Our Q2 FY22 letter to shareholders

An update to customers, stakeholders, and shareholders on our mission to unleash the potential in every team.

Fellow shareholders,

Each new year prompts us to pause and take stock. More than anything, we’re grateful for our customers, staff, and stakeholders. Their determination and resilience inspire us to bring our best, most energetic selves to work every day.

Customers look to Atlassian for innovative products that take the “work” out of teamwork, and we’re committed to coming through for them. We’re building a cloud platform that lets us ship new capabilities and products quickly, as we’re beginning to see with Point A. By anticipating the trends in our three addressable markets, investing heavily in R&D, playing the long game with our uniquely efficient GTM model, and staying true to our values, Atlassian is delivering a metric tonne of value.

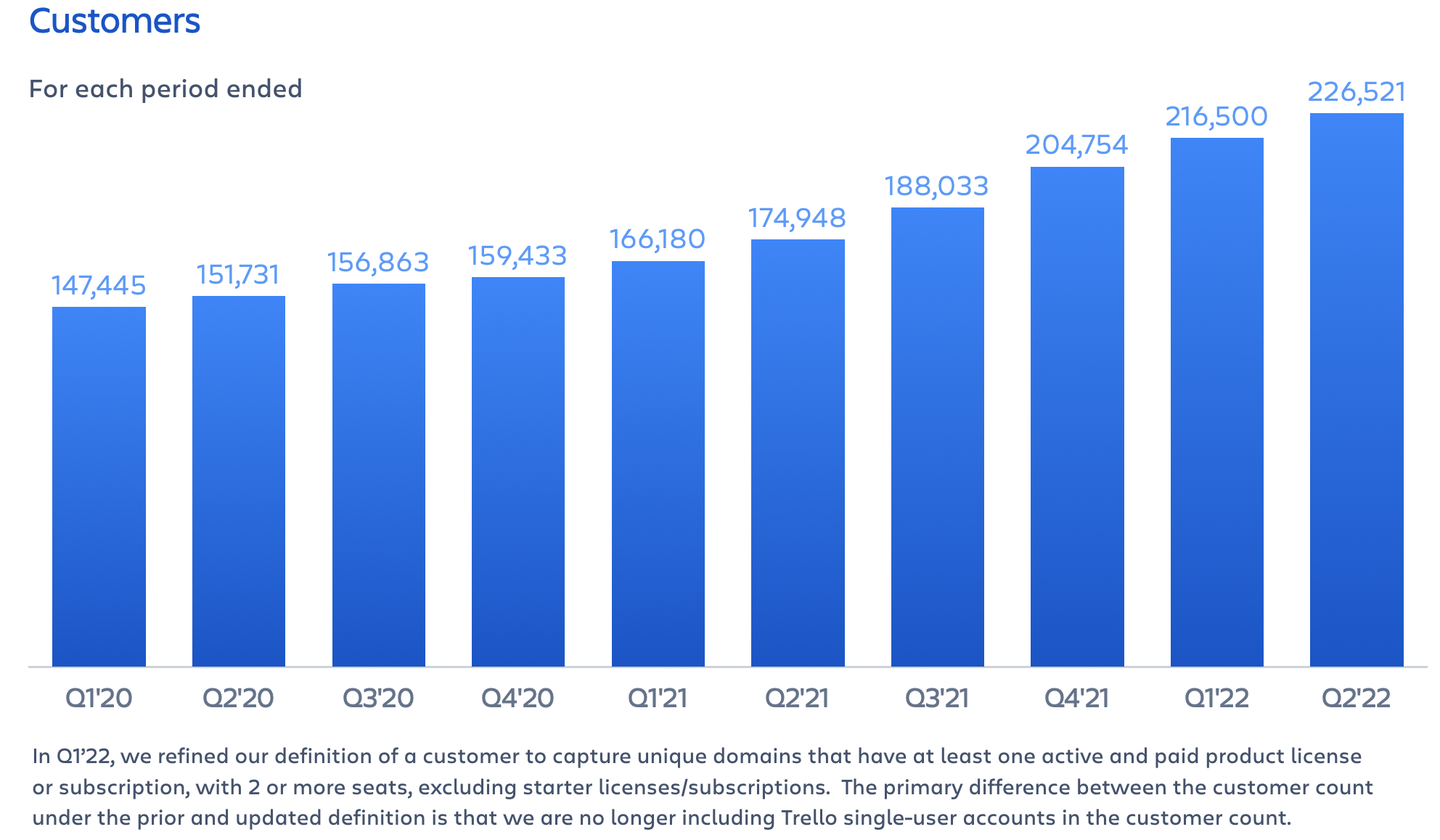

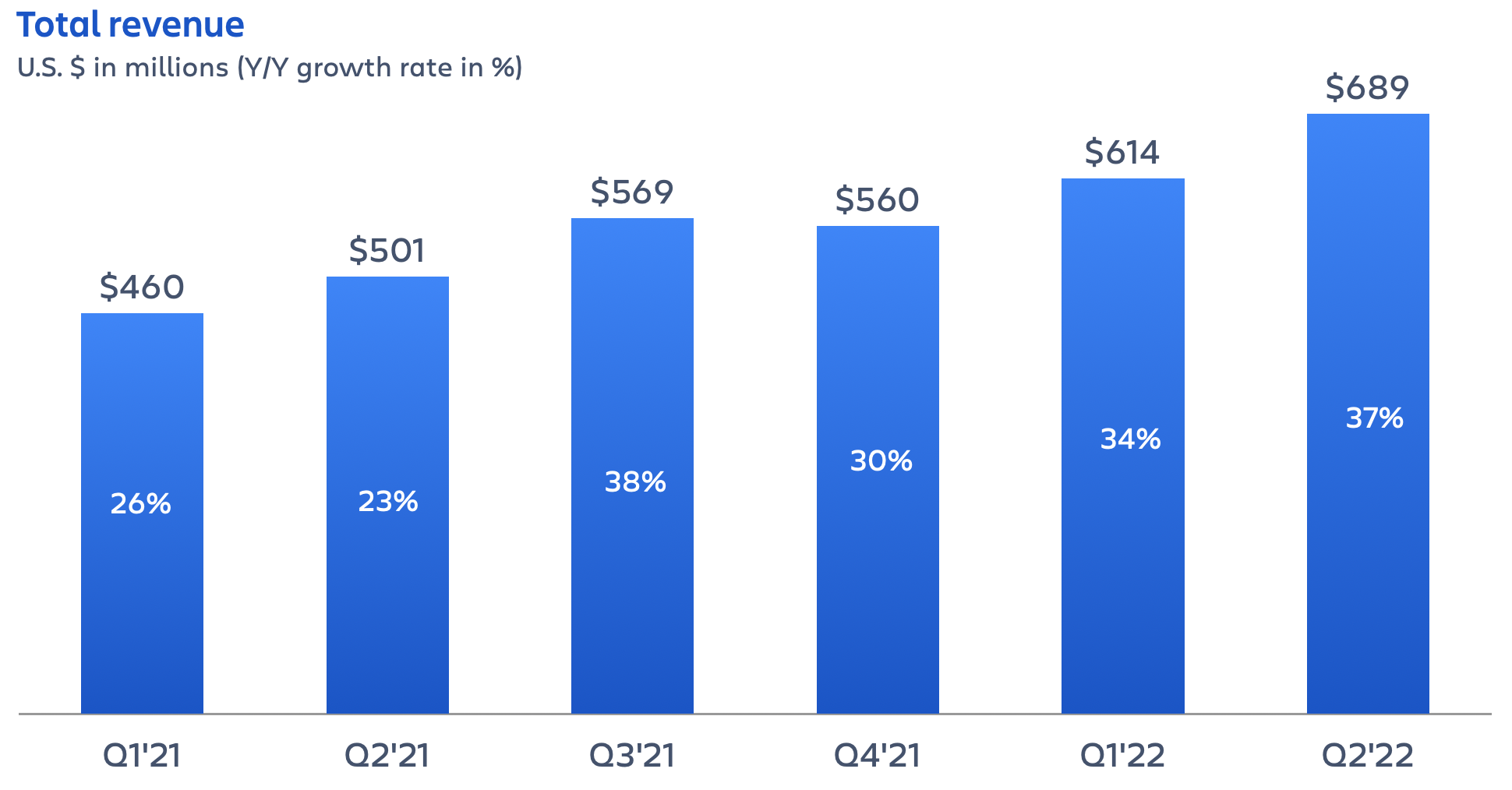

Coming off a solid start to the fiscal year, the Atlassian flywheel kept our momentum high and delivered a bonza ![]() Q2. We landed over 10,000 net new customers this quarter, 98% of whom chose Cloud, and made steady progress migrating our on-premises customers. Total revenue grew 37% year-over-year, driven by subscription revenue, which grew 64% year-over-year.

