human connections with each other as we figure out new ways of working in this digital-first world, and to just. keep. executing.

Building a castle on our cloud 🏰

Building a world-class cloud platform and migrating our installed base of server customers continues to be our primary focus. Our momentum stayed high in Q4, with large customer cloud migrations (1000+ users) up 70% quarter-over-quarter 💥, and cloud revenue up 47% year-over-year.

Our platform provides both a strong foundation for our current products and an accelerant for delivering new products and features. Looking back on the year, it’s easy to see this in evidence.

- Our Enterprise edition now allows customers to have multiple instances of a cloud product under a single bill with a shared set of users.

- Enterprise and Premium edition customers can now choose to receive continuous releases of new features or have updates bundled so admins can roll them out when it works best for their organization.

- Free editions are now the default option for new users looking to try our products. Free also allows end-users to invite teammates to use the product directly instead of having to go through an admin. Free editions greatly expand our ability to reach new users and are driving strong customer conversion to paid plans.

- Jira Service Management and Automation for Jira locked in SOC2 type II, ISO 27001, and ISO 27018 compliance this quarter. This milestone brings them into alignment with the high standards for security and compliance we set across our core products.

- Jira macros for Confluence got a performance boost across all editions and now render 1.5x faster when loading Confluence pages.

Thanks to the steady drumbeat of enhancements, each edition of our products is helping Atlassian scale to new levels. We’re seeing Free fuel our tremendous customer growth, great uptake of Premium, and strong customer demand for Enterprise.

Four months down the line, we’re happy we made the right decision moving to Atlassian Cloud [Premium]. There’s been virtually no downtime, good user feedback, and the savings on engineering overhead we hoped for have been achieved.

– Simon Logan, cloud engineer at the U.K.’s Driver and Vehicle Licensing Agency

Q4 also brought a ray of sunlight for companies who want to move to cloud but have been caught up in an increasingly complex data compliance landscape, confining them to on-premises deployments (until now). This quarter we rolled out data residency capabilities that allow customers to choose whether certain content data is stored in the U.S. or E.U., with additional geographies to be added in the future. For many customers, this knocks down a critical barrier standing between them and our cloud platform. Data residency capabilities are now part of our Standard, Premium, and Enterprise editions for Jira Software, Jira Service Management, and Confluence.

We also launched our next-generation cloud app development platform, Forge, into general availability. Customers and third-party developers can use Forge to create apps for cloud products quickly and confidently, knowing that Atlassian has the infrastructure handled. Over 500 apps emerged from Forge’s early access program, and we’re excited to see it unleash even more of our customers’ potential as adoption increases.

As customers witness all of these developments, they increasingly understand the value they get from the Atlassian cloud platform. Today, over 90% of our total customers take advantage of the instant scalability, enterprise-grade data privacy and security, streamlined administration, and deep integrations our cloud products offer. For the remaining 10%, we teamed up with Forrester to develop a Total Economic Impact™ framework that guides these customers through a deep cost/benefit analysis and features testimonials from decision-makers at companies who’ve already invested in the Atlassian cloud platform.

We’ve made tremendous progress moving customers to cloud this year. There’s still a long way to go, but we’re confident we can get there.

Scoring a hat trick in our three core markets 🥅

Our mission is to unleash the potential of every team, and we will continue to invest against the massive opportunities in our three addressable markets. We kept our nose to the sandstone in Q4, scoring wins across our portfolio that will benefit admins and end-users alike.

Agile development

Going up against the Jira family of products is tougher than a crocodile’s hide, as any competitor who’s ever tried knows well. And it got even tougher as Jira Software surged over the 100,000 customer milestone during Q4. Jira has long been the central nervous system for software teams at companies of all sizes, providing a customizable workflow engine and keeping teams across the org on the same page. And recently, Atlassian was once again named by Gartner as a Leader in their Magic Quadrant for Enterprise Agile Planning Tools, with the highest score for ability to execute. In addition to the Magic Quadrant, we received the highest score for the Scaled Agile Framework (SAFe) use case in the companion Critical Capabilities report from Gartner. Recognitions like these, and the impressive customer milestones we continue to surpass, highlight our role in fostering mission-critical outcomes for customers large and small.

It’s not just about Jira, though, or just about Atlassian. Dev teams use a vast array of tools tailored to serve specific needs. The problem is getting all these tools from all these different vendors to work seamlessly together. So we built a solution we call Open DevOps, powered by Jira Software. Dev teams can now connect Jira Software, Confluence, Bitbucket, and Opsgenie to 3rd party tools like Datadog and Snyk with a few clicks. Open DevOps automatically handles the nitty-gritty integration details and makes a diverse toolchain feel like an all-in-one.

IT service management (ITSM)

Now that agile and DevOps have smashed the silos that once separated software teams from their counterparts in IT and across the business, these teams need to share tools in common. So we integrated ticketing, monitoring, alerting, and asset management capabilities to create Jira Service Management, which is powering teams at over 30,000 customers. By bringing IT, dev, and business teams together into one shared workspace, Jira Service Management enables high-velocity collaboration and is redefining the ITSM space.

IT teams are now key strategic partners supporting digital (and often virtual) collaboration for the entire company. But disconnected, outdated tooling can constrain the flow of information and hamper their progress. That’s why teams at over 75,000 customers are using Confluence. Our investments in machine learning and integration with Jira Service Management make it easy for teams to build knowledge bases in Confluence and resolve issues faster. We’ve also invested in a suite of ITSM-ready page templates so communicating changes to the rest of the business is dead simple.

Work management for all

Just as the Jira family isn’t only for technical projects, work management for an entire organization isn’t just about Confluence and Trello. Jira Work Management, fresh off its general availability launch last quarter, is already supporting business teams at UiPath, Bayer, Seaworld, Avalara, and the European Space Agency. We’re getting great early customer feedback and we’re excited to carry the momentum into FY22.

Atlassian is no longer just an IT tool. We’ve seen non-technical teams run with [Jira products], which has provided them with better visibility into what’s happening with our technical teams. Communication has improved too as we’ve adopted a standard with Confluence documentation and linking it to Jira.

– Eric Raymond, Senior Manager of Business Technology at Castlight Health

Similarly, Team Central, which serves as an organization’s connective tissue, is helping any team connect and communicate progress as frequently and frictionlessly as modern work demands. Early customers like Canva, LaunchDarkly, and TripAdvisor are using Team Central to allow their teams to track progress and provide real-time updates to others across their organization. At Atlassian, we are using Team Central for OKR tracking from company-wide goals all the way down to team goals.

Both of these products came out of our Point A program, which promotes home-grown innovation in collaboration with our customers. In its first cohort, the program is fast-tracking five products across our three markets. All Point A products are built on our cloud platform, which provides shared functionality across all our products such as user management, thus accelerating the development cycle.

Better, stronger, and faster together 💪

The world’s most enduring businesses have one thing in common: they don’t go it alone. We want Atlassian to continue growing into the 22nd century, so we make a point to make a lot of friends. In fact, there are thousands of people all over the world who grow this company – they just don’t carry an Atlassian business card. But they do carry our mission in their hearts (and often put our t-shirts on their backs).

Along with our top-notch SEO and performance marketing machine, we also build bridges to expand the reach of our GTM model so we can keep scaling for years to come. As we reimagine the future of work in our three core markets – agile development, ITSM, and work management for all – we’re growing an entire ecosystem that advances our mission. 🌱

- Channel partners – Atlassian works with over 700 Solution Partners and Global Alliance Partners who provide a higher-touch sales and rollout experience and drive over one-third of our total revenue. Although they traditionally specialized in on-premises deployments, cloud sales from our channel partners are up 300% year-over-year, proving how enthusiastically they’ve embraced a cloud-first mentality.

- Marketplace partners – Over 60% of our customers* use an app built by one of the 25,000+ developers who contribute to the Atlassian Marketplace. Our Marketplace partners make it possible for customers to extend, customize, and ultimately get more value out of their Atlassian solutions through thousands of apps. Our Marketplace is home to hundreds of founder-led, highly profitable businesses who have built and scaled SaaS offerings in partnership with Atlassian. In FY21 alone, they added over 600 new cloud apps to our Marketplace.

- Integration partners – Atlassian partners with peer companies to deliver deep integrations with other leading tools like AWS and Slack. These partnerships make our products stickier and, thanks to identity integrations, help expand our user base. For example, users can request access to Confluence directly from a Slack channel when a teammate shares the link to a page. Ultimately, we focus on these partnerships to give our customers the best experience possible. A recent survey conducted by 451 Research showed nearly two-thirds of respondents using Slack and Atlassian product integrations saved over 312 hours per year – that’s nearly two weeks! ⏱

- Atlassian Ventures – Earlier this fiscal year, we launched a strategic venture fund designed to help drive customer value across our entire ecosystem. In FY21, Atlassian Ventures made a total of 13 investments, across both early-stage and at-scale companies.