Q2. We landed over 10,000 net new customers this quarter, 98% of whom chose Cloud, and made steady progress migrating our on-premises customers. Total revenue grew 37% year-over-year, driven by subscription revenue, which grew 64% year-over-year.

Atlassian doesn’t need to reinvent itself every January 1st. We play the long game. As a dedicated team of over 7,000 (and growing!), we march forward with our eyes on the horizon, shaping and living the future of work every single day so our customers are equipped for whatever comes next.

Hey! You! Get off of onto my cloud! ⛅️ 🎸

Along with the obvious benefits like hosted infrastructure and unified user management, many long-time customers are discovering that migrating to our Cloud products also offers a chance to streamline the way they configure their Atlassian products and maximize the value they get.

Marty Hagewood, a software development manager at EMC Insurance Companies, experienced this first-hand. When EMC decided to move from their Data Center deployments to Cloud, they saw a unique chance to make long-lasting improvements. “We said, ‘Let’s not just move it over. Let’s rearrange the blocks a little bit and challenge ourselves to ask questions,’” he recalls. Those questions prompted them to simplify. We think Marie Kondo would approve. ![]()

Between migrations, customers expanding their footprint in the Cloud, strong adoption of Premium editions, and new customer additions driven by Free editions, Cloud Q2 revenue was up 58% year-over-year. Of note: approximately one-third of total Cloud migrations in Q2 came from Data Center.

As you’ll see below, continuous improvements to our platform allow us to welcome even our largest and most regulated customers to Atlassian Cloud. We still have more work ahead of us, but we’re happy with the progress we’re making.

Wins for enterprise customers

When we talk to our largest customers, they tell us they’re excited to move to Cloud. And each quarter we make it easier for them to do so. This quarter we satisfied a requirement for many of our regulated customers by achieving compliance for the financial services industry in EMEA.

Cloud Enterprise editions of our products now meet some of the most stringent compliance standards in the world, including those of the European Banking Authority (EBA) and Germany’s Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin). This win comes on the heels of delivering data residency for EMEA and Australia back-to-back in Q4 FY21 and Q1 of this fiscal year. Stay tuned for more region- and industry-specific security and compliance capabilities in the coming quarters. 🔐

Long-term investments in our platform are paying consistent dividends. Centralized platform capabilities like scalable infrastructure and a steady cadence of security enhancements help us attract enterprise customers without upending our unique business model.

While it’s still early days for our Cloud Enterprise editions, we’re seeing solid initial traction as we strengthen these offerings further. Large companies’ needs are becoming more complex due to emerging regulations around privacy and security. Atlassian stands ready to shoulder that burden on our customers’ behalf so they can focus on their core objectives.

Creating value for partners

Partners are critical to our long-term success. What’s more, they see Atlassian Cloud as being critical to their success and are embracing the new opportunities around migrations, sales, and app development it provides. And the numbers bear this out: Cloud sales from our Channel Partners in Q2 were up 131% year-over-year.

Customers add roughly 28,000 apps to their Atlassian products each week. In fact, adoption of our Cloud apps is growing faster than adoption of our Cloud products themselves – a sign of a thriving ecosystem with room to expand. Cloud apps now account for nearly 50% of Atlassian Marketplace listings overall, with over 70% of Jira and Confluence Cloud customers having at least one app installed.

Apps are tightly correlated with customer loyalty because of the additional value they help customers realize. We’ll continue to make the right moves to grow our offerings and invest in the success of our 1,250+ Marketplace Partners.

Meeting notes app-maker Hugo is a great example of the impact the Atlassian ecosystem has for our partners. Soon after starting their company, Hugo’s founders built integrations for their app that let users turn action items into Jira tickets and sync meeting notes with Confluence pages. “Those integrations got us into the Atlassian Marketplace,” says co-founder and COO Darren Chait. “That’s been driving traffic and sign-ups ever since. It’s a great source of customer acquisition and ultimately, revenue growth.”

We’re incredibly proud of our ecosystem and its momentum. After the Marketplace’s inception in 2012, it took seven years to reach $1 billion in lifetime sales. Now we’ve surpassed $2 billion, just two years later. It’s been an honor and a pleasure to pay out over $1.5 billion in revenue share to our global network of app developers, fueling their growth. 💸 Here’s to the next $1.5 billion, and beyond!

Our platform enables us to expand our partnerships in ways we’ve only begun to explore. Capabilities like unified billing and enterprise-grade security make it easy for other innovators out there to plug in and become part of our ecosystem. They know Atlassian is the central hub that moves work forward and recognize the industry-leading scale at which we operate, thanks to our diverse and rapidly growing customer base. We’re excited to create new ways of working as a team with partners for the benefit of our customers.

We’re also leveraging Atlassian Ventures as another mechanism to expand the economy around Atlassian. When visual collaboration company Miro approached us about contributing to their Series C funding round, we jumped at the chance. Similarly, Clockwise, a time orchestration provider that helps teams free up more focus time, recognized our shared focus on teams and turned to Atlassian Ventures. Our venture investments, from Marketplace vendors to partners like Miro and Clockwise, ensure we’re driving alignment and customer value across the board.

Shaping the future of work across three global markets🔮

Today’s teams are tackling ever-more complex problems. Solving them takes cross-functional collaboration. In a recent study we conducted in partnership with Forrester Research, 83% of tech leaders said open, interdepartmental collaboration is critical to their organization’s success.

That’s why Atlassian delivers a portfolio of powerful, seamlessly integrated products that reach across entire organizations. And our three-pronged approach is delivering more value than just the sum of its parts.

Work management for all

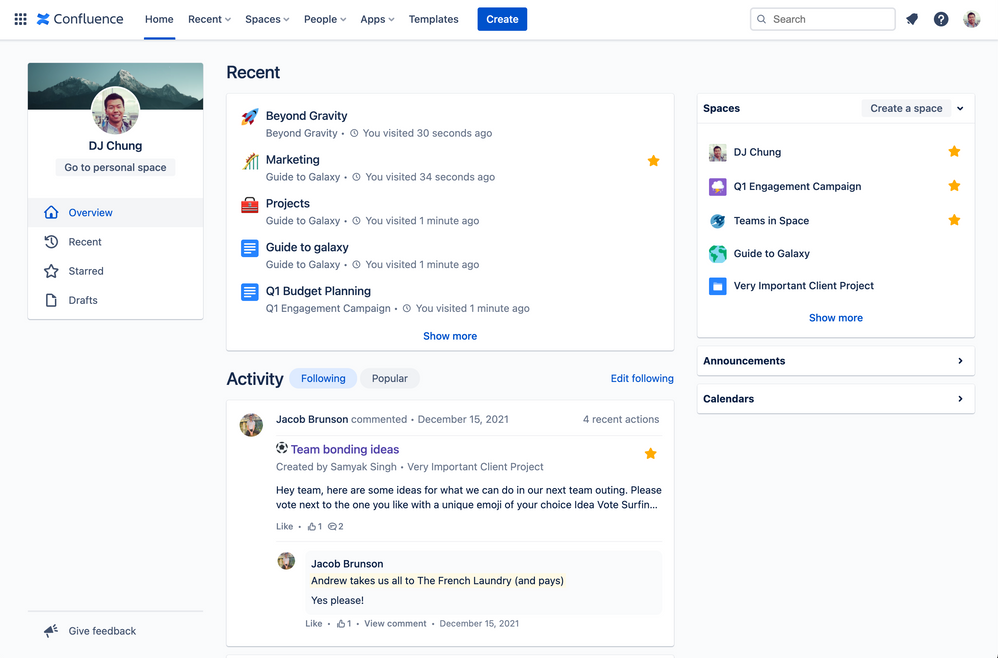

Products like Confluence, Trello, Jira Work Management, and Team Central are key players in our mission to unleash the potential of every team. Among these, Confluence is the unsung hero. It quietly powers cross-functional collaboration for more than 75,000 customers, drives hundreds of millions in revenue annually, and continues to grow at a rapid clip. ![]()

Confluence picks up where chat tools leave off. It serves as the digital watercooler where the whole company shares updates about their work, their team, and themselves. As any Atlassian will tell you, Confluence helps the whole company feel connected on both a professional and personal level.