- Our customer community – Whether through the Atlassian Community website or webinars and other events, our customer champions share tips and techniques for getting more value out of our products. Our Community site attracted over 19 million visitors in FY21 and Community leaders hosted virtual events attended by nearly 20,000 fellow end-users. 80% of attendees started a cloud trial within 30 days of attending. 💥

Over the last 15 years, Appfire has been both a Solutions and Marketplace Partner, growing and scaling alongside Atlassian to offer a platform for collaboration, cloud migration, and an array of other business needs. Through Atlassian’s partnership model, we can leverage a frictionless go-to-market motion and expand Atlassian’s addressable market, unlocking massive value.

– Randall Ward, co-founder and CEO at Appfire

An award-winning culture that just won’t quit

We say it every quarter because it bears repeating: we are deeply grateful to our customers, partners, peers, and teammates. It’s been a year of professional and personal challenges like we’ve never seen before. But we got through it by sticking together and are coming out stronger for it. Thank you.

Culture has always been a competitive advantage for us, and we’re committed to making sure it always will be. True to form, we’re taking a long-term approach to reimagining work and defining what great company culture looks like in a hybrid world. And if the awards we’ve won in the past year are any indication, we’re doing it right:

- 🇺🇸 30 Best Large Workplaces in Technology, Fortune

- 🇺🇸 Fortune 100 Best Companies to Work For® 2021, Fortune

- 🇺🇸 The 10 Most Innovative Workplace Companies of 2021, Fast Company

- 🇵🇭 Philippines’ Best Workplaces 2021, Great Place to Work®, Fortune

- 🇳🇱 Netherlands’ 2021 Best Multinational Best Workplaces, Great Place to Work®

- 🇮🇳 India’s Best Companies to Work For 2021, Great Place to Work®

- 🏳️🌈 Best Places to Work for LGBTQ Equality 2021, Human Rights Campaign Foundation

- 🙋🏾♀️Endorsed Employer for Women, WORK180

We’re not resting on our laurels, though. A year ago, we wrote these words:

Fiscal 2021 will be a meaningful investment year for Atlassian. We’ll continue investing to pursue the large market opportunities ahead of us, despite macro headwinds and slower revenue growth. At a time when there’s great talent available, we plan to hire 1,000+ new Atlassians, with the majority in R&D. We’ll look to invest in our platform, cloud services, migration tools, new product initiatives, and in improvements across the cloud portfolio. We readily acknowledge that this decision affects our fiscal 2021 operating margin and free cash flow profitability. Nonetheless, we believe this is the right long-term decision to make, informed by our experience during the last recession.

As is the Atlassian way, we executed on our plan. We’re open and we do what we say. We played offense throughout this difficult year. As a result, we emerged bigger and stronger. We’ve successfully integrated the 1,500+ new Atlassians we welcomed this year – one-fourth of our global team! Most of them have never met their manager or teammates in person, which we look forward to changing as soon as it’s safe. 😷

TEAM Anywhere

Our Return on Action study, released earlier this month, surveyed workers in the U.S. and Australia across a range of industries and revealed that 54% would consider switching companies to access remote work opportunities. We’re proud to say that Atlassian is ahead of the curve when it comes to anticipating and responding to workers’ changing preferences.

We remain committed to offering our teams flexibility around where and when they work. Atlassian will not require employees to turn up at an office for work. This program, known as “TEAM Anywhere,” is proving very attractive to candidates. It has helped set new company records for hiring this year. In fact, over 1/3 of new hires added since January 2021 live more than two hours away from the nearest Atlassian office.

Distributed teamwork is here to stay at Atlassian, and for many of our customers, too. So we’re investing in re-skilling programs that bring managers up to speed on virtual leadership as well as continuously re-evaluating our everyday rituals and collaboration practices. And in the spirit of playing as a team with our customers and the broader knowledge worker community, we’ll be sharing what we learn – both through thought leadership and product innovations that help teams thrive in a distributed world.

Opportunities multiply as they are seized

Looking ahead, the broader economic and talent environments present some fascinating challenges and opportunities. As the world digitizes, companies are realizing that technology is the true competitive advantage. Every company will either become a digital company or perish. At the same time, cheap capital is fueling this once-in-a-lifetime technology investment boom. Because technology is built by people, the combination of these factors creates a much tighter, more expensive market for the best talent. We believe this will be the case for a long time and will be incredibly challenging for many companies to navigate.

For Atlassian, these twin forces of digital transformation and the technology boom mean the opportunities in front of us have never been greater. Hence, even more than last year, we are going to continue to play offense in FY22. Our uniquely efficient business model and historical capital efficiency allow us to hire ambitiously and continue investing in our strongest asset: our people. For further detail, see the CFO section later in this letter.

We’re looking forward to discussing all of this and more with you on our earnings call. Here’s to the road ahead, and to unleashing the potential of every team.

Cheers,

– Mike and Scott

The bottom line

- Q4 was a ripper. 🏄🏾♀️ Highlights include subscription revenue growth of 50 percent year-over-year and over 23,000 net new customers.

- FY21 began with uncertainty and headwinds but finished with lots to celebrate. We’re proud of how well our team executed in the face of adversity.

- There’s loads of opportunity to get after on the multi-year journey ahead of us. Our resilience and execution in FY21 bolster our confidence in our progress.

Customer highlights

We continue to see robust growth at both ends of our customer base. With our full ladder of cloud editions ranging from Free to Enterprise, we are able to land with a wide array of customers, expand within their walls, and scale with themas their teams grow ever larger and more complex.

Atlassian has the worlds leading self-serve sales funnel, landing new customers Monday through Sunday. By getting people into our products as quickly as possible, where they can experience real value, we grew our customer base by over 60,000 in FY21.