Confluence is the lifeblood of business teams like HR and marketing, allowing them to collaborate on long-form content like reports, company policies, project plans, and blog posts. (We even draft our earnings reports in Confluence!) And because it’s long been the go-to place for technical teams to create knowledge bases and design docs, Confluence facilitates cross-functional collaboration like a champ.

Confluence went from a tool used just by the technology organization to an enterprise tool used by the entire company. It’s given us a central place to document, track, and collaborate within and across Nextiva. We’re able to share the same platform and can work more efficiently.

– Catherine White, Atlassian Solutions Specialist at Nextiva

This quarter, we shipped a new home screen inside Confluence that helps users dive back into their work, catch up on relevant activity, and discover what’s happening around them. Users can now jump straight to pages they’ve been following or working on and see real-time updates from the people they work with most often. And speaking of digital watercoolers, the Popular feed highlights the most trafficked and commented pages, making it easy to see what the company is buzzing about and join the conversation.

We also gave users new ways to add pages. Confluence customers of all sizes tell us that bringing different data sources together to create robust, structured content is a massive challenge. So we introduced 40 new page templates, added support for images to all templates, and made it easier to pull in excerpts from other pages.

IT Service Management (ITSM)

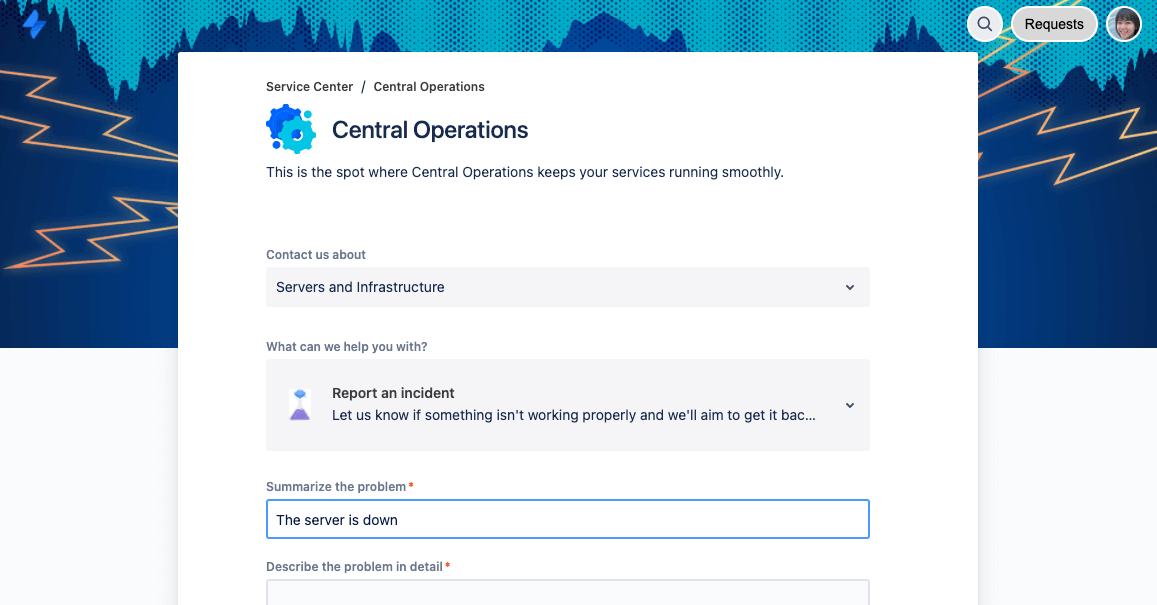

Three years ago, we declared our intention to double down on IT teams. Since then, we’ve delivered a steady stream of innovation and, powered by our platform, launched Jira Service Management last fiscal year. Its unique blend of ITSM capabilities is helping customers deliver great employee and customer support quickly – a critical capability in today’s digital-first, remote-friendly world.

All Atlassian’s ITSM competitors are monolithic solutions that start at half a million dollars and need an army of consultants to get started. We needed something that would scale with us today. And we don’t have to change our business to use Jira Service Management. That’s really different from the rest of the products on the market.

– Dave Treff, Head of Digital Operations at Ginkgo Bioworks

Jira Service Management’s 35,000+ customer base speaks for itself. And this quarter, Forrester joined the conversation when it recognized Jira Service Management as a Leader in its Enterprise Service Management wave.🏅 Not only that, but Forrester also recognized Atlassian’s strategy for enterprise service management with the highest possible score.

But we’re not stopping there. We recently added Percept.ai to the Atlassian family, bolstering our investments in automation and machine learning. As part of Jira Service Management, Percept.ai’s virtual agent technology will automate day-to-day support interactions. Its AI engine analyzes intent, sentiment, and context to personalize interactions, and when necessary, seamlessly transitions conversations to human agents. With the robots taking the rote aspects of their job 🤖, support staff can focus on process improvements and other forward-looking work.

Agile development

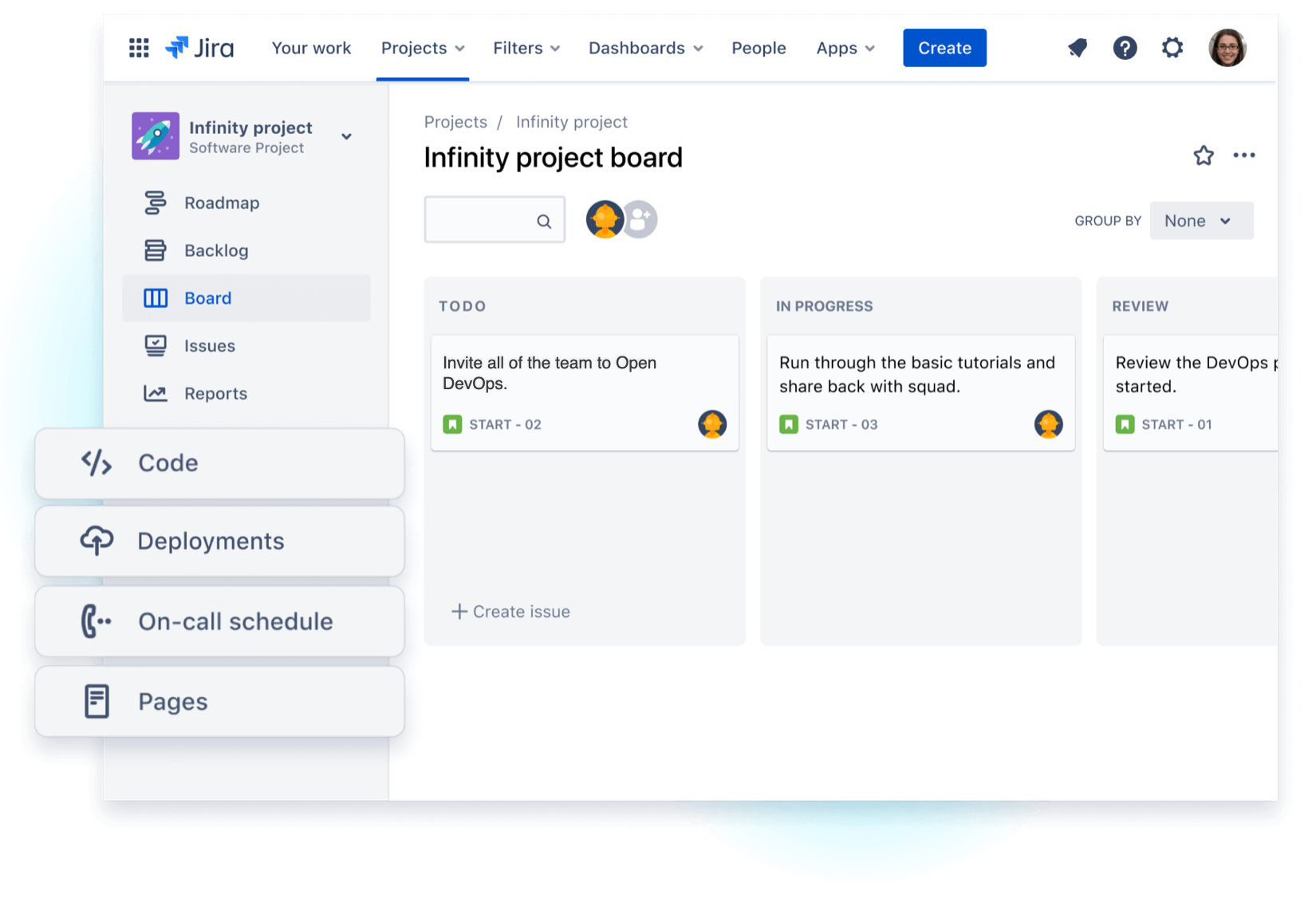

Software development tools power a broad array of operations on the journey from concept to code to customer. But teams don’t want to be forced into an all-in-one solution that may or may not suit their needs. Flexibility is vital to their success, so we focus on being the beating heart that keeps development work flowing. Our Open DevOps framework extends the power of Jira, Bitbucket, Opsgenie, and Confluence with best-of-breed third-party integrations that let teams build custom toolchains with Atlassian at the center, coordinating it all.