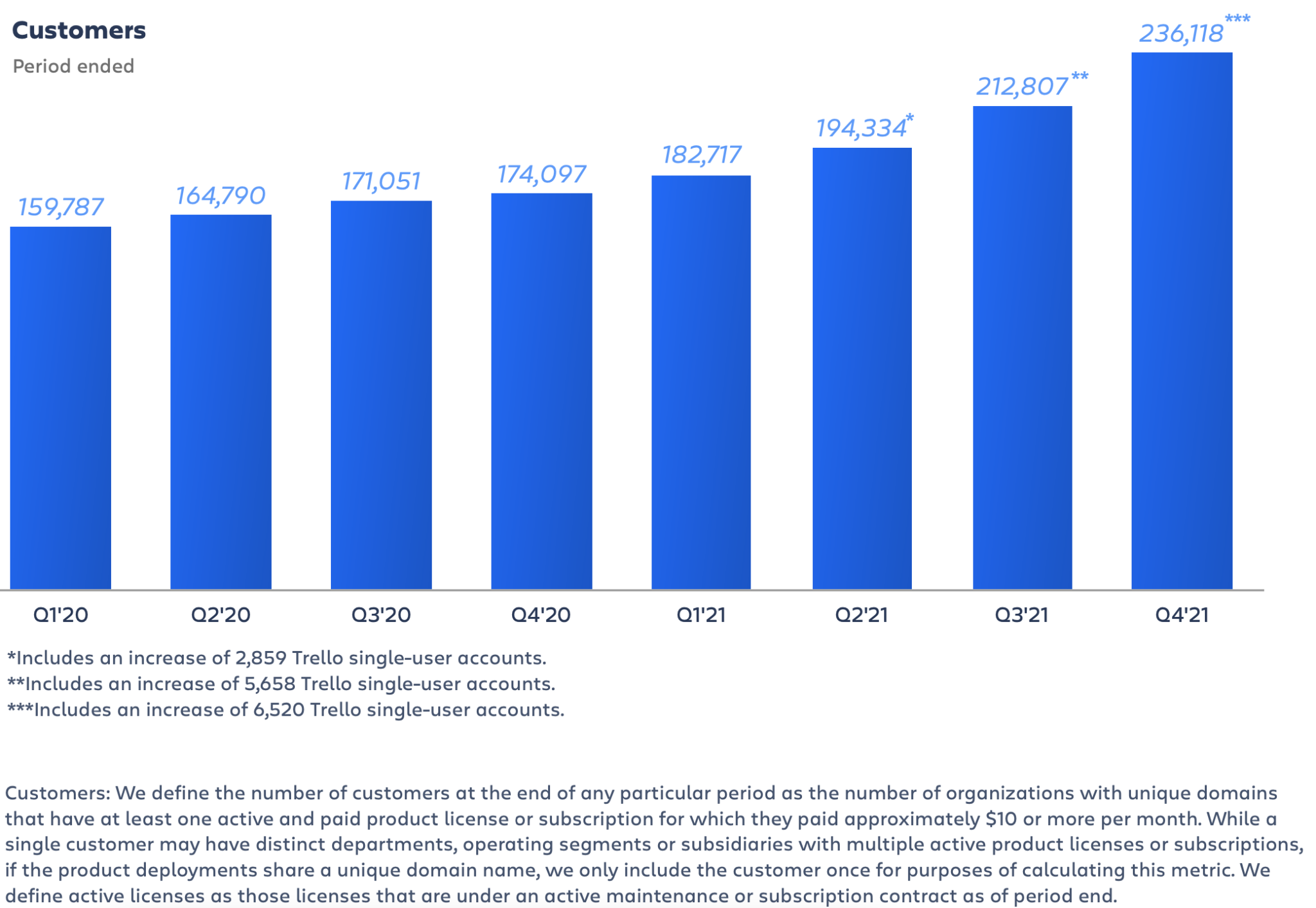

Free makes it easier than ever for teams to try and then immediately get value from our products, blowing our sales funnel wide open and fueling the strong customer growth we saw this year. We ended FY21 with 236,118 customers, adding 23,311 net new customers during Q4. 📈 Our customer growth for the quarter includes 6,520 new customers that are single-user Trello accounts.

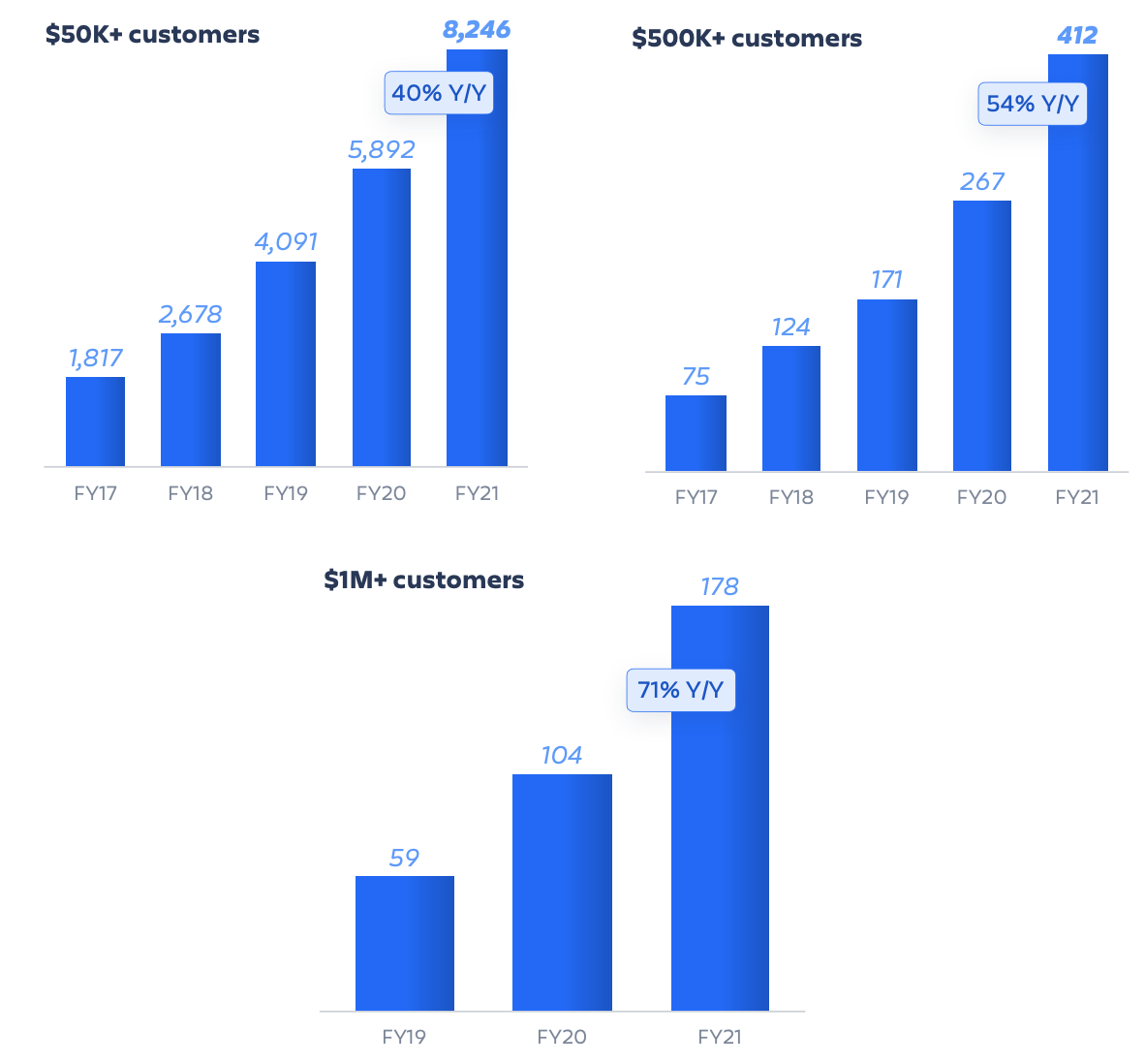

We’ve also invested more in forming strategic relationships with larger customers who are expanding with us at a healthy clip. This is the direct result of the continuous improvements to our cloud platform, our enterprise-grade products, high-performing sales and support teams, and the support of our channel partners.

At the end of FY21, we had:

And we’re accomplishing all of this while maintaining the most efficient GTM model in the industry. With an incredible ecosystem supporting us, an automated sales funnel that allows us to scale, and a talented team facilitating higher-touch sales motions, Atlassian is entering FY22 with a spring in our step.

Financial highlights

Fourth quarter and fiscal 2021 highlights

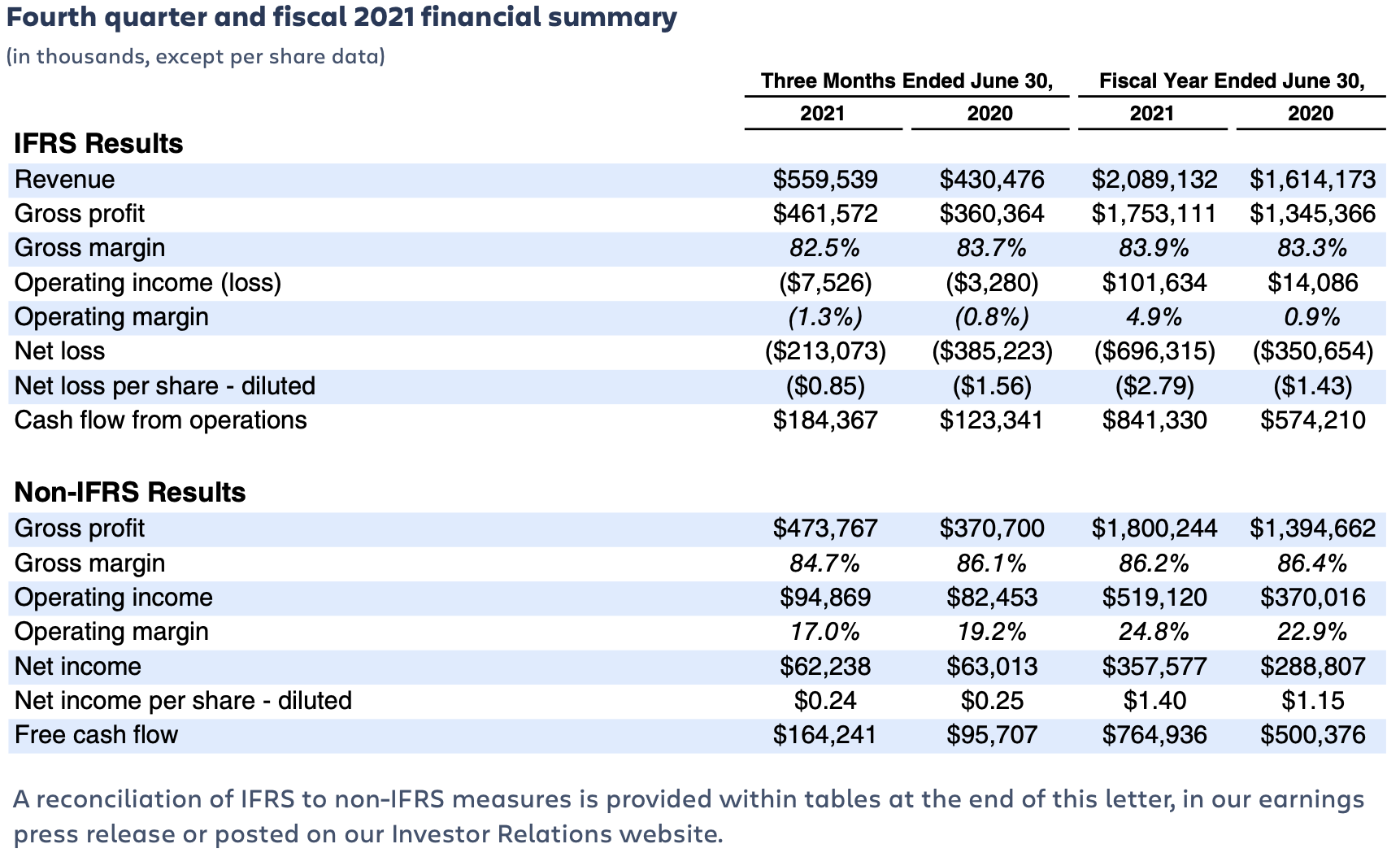

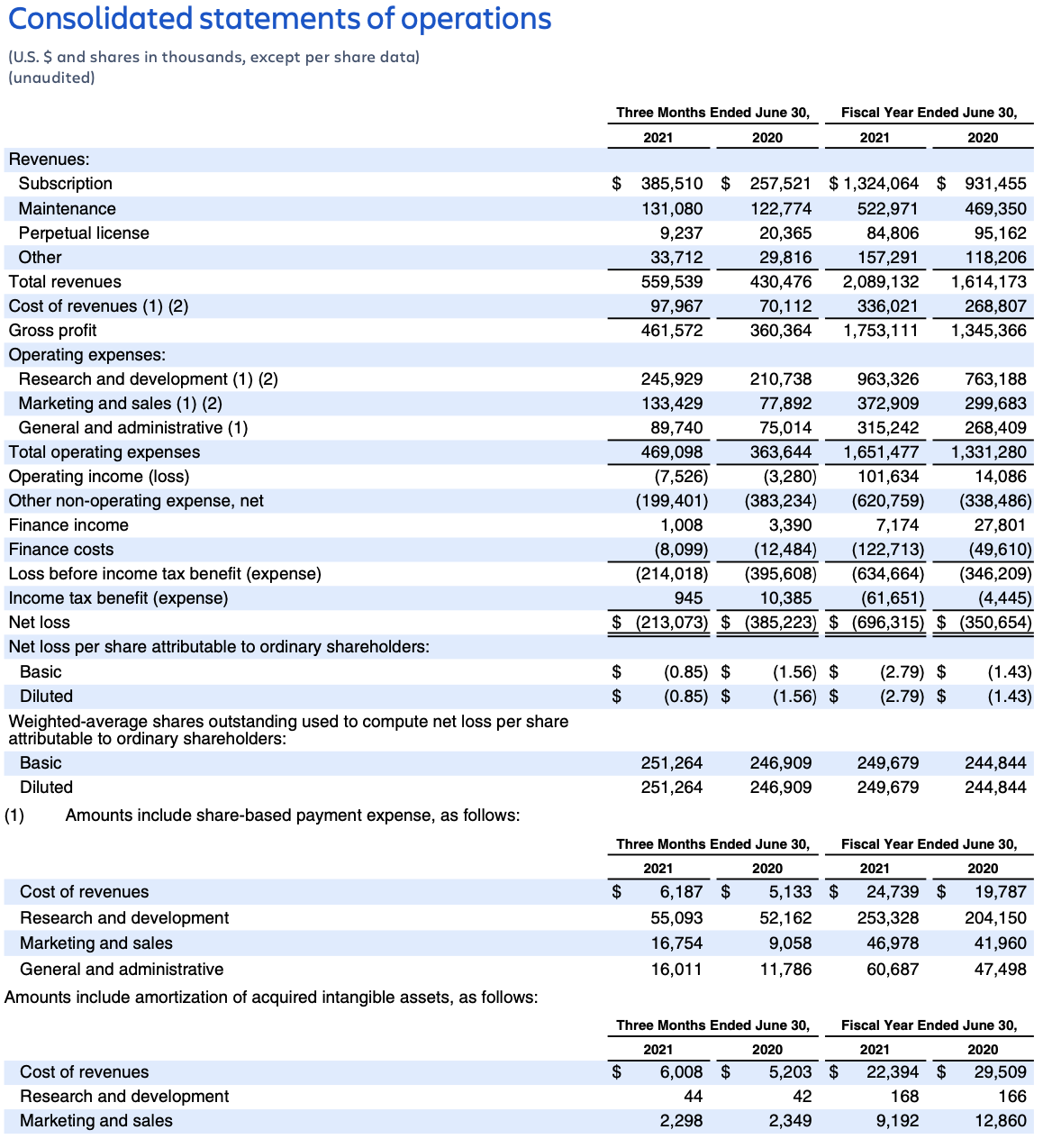

We are pleased with Atlassian’s excellent financial performance in Q4’21, as we closed out FY21 in strong fashion. We are proud of our resilience and how we executed in the face of headwinds during FY21. We enter FY22 confident in our continued ability to execute towards our long-term goals. We continue to see strong customer demand across our cloud products and we are tracking well against our cloud migration expectations – led primarily by smaller customers while migration momentum continues to build at larger customers.

Highlights for Q4’21 include:

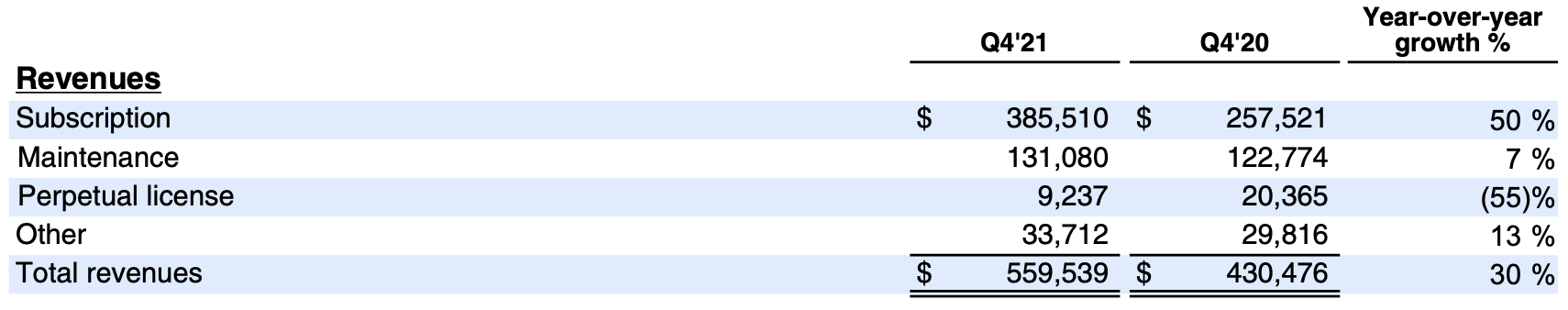

- Subscription revenue grew 50% year-over-year. Specifically, cloud revenue grew 47% year-over-year while Data Center revenue grew 63% year-over-year. Cloud revenue represented 50% of total revenue during Q4’21. We are proud of these growth rates as we focus on driving subscription revenue growth.

- We continue to execute well against our ambitious hiring plans. We added 316 new Atlassians in Q4’21 and over 1,500 new Atlassians in FY21. The majority of our new hires are focused on R&D. We will leverage our unique culture, “TEAM Anywhere,” and our financial capacity as we continue adding top-tier talent in FY22.