Take test management, for example. We don’t try to cover every technical nook and cranny on our own. Instead, we use our open integrations strategy to bring this capability to customers. Atlassian partnered with companies like Xray, SmartBear, and Mabl so teams can manage their automated tests without leaving Jira.

The DevOps tool market evolves quickly, with whole new categories emerging on a regular basis. Through it all, customers consistently turn to Atlassian. With Open DevOps, we can anticipate their needs so they can carry on building great software for their customers.

Flexibility is our strength 🧘🏽🏋🏼

The past two years have underscored the importance of scaling efficiently and flexibly. With our “TEAM Anywhere” program, we can offer employees the option to live anywhere within countries where we have a legal entity (hello, Australian Antarctic Territory! 🇦🇶) and work from just about any other location on a temporary basis. We believe this has helped shield Atlassian from the massive employee attrition many other companies are experiencing.

It also means Atlassian is recruiting the most talented people to support our goals, even if they don’t turn up to an office every day. Over 40% of the new Atlassians hired in calendar 2021 live more than two hours away from the nearest Atlassian office. That number will keep growing as we ramp up the pace of hiring over the next several quarters.

Hiring is the key to Atlassian’s future and our top priority – full stop. We deeply believe in the massive market opportunities in front of us, and investing in people is our path to seize these opportunities. It’s also our biggest challenge. Behind every headline about the “Great Resignation” are a hundred companies duking it out for the best talent. We believe Atlassian can, and will, win the right people on the strength of our award-winning culture, compelling mission, competitive compensation, and flexible work environment.

TEAM Anywhere lets us adapt quickly when we need to. We’ll continue to evolve these practices day by day as we build toward 10,000 employees globally. We’re proud to share our lessons learned (warts and all! 😳) through our blog, customer events, and other forums. It’s all part of our mission to unleash the potential of every team.

A fond farewell 👋🏽

After six incredible years leading Atlassian’s Engineering team, our CTO Sri Viswanath has decided to move on. This will see him transition CTO responsibilities to a to-be-determined successor at the end of FY22.

Sri joined as Atlassian’s first CTO in January 2016, shortly after our initial public offering. At the time, we had approximately 800 employees in R&D and 54,000 customers. Sri has been instrumental in transforming the architecture of our platform and products to establish the foundation of our cloud-first business. Today, there are nearly 4,000 Atlassian under Sri’s leadership. We now support more than 226,000 customers, and Cloud revenue has grown approximately 13x during his tenure.

Sri is a respected and inspiring leader as well as a natural mentor, nurturing the careers of countless Atlassians. While we are sad to see him go, we are thankful for the huge impact he has had on our customers, our growth, and our culture. 💙 We look forward to cheering him on in his next chapter – whatever that may be.

We look forward to discussing all of the above and answering your questions on our earnings call.

– Mike and Scott

the bottom line

- Atlassian’s ecosystem is creating heaps of value for partners and customers alike. A thriving ecosystem is critical to our success and we’ll continue to look for new ways to expand it even further.

- Hiring remains our top priority. Thanks to our award-winning culture, mission, and “TEAM Anywhere” program, we’re well positioned to ramp up hiring over the coming quarters as we seize the massive market opportunities in front of us.

- Our cloud platform continues to evolve, unlocking migration opportunities for more customers every quarter, particularly those in regulated industries. We’re pleased with the steady progress we’re making on our journey as a cloud-first company.

Customer highlights ⭐️

Over 10,000 net new customers from a wide range of industries came on board in Q2, and over 50,000 in calendar year 2021. To give you an idea of the momentum we’ve built, it took 13 years to reach 50,000 customers total. These incredible numbers are due to the growing demand for our products that address ongoing digital and cultural transformations within businesses, as well as our unique go-to-market machine that optimizes each step in the customer journey.

While I don’t play favorites with Atlassian products, Jira Service Management is near the top of my list. The reality is, the entire ITSM market desperately needs a different approach to tooling, and Jira Service Management is precisely the right product at the right time.

There’s a lot of talk out there about breaking down organizational silos, and Jira Service Management actually helps companies walk the walk. It brings development, operations, and business teams together in a way no other product can beat. Whether it’s enterprises like CBS and mid-Western grocery giant Hy-Vee, or Valemas, a small marketing consultancy in Bogatá, we’ve struck a chord that will be music to customers’ ears for years to come.

Customers took center stage at the “High Velocity” virtual event in November, sharing how Jira Service Management drives exceptional service experiences for both customers and employees at scale. For the IT leaders from around the globe who attended, the event was a smash hit. 🤘🏼 Encore, please!

For now, however, we’re turning our attention to our flagship event of the year: Team ‘22. And we’re heading back to Vegas!

We’re preparing for a three-day live event, April 5 – 7, that will include keynotes, breakout sessions, training, an expo floor, and networking events. We’ll complement the in-person activities with live streams of the keynote and breakout sessions, extending the experience to an even larger group and empowering teams to attend in whatever way works best for them. As with everything we do, we’ll stay nimble and adapt plans for Team ’22 as the situation warrants.

We’ll also be holding our next Investor Day at Team ’22 on April 7, with plans for both on-site and virtual sessions – more details to follow. We hope to see you there!