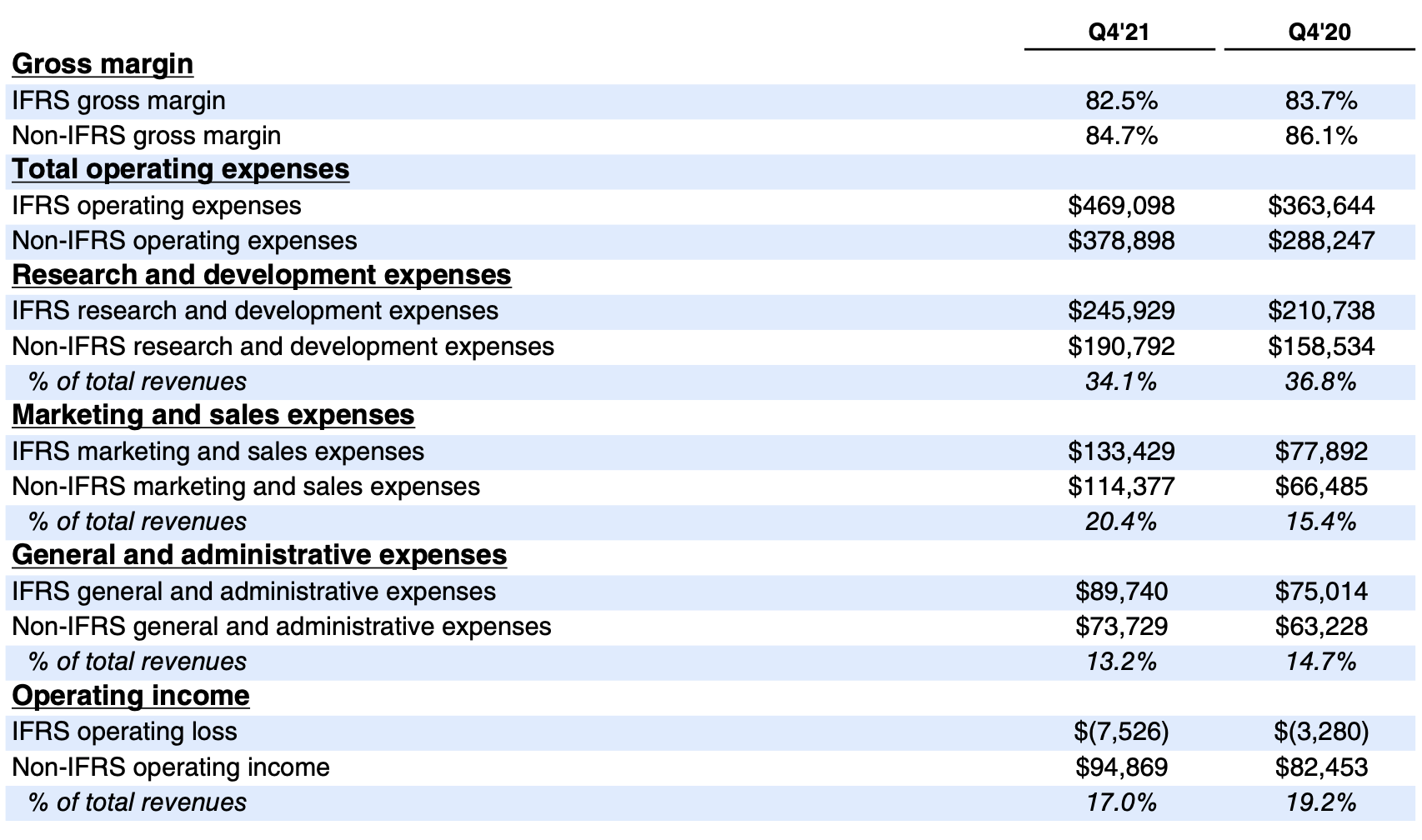

- We capped off FY21 with strong operating margin and free cash flow margin results, even as we continued to invest heavily in cloud R&D and executed on certain marketing initiatives during Q4. Our strong financial position provides us with the flexibility to invest purposefully in FY22 to further our cloud-first goals and create value for our customers in our three core markets.

Revenue

Margins, operating expenses, and operating income

Headcount

Total employee headcount was 6,433 at the end of Q4’21, an increase of 316 employees since the end of Q3’21. The majority of the increase was in R&D.

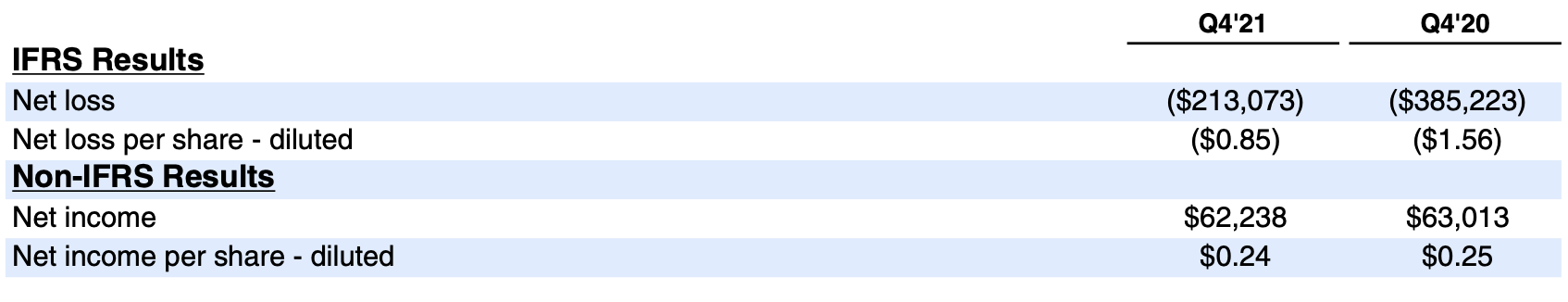

Net income

Net loss for Q4’21 included a charge of $200.5 million recorded in “other non-operating expense, net,” compared with a charge of $382.7 million in Q4’20 relating to our exchangeable senior notes and related capped calls. Of this amount, a loss of $180.9 million is related to marking to fair value the exchange feature of the notes and related capped calls that remain outstanding as of quarter-end. In addition, a net loss of $19.6 million is related to the net impact of settling a portion of the notes and the unwinding of the related capped calls during this quarter.

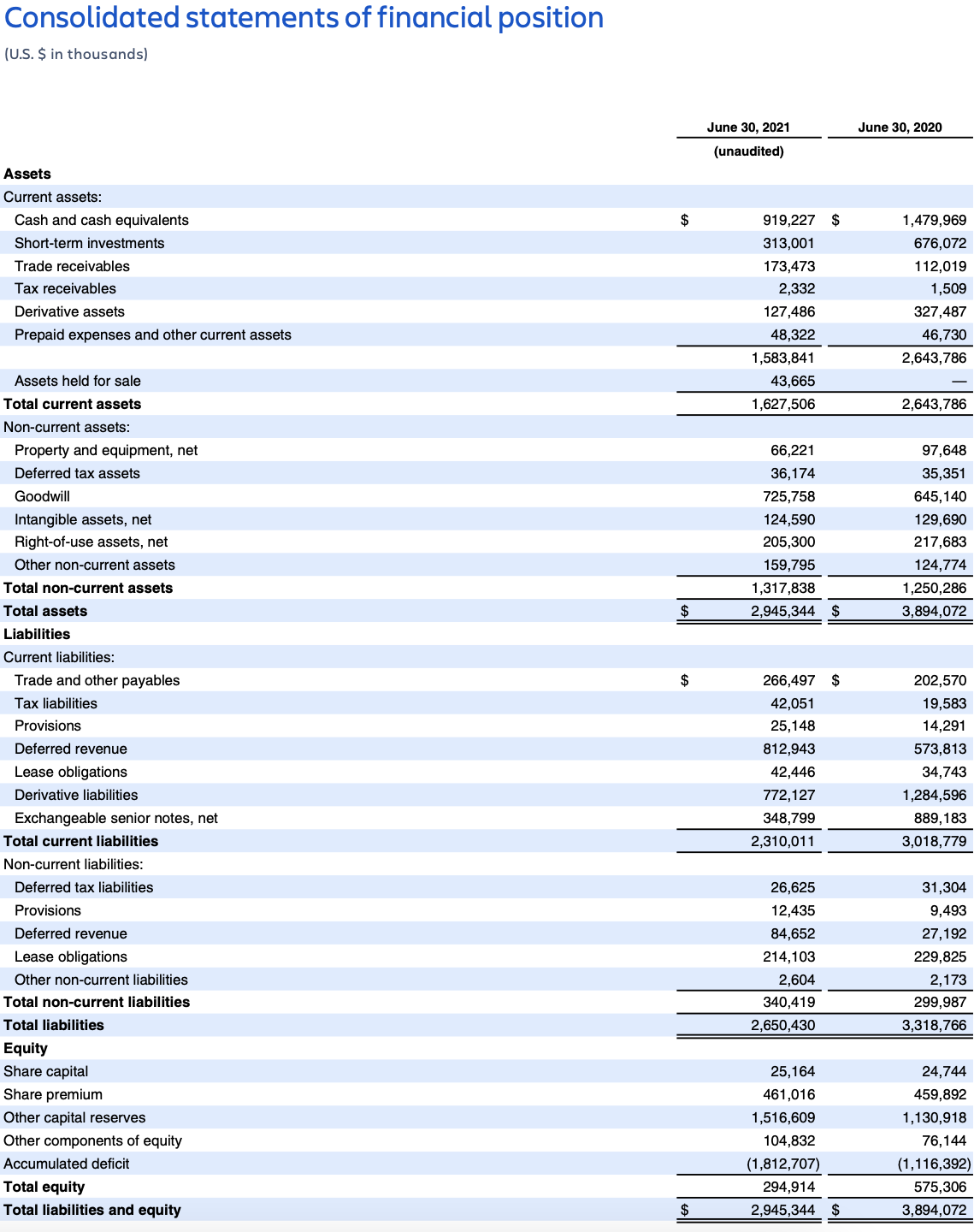

Balance sheet

Atlassian finished Q4’21 with $1.2 billion in cash, cash equivalents, and short-term investments.

During Q4’21, we used $540.2 million in cash to settle a portion of the notes in privately negotiated transactions and early exchange requests and received $67.0 million in cash from the unwinding of the related capped calls. The net impact resulted in cash outflows of $473.2 million, which is reflected in cash used in financing activities on our consolidated statements of cash flows.

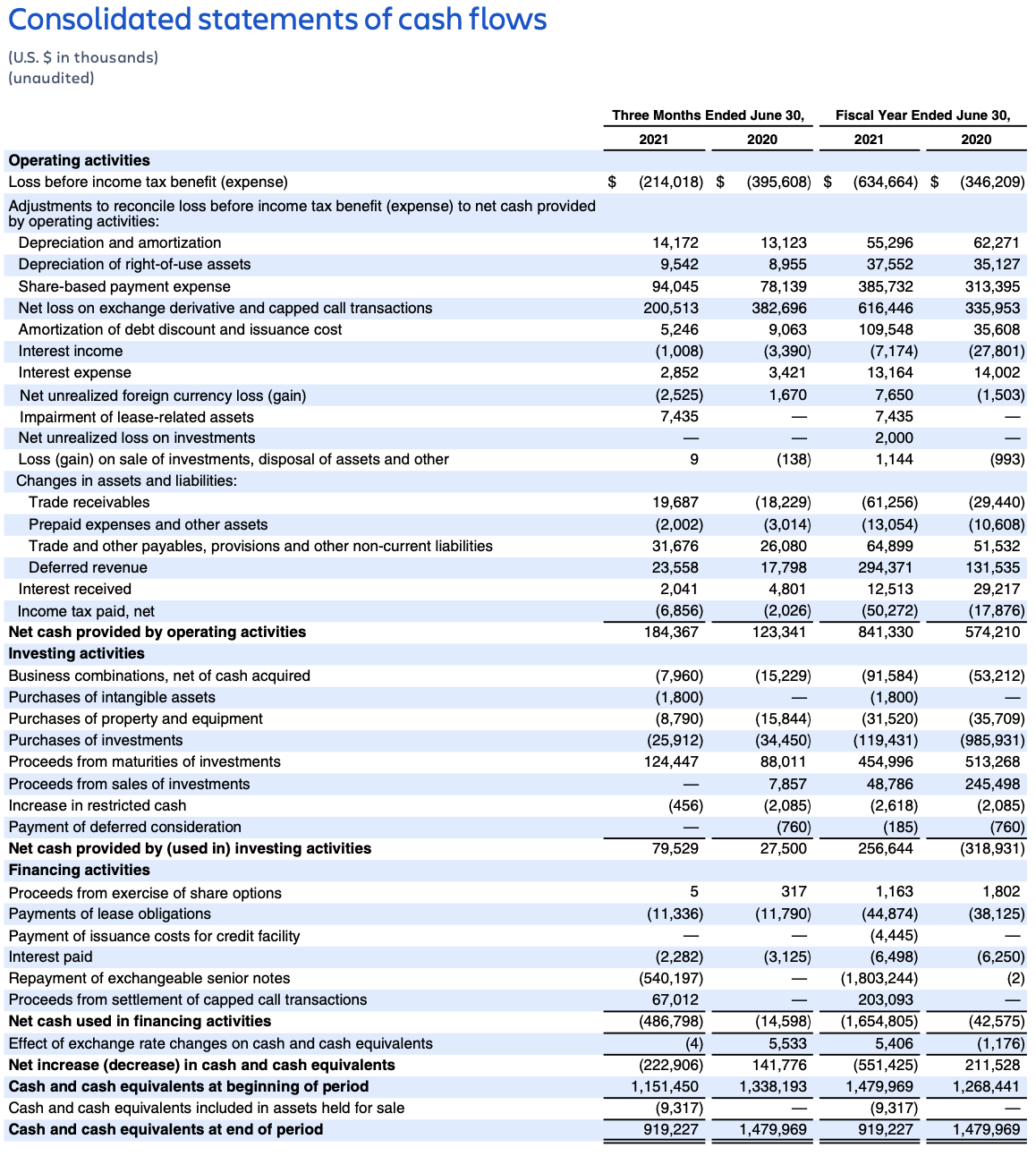

Free cash flow

Cash flow from operations for Q4’21 was $184.4 million, while capital expenditures totaled $8.8 million and payments of lease obligations totaled $11.3 million, resulting in free cash flow of $164.2 million. The free cash flow margin for Q4’21, defined as free cash flow as a percentage of revenue, was 29.4%.

Financial targets

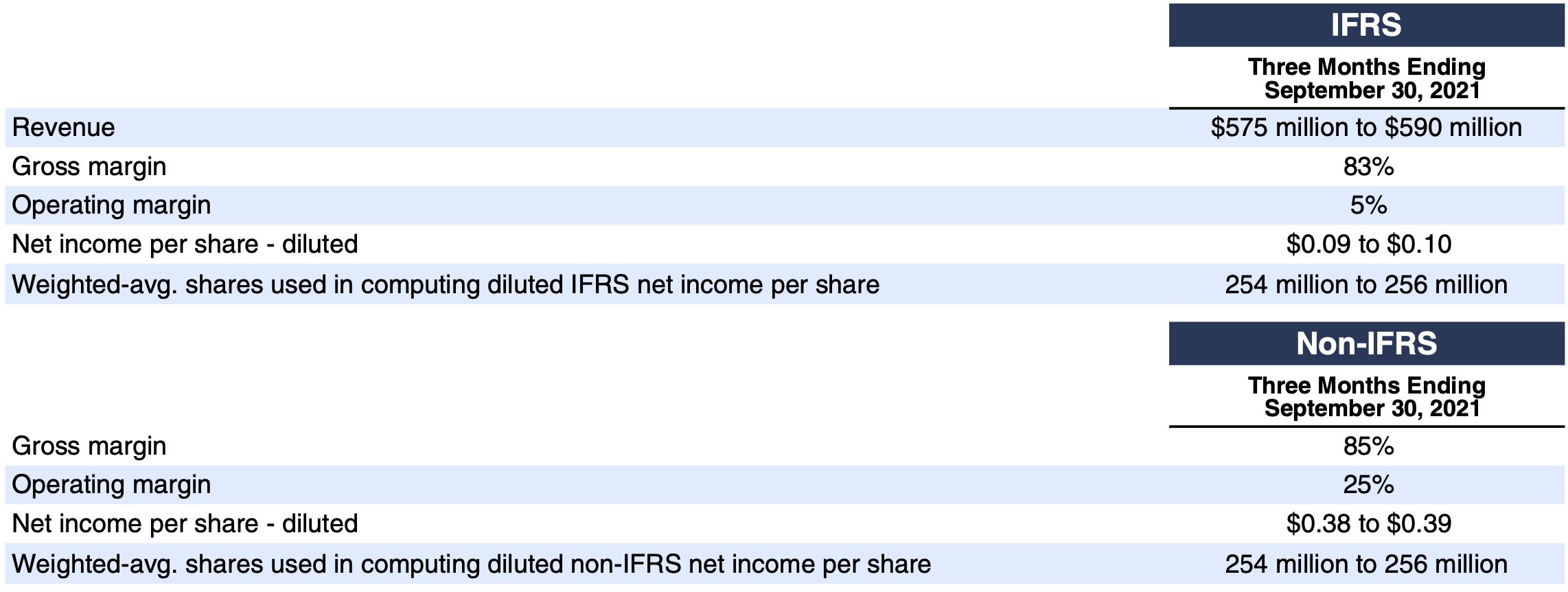

Fiscal 2022 outlook

Revenue

While we’re pleased with the progress of our cloud migration activity, we continue to believe we have a multi-year migration journey ahead of us. As a result, we continue to expect variability in our revenue growth as customers choose the timing of when to migrate to our cloud or data center offerings. We believe this variability will be transitory as we work through our cloud-first transformation.

As a reminder, while we have discontinued sales of new server licenses in Q3’21, upgrades of existing server licenses will continue to be available through Q3’22. We will continue to offer maintenance and support to server customers until February 2024.