– Cameron

Financial highlights 📈

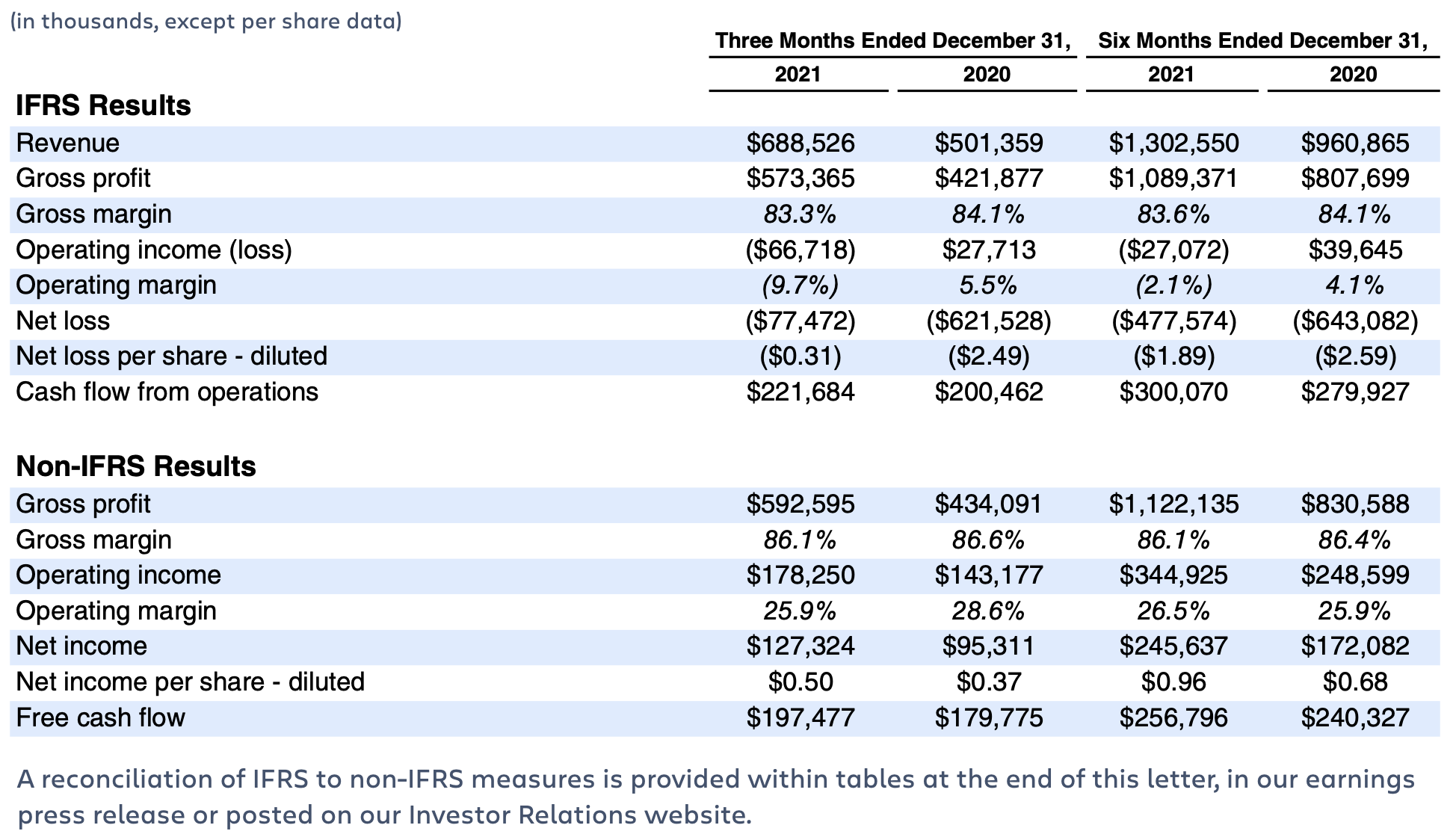

Second quarter fiscal 2022 financial summary

Second quarter fiscal 2022

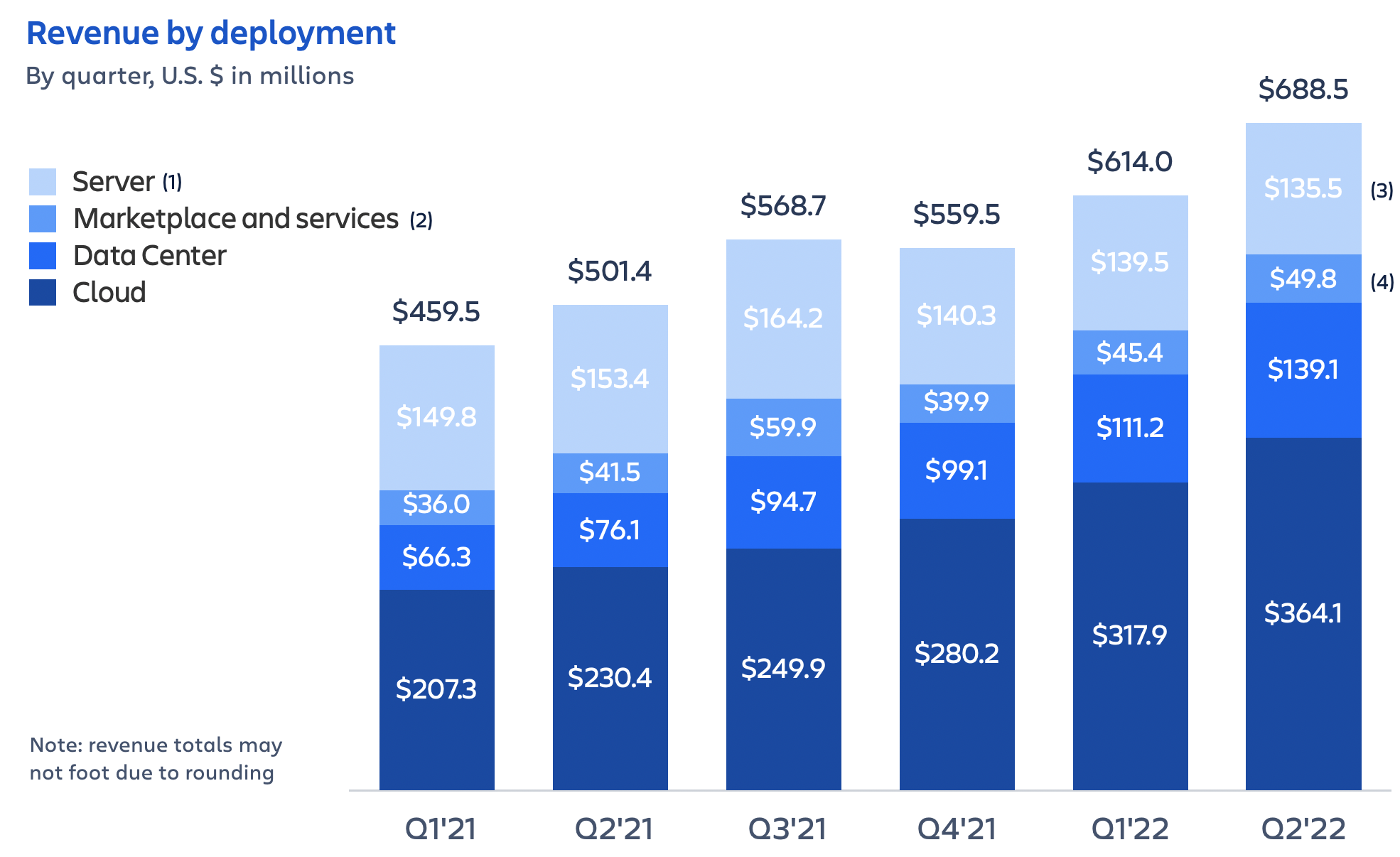

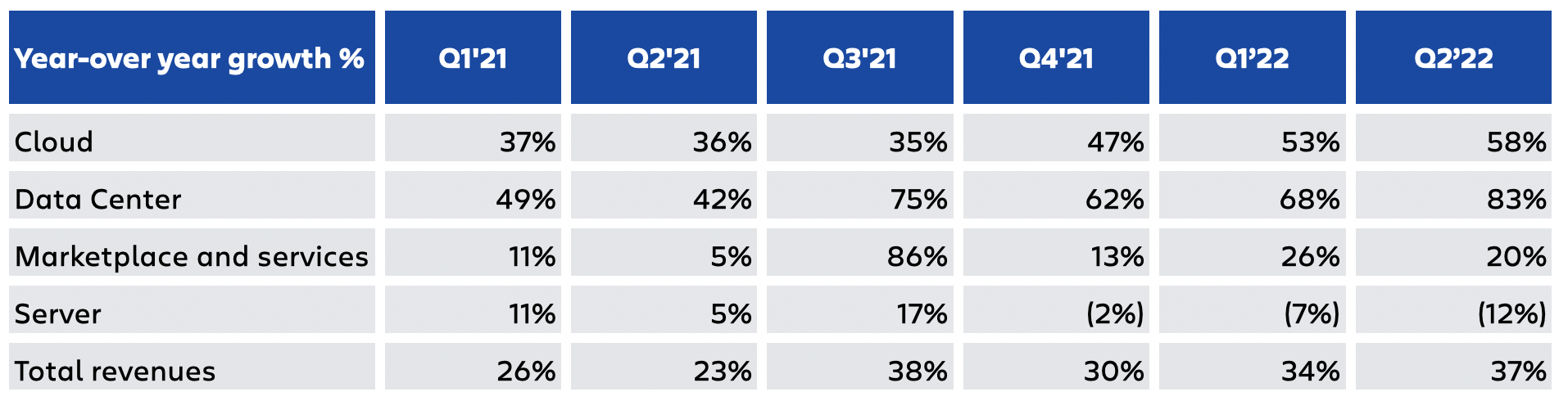

We recorded excellent financial performance in Q2’22 and I am pleased to see the results of past investments come to fruition in the current quarter. Our Cloud and Data Center products continue to be in strong demand and we were pleased with the number of net new Cloud customer additions. Furthermore, our Cloud migration progress is encouraging.

Highlights for Q2’22 include:

- Subscription revenue grew 64% year-over-year. Specifically, Cloud revenue grew 58% year-over-year while Data Center revenue grew 83% year-over-year.