In FY22, we expect to see the following trends:

Subscription revenue

- We expect subscription revenue growth year-over-year to be in the low-to-mid 40s percent range for FY22. Subscription revenue will continue to be the primary driver of revenue growth.

- We expect our subscription revenue growth rate to be higher in the first half of FY22 relative to the second half.

- Recall, our subscription revenue in Q3’21 benefited from a strong data center revenue growth rate, driven by accelerated demand resulting from the discontinuation of new server license sales and customers purchasing ahead of price increases that went into effect during Q3’21.

- For data center revenue, approximately 20% is recognized in subscription revenue in the period that the contract is signed, while the remaining 80% is recognized ratably over the life of the contract.

- In addition, it is important to note Q4’21 continued to see strong data center revenue growth, as it benefited from ratable revenue rolling off of our deferred revenue balance. Our deferred revenue balance benefited by the event-driven purchasing observed in Q3’21.

- We expect our cloud revenue growth rate to accelerate in FY22 relative to FY21.

Maintenance revenue

- While we expect our server business to be the primary driver of the variability in this coming year’s results, we are assuming maintenance revenue slowly contracts over the course of fiscal 2022. In Q4’22, we expect maintenance revenue to decline to approximately $100 million.

License revenue

- We expect quarterly perpetual license revenue to be approximately flat from the $9 million we recognized in Q4’21, through the end of Q3’22. Upgrades of existing licenses will no longer be offered after Q3’22, and as a result, we do not expect any further perpetual license revenue beginning in Q4’22.

Other revenue

- We expect other revenue to be approximately flat relative to FY21 other revenue.

- Marketplace revenue, which is reflected in other revenue, will be impacted by the temporarily lowered Marketplace take rates on the sales of third-party cloud apps which are designed to incentivize further cloud app development.

- The contracting server business, and the related server app business, will also create a headwind for the other revenue line.

- Marketplace revenue will also continue to see a headwind from the accelerated, event-driven app purchasing in Q3’21 across Server and Data Center. Recall that revenue on the sale of third-party marketplace apps is recognized in the period the product is purchased.

Tough compare in Q3

We observed unprecedented customer purchasing in Q3’21 driven by the confluence of events from the end of new Server license sales and price changes to on-premises products. As a result, Q3’22 will be a tough compare from a year-over-year revenue growth perspective.

Given our ongoing transformation into cloud-first company, we plan to supplement our financial statements with updated quarterly revenue disclosure beginning in Q1’22 to highlight the scale and growth rate of our cloud and data center businesses.

Profitability

As discussed earlier, we executed well on our plan to play offense and invest in our large market opportunities, despite the headwinds we faced this year. We emerge from FY21 stronger having hired 1,500+ Atlassians, advanced our cloud platform, bolstered our existing cloud products with new functionality, and innovated through new product initiatives. And while we’ve made tremendous progress, we have more work to do. We have so many opportunities across agile development, IT service management, and work management for all teams.

In FY22, we will continue to invest purposefully to drive long-term durable growth. We will continue to hire talent from across the globe with the significant majority in R&D. Our ambitions reflect our long-term view. Our willingness to invest for durable growth across each of our core markets will cause our operating and free cash flow margins to decline in FY22 relative to FY21.

We expect the following dynamics to impact our margins in FY22:

- Gross margin will decrease in FY22, due to the business mix shift from server to cloud. This impact will be primarily driven by increased hosting costs for cloud enterprise customers, as well as additional personnel costs to support cloud migrations and our cloud customer base. We expect gross margins to be lower in the second half than in the first half.

- Operating margin is expected to decline as server revenues contract and we continue to invest heavily in cloud R&D. We will continue investing in our cloud platform, supporting microservices, developing new products, improving migration tools, and driving product improvements. We expect operating margins to be lower in the second half than in the first half.

- Free cash flow is expected to be impacted as a result of the continued business mix shift to the cloud. Maintenance contracts for our server products are only offered on annual terms, while we offer subscriptions for our cloud products on both annual and monthly terms. In the short term, the shift to the cloud and the potential mix change in billing term may create a headwind for free cash flow. Over the long term, as more enterprise customers migrate to the cloud, we expect any such headwind to subside. The reduction in operating margin in FY22, noted above, and the unprecedented customer purchasing activity in Q3’21, will also both impact our free cash flow margin in FY22.

Share count

In FY22, we expect to see a material increase in our share-based compensation (SBC) expense as we continue to play offense and invest in our team. Recall that we report our financial statements in accordance with IFRS. SBC is recognized on a more front-loaded schedule compared to U.S. GAAP. We are targeting approximately 2% share count dilution for FY22. Therefore despite the near-term increase in SBC expense, our comparable share dilution will still be ranked in the bottom half of our peer company set.

FY21 was another solid step in our multi-year journey, and we’re excited about the progress we’ve made. FY22 will be another step forward in our mission of unleashing the potential of every team.

FORWARD-LOOKING STATEMENTS

This shareholder letter contains forward-looking statements, within the meaning of the Private Securities Litigation Reform Act of 1995, which statements involve substantial risks and uncertainties. All statements other than statements of historical fact could be deemed forward-looking, including risks and uncertainties related to statements about our products, customers, anticipated growth, strategy, go-to-market model, Atlassian Marketplace, acquisitions, outlook, effects of the COVID-19 pandemic, technology and other key strategic areas, and our financial targets such as revenue, share count, and IFRS and non-IFRS financial measures including gross margin, operating margin, net income (loss) per diluted share and free cash flow.

We undertake no obligation to update any forward-looking statements made in this shareholder letter to reflect events or circumstances after the date of this shareholder letter or to reflect new information or the occurrence of unanticipated events, except as required by law.

The achievement or success of the matters covered by such forward-looking statements involves known and unknown risks, uncertainties and assumptions. If any such risks or uncertainties materialize or if any of the assumptions prove incorrect, our results could differ materially from the results expressed or implied by the forward-looking statements we make. You should not rely upon forward-looking statements as predictions of future events. Forward-looking statements represent our management’s beliefs and assumptions only as of the date such statements are made.

Further information on these and other factors that could affect our financial results is included in filings we make with the Securities and Exchange Commission from time to time, including the section titled “Risk Factors” in our most recent Forms 20-F and 6-K (reporting our quarterly results). These documents are available on the SEC Filings section of the Investor Relations section of our website at: https://investors.atlassian.com.