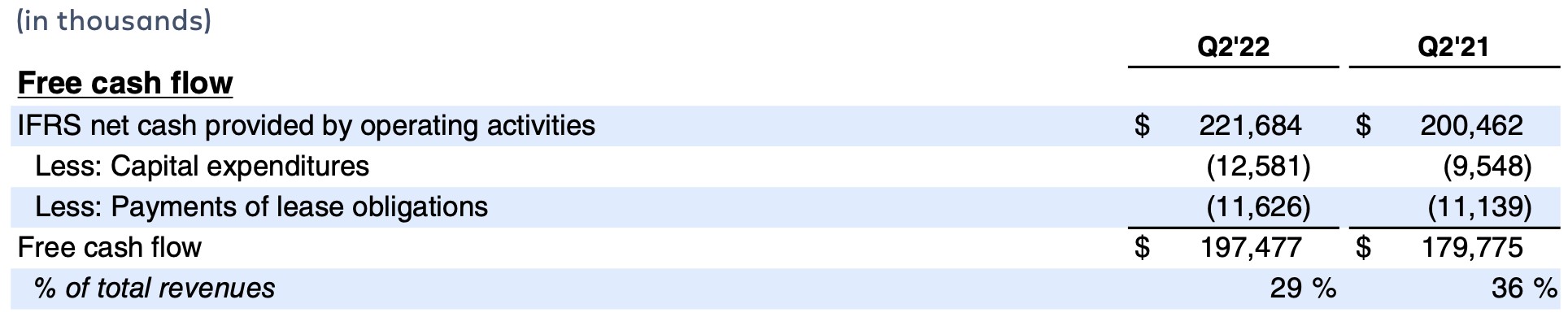

- Strong free cash flow generation of $197.5 million, representing a 29% free cash flow margin.

- Hiring remains a top priority and we continue to execute well against our ambitious plans. In Q2’22, we added 476 net new Atlassians and expect this momentum to build in the remainder of FY22 and beyond. We will continue to invest in top-tier talent wherever they are around the globe to drive durable growth and expand our reach across our three core markets.

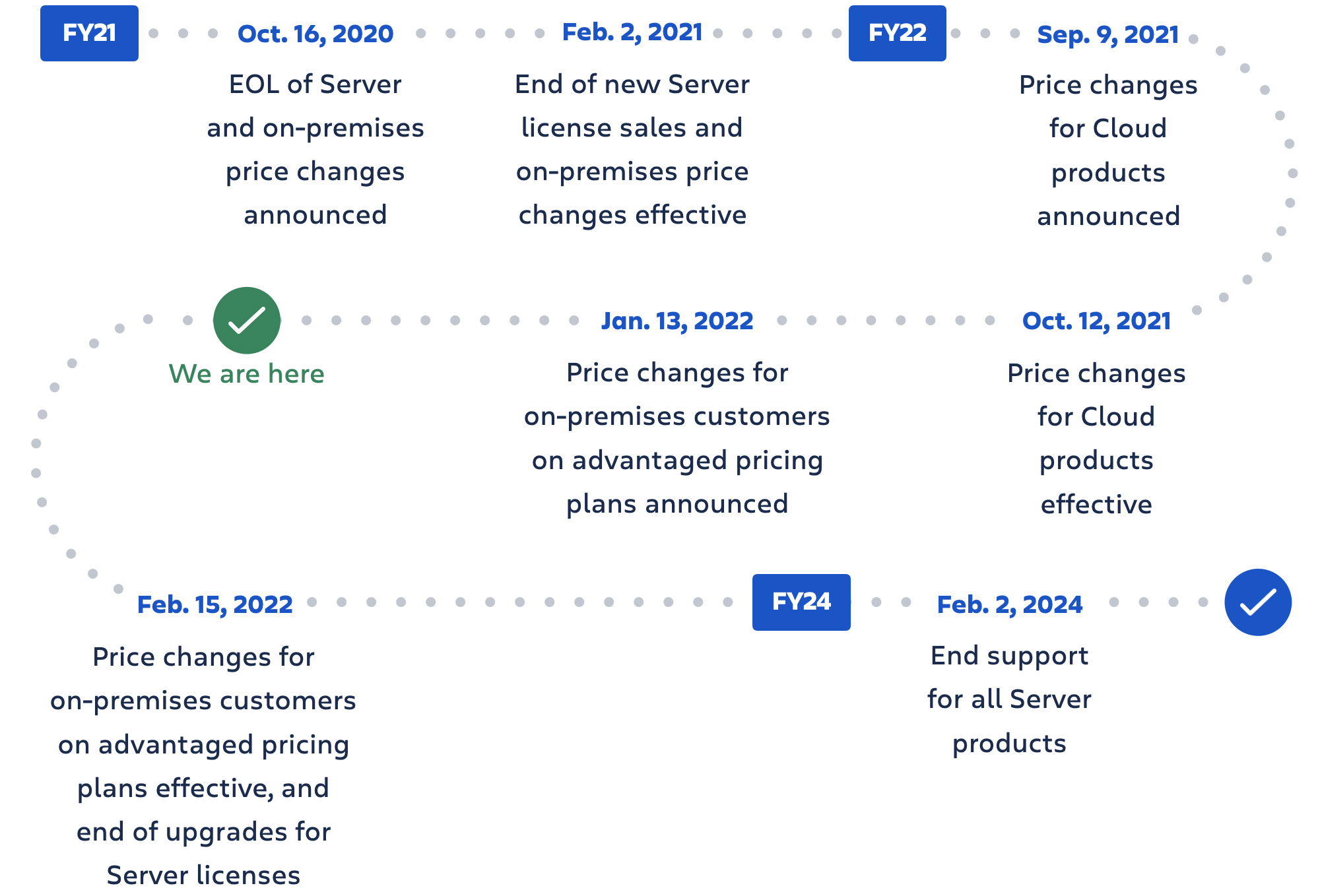

Pricing changes and end of upgrades for Server licenses

We recently announced price changes to certain Data Center and Server products. We also reminded customers that we are ending both user tier upgrades for Server licenses and new Server feature development, effective February 15, 2022.

Pricing increases

We notified a number of our Data Center and Server customers that they would see price changes to certain products. These price changes only impact existing customers that are on legacy pricing plans (“advantaged pricing plans”) and vary depending on product and user tier. The significant majority of Data Center and Server customers are on these advantaged pricing plans. The increases will gradually bring these customers to our list prices over time. For Data Center deployments, the increases equate to approximately 13-15% across Jira Software, Jira Service Management, and Confluence. For Server deployments, the increases will be approximately 10-25%, across all tiers of Jira Software, Confluence and Jira Work Management with the largest tiers seeing the greatest increase. This most recent announcement does not impact Cloud pricing. As a reminder, last September, we announced pricing changes on certain Cloud products that went into effect in mid-October.

Below is a summary of the primary FY22 price changes:

| Deployment model | Price Change | Effective Date |

| Data Center | ~13 – 15% | February 15, 2022 |

| Server | ~10 – 25% | February 15, 2022 |

| Cloud | ~5% | October 12, 2021 |

End of Server license upgrades and Server feature development

As previously communicated in October 2020, customers on any Server license will no longer be able to upgrade their user tier after February 15, 2022. We will also end new Server feature development and only commit to providing security bug fixes for critical vulnerabilities until we withdraw support for Server products in February 2024.

The timeline for the Server end-of-life and recent price changes is as follows:

Additional details and resources are available on our Migration Center.

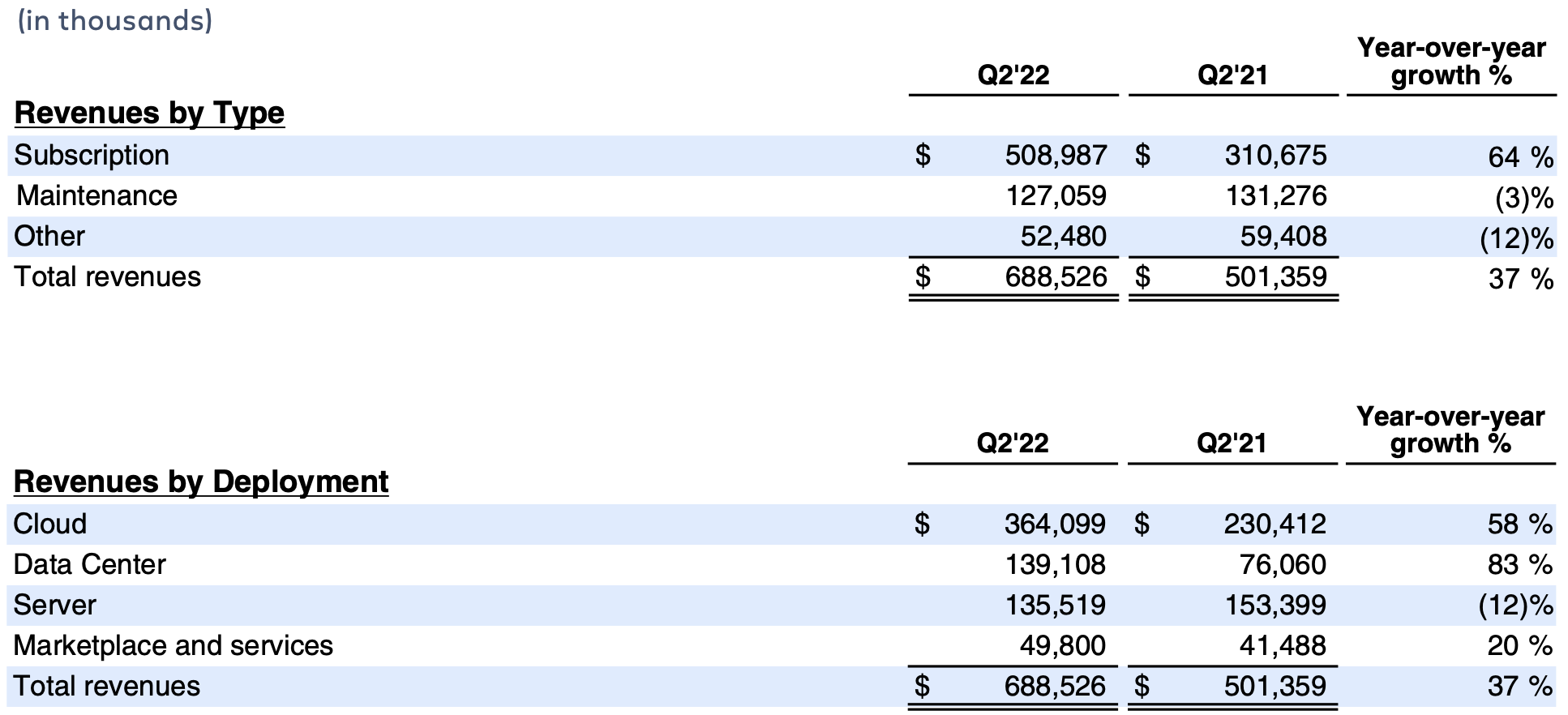

Revenue

(1) Included in Server is perpetual license revenue. Perpetual license revenue is captured as other revenue on the Consolidated Statements of Operations.

(2) Included in Marketplace and services is premier support revenue. Premier support is a subscription-based arrangement for a higher level of support across different deployment options. Premier support is recognized as subscription revenue on the Consolidated Statements of Operations as the services are delivered over the term of the arrangement.

(3) In Q2’22, Server revenue includes approximately $8 million of perpetual license revenue which is included in other revenue on the Consolidated Statements of Operations.

(4) In Q2’22, Marketplace and services revenue includes approximately $6 million of premier support revenue which is included in subscription revenue on the Consolidated Statements of Operations.

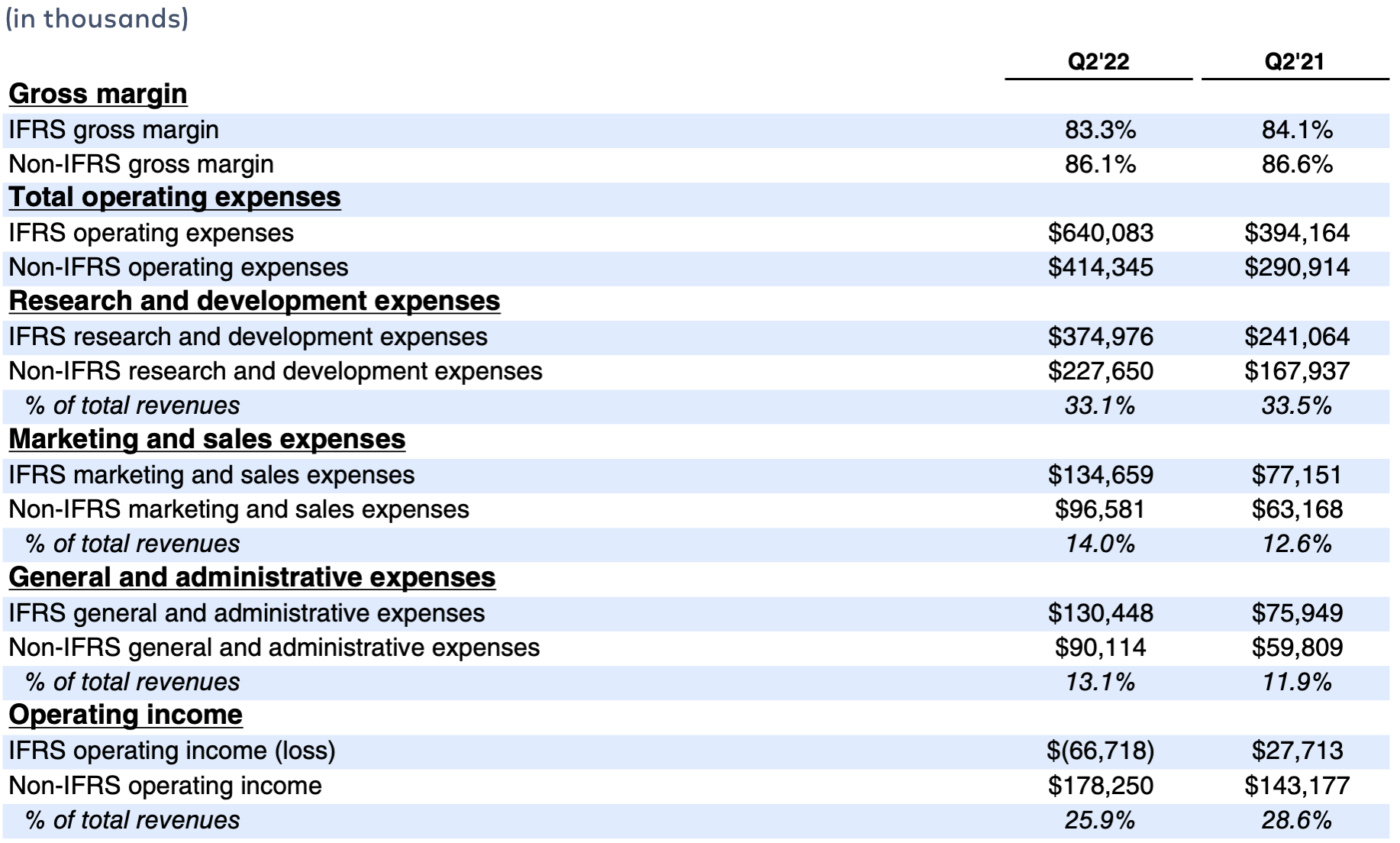

Margins, operating expenses, and operating income

Headcount

Total employee headcount was 7,388, an increase of 476 employees since the end of Q1’22. We hired across all major functions, with the largest number being added in R&D.