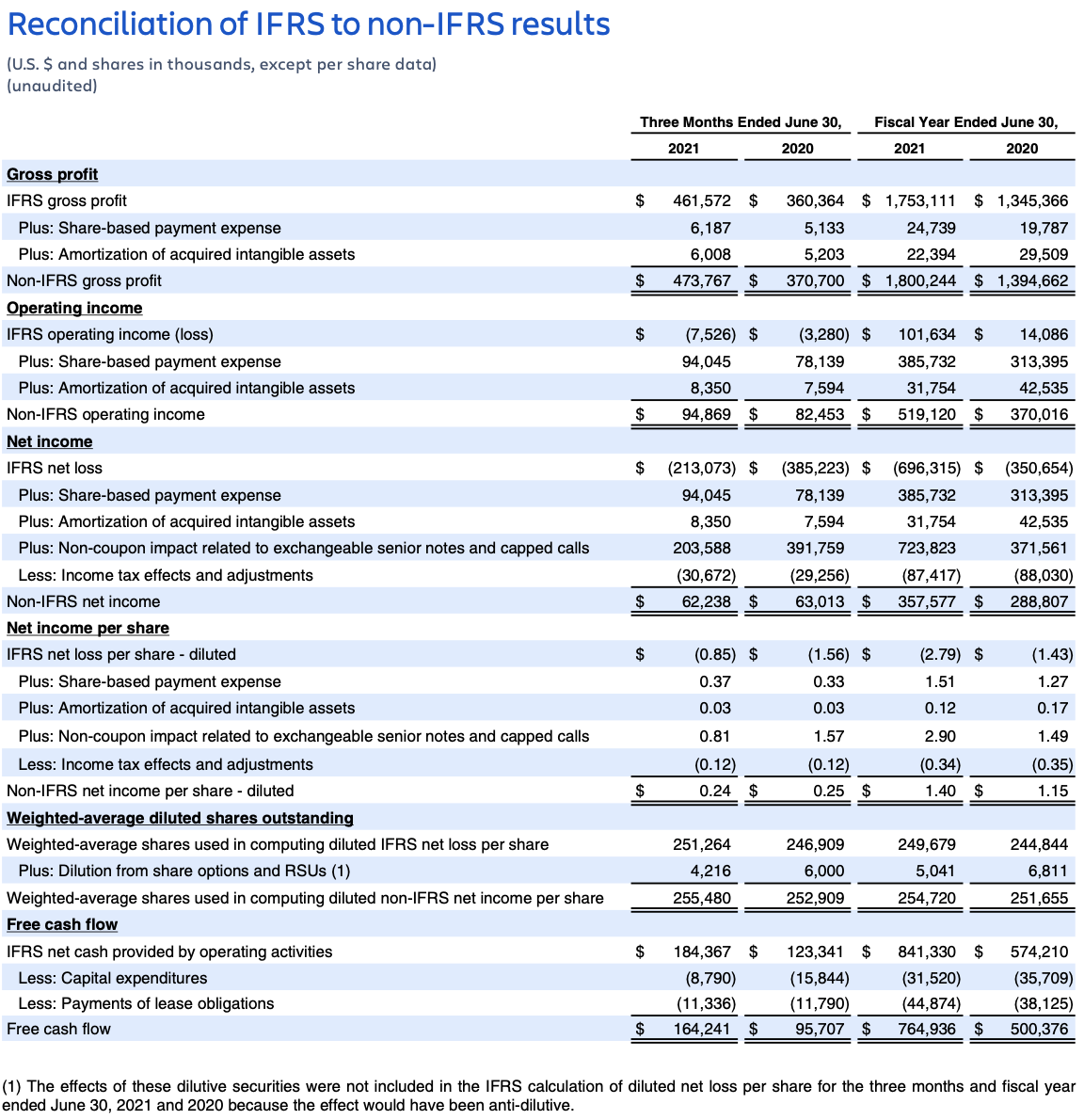

ABOUT NON-IFRS FINANCIAL MEASURES

Our reported results and financial targets include certain non-IFRS financial measures, including non-IFRS gross profit, non-IFRS operating income, non-IFRS net income, non-IFRS net income per diluted share, and free cash flow. Management believes that the use of these non-IFRS financial measures provides consistency and comparability with our past financial performance, facilitates period-to-period comparisons of our results of operations, and also facilitates comparisons with peer companies, many of which use similar non-IFRS or non-GAAP financial measures to supplement their IFRS or GAAP results. Non-IFRS results are presented for supplemental informational purposes only to aid in understanding our results of operations. The non-IFRS results should not be considered a substitute for financial information presented in accordance with IFRS, and may be different from non-IFRS or non- GAAP measures used by other companies.

Our non-IFRS financial measures include:

- Non-IFRS gross profit. Excludes expenses related to share-based compensation and amortization of acquired intangible assets.

- Non-IFRS operating income. Excludes expenses related to share-based compensation and amortization of acquired intangible assets.

- Non-IFRS net income and non-IFRS net income per diluted share. Excludes expenses related to share-based compensation, amortization of acquired intangible assets, non-coupon impact related to exchangeable senior notes and capped calls, the related income tax effects on these items, and discrete tax impact resulting from a non-recurring transaction.

- Free cash flow. Free cash flow is defined as net cash provided by operating activities less capital expenditures, which consists of purchases of property and equipment and payments of lease obligations. Our non-IFRS financial measures reflect adjustments based on the items below:

- Share-based compensation.

- Amortization of acquired intangible assets.

- Non-coupon impact related to exchangeable senior notes and capped calls:

- Amortization of notes discount and issuance costs.

- Mark to fair value of the exchangeable senior notes exchange feature.

- Mark to fair value of the related capped call transactions.

- Net loss on settlements of exchangeable senior notes and capped call transactions.

- The related income tax effects on these items, and discrete tax impact resulting from a non-recurring transaction.

- Purchases of property and equipment and payments of lease obligations.

We exclude expenses related to share-based compensation, amortization of acquired intangible assets, non-coupon impact related to exchangeable senior notes and capped calls, the related income tax effects on these items, and discrete tax impact resulting from a non-recurring transaction from certain of our non-IFRS financial measures as we believe this helps investors understand our operational performance. In addition, share-based compensation expense can be difficult to predict and varies from period to period and company to company due to differing valuation methodologies, subjective assumptions, and the variety of equity instruments, as well as changes in stock price. Management believes that providing non-IFRS financial measures that exclude share-based compensation expense, amortization of acquired intangible assets, non-coupon impact related to exchangeable senior notes and capped calls, the related income tax effects on these items, and discrete tax impact resulting from a non-recurring transaction allow for more meaningful comparisons between our results of operations from period to period.

Management considers free cash flow to be a liquidity measure that provides useful information to management and investors about the amount of cash generated by our business that can be used for strategic opportunities, including investing in our business, making strategic acquisitions, and strengthening our statement of financial position.

Management uses non-IFRS gross profit, non-IFRS operating income, non-IFRS net income, non-IFRS net income per diluted share, and free cash flow:

- As measures of operating performance, because these financial measures do not include the impact of items not directly resulting from our core operations.

- For planning purposes, including the preparation of our annual operating budget.

- To allocate resources to enhance the financial performance of our business.

- To evaluate the effectiveness of our business strategies.

- In communications with our Board of Directors and investors concerning our financial performance.

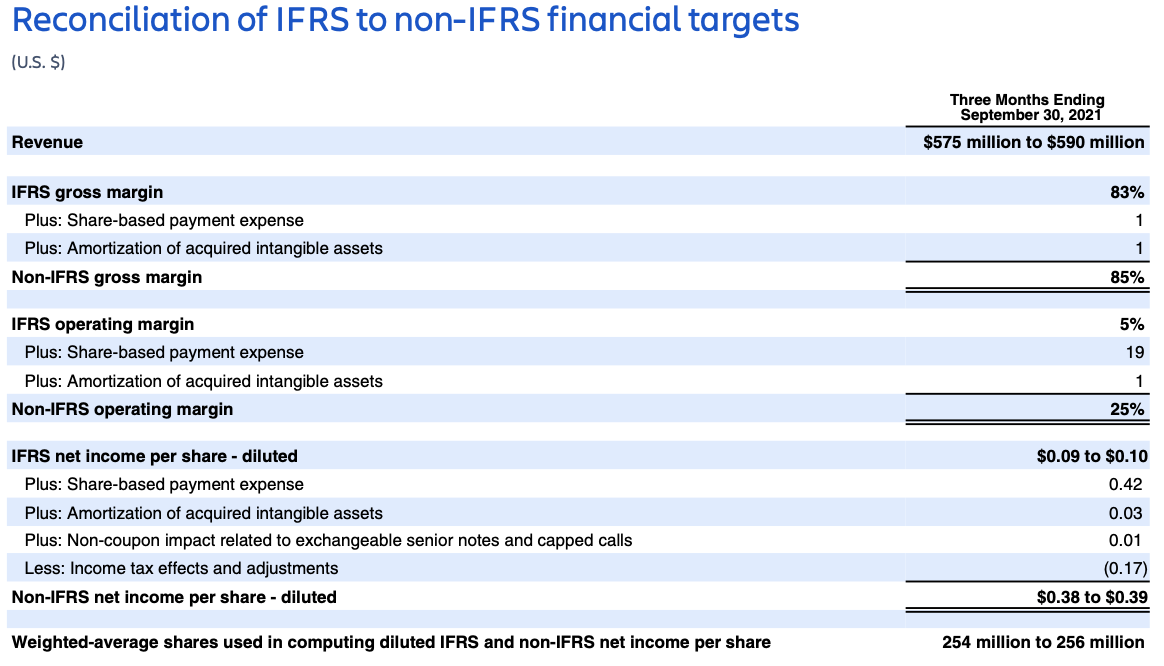

The tables in this shareholder letter titled “Reconciliation of IFRS to non-IFRS Results” and “Reconciliation of IFRS to non-IFRS financial targets” provide reconciliations of non-IFRS financial measures to the most recent directly comparable financial measures calculated and presented in accordance with IFRS.

We understand that although non-IFRS gross profit, non-IFRS operating income, non-IFRS net income, non-IFRS net income per diluted share, and free cash flow are frequently used by investors and securities analysts in their evaluation of companies, these measures have limitations as analytical tools, and you should not consider them in isolation or as substitutes for analysis of our results of operations as reported under IFRS.

ABOUT ATLASSIAN

Atlassian unleashes the potential of every team. Our team collaboration and productivity software help teams organize, discuss and complete shared work. Teams at more than 212,000 customers, across large and small organizations – including Redfin, NASA, Verizon, and Dropbox – use Atlassian’s project tracking, content creation and sharing, and service management products to work better together and deliver quality results on time. Learn more about our products including Jira Software, Confluence, Jira Service Management, Trello, Bitbucket, and Jira Align at https://atlassian.com.

Investor relations contact: Martin Lam, IR@atlassian.com

Media contact: Jake Standish, press@atlassian.com