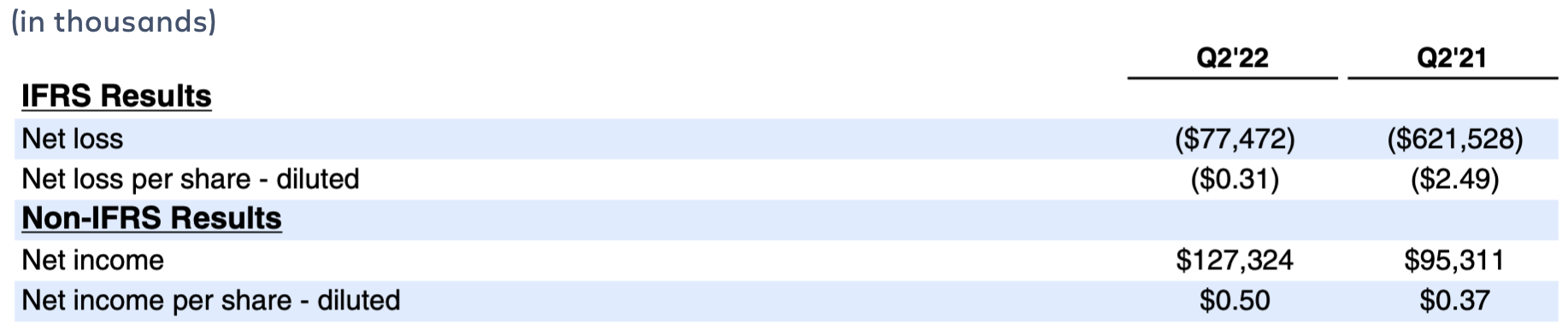

Net income

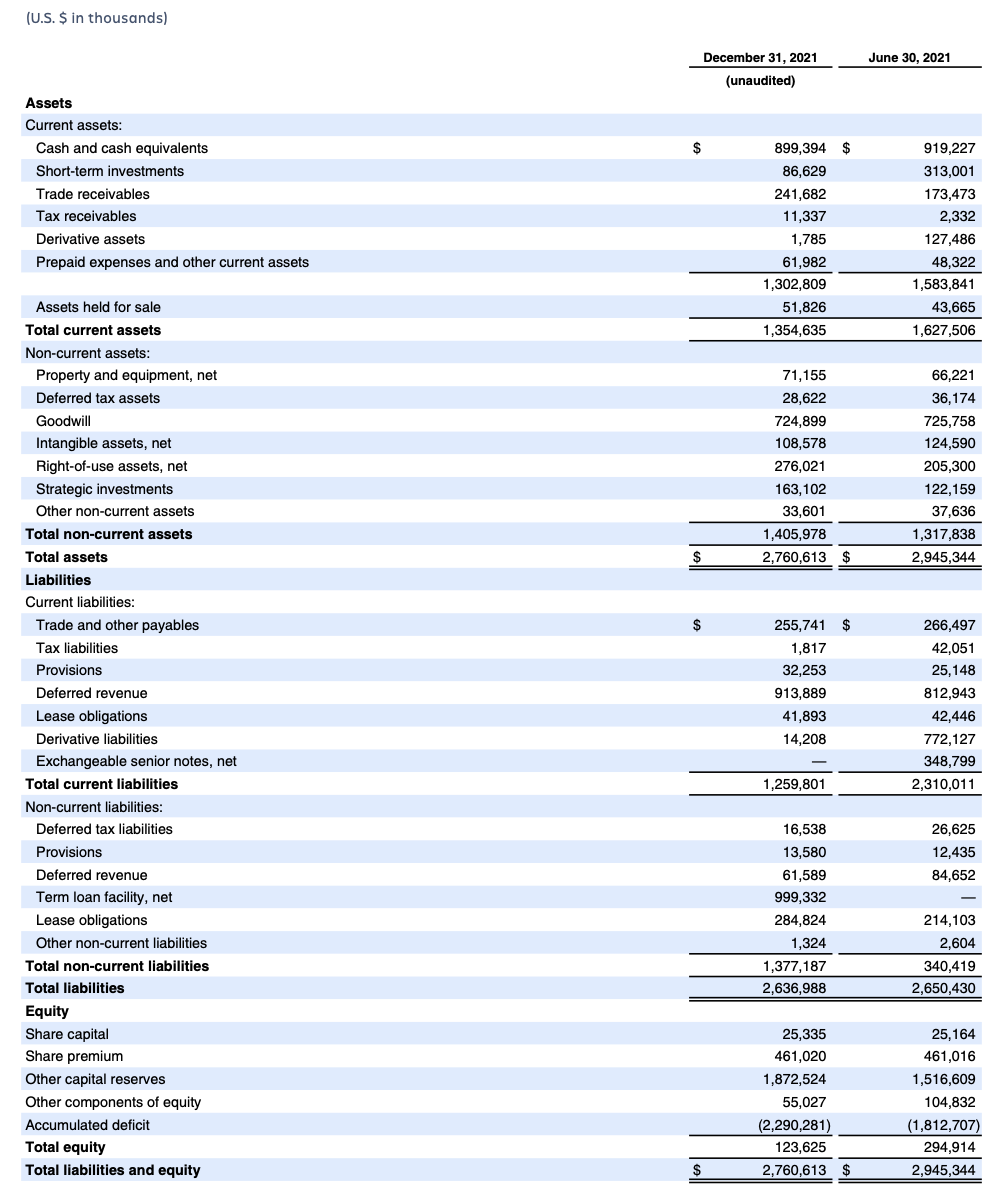

Balance Sheet

Atlassian finished Q2’22 with $986.0 million in cash and cash equivalents plus short-term investments.

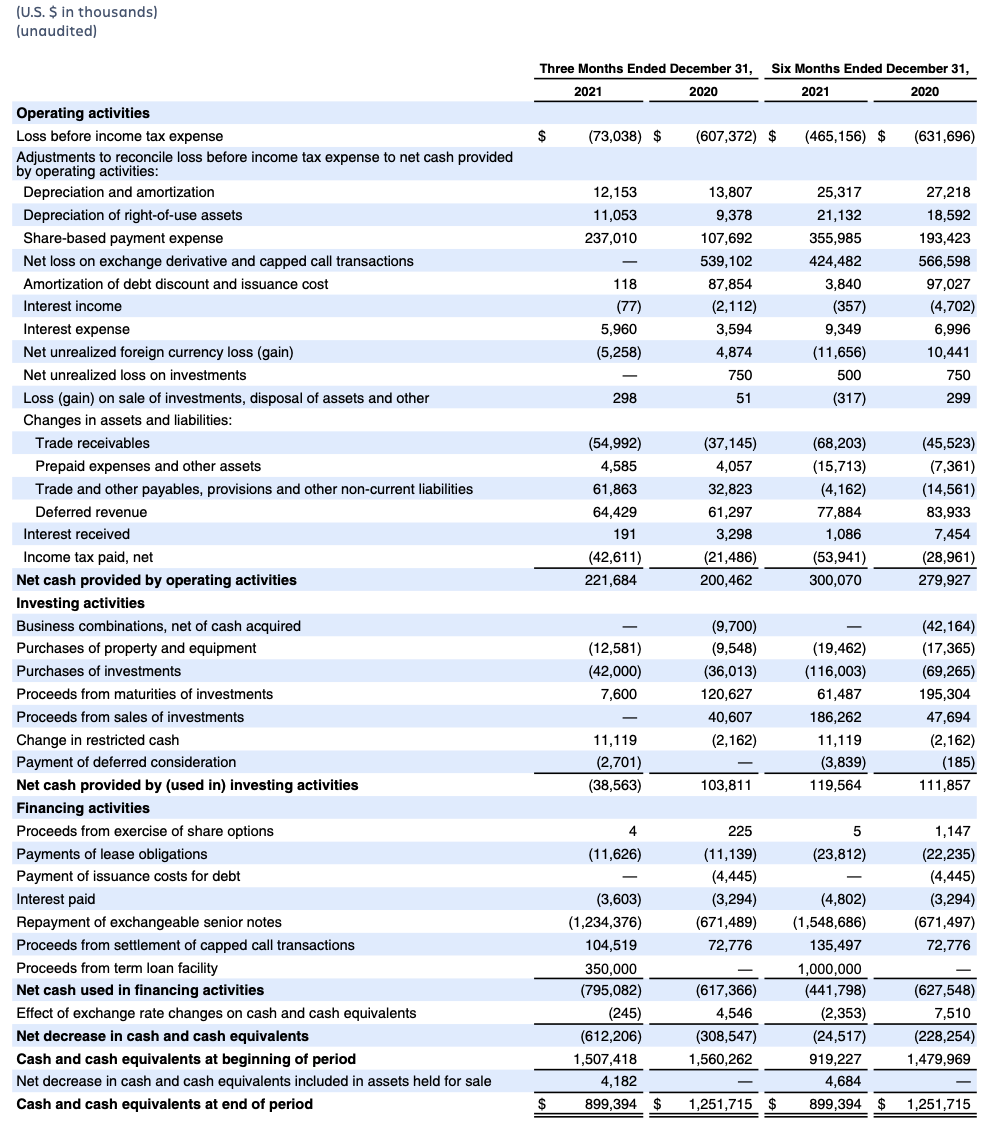

During Q2’22, we drew $350.0 million from our term loan facility, used $1.2 billion in cash to settle the remaining portion of our outstanding exchangeable senior notes, and received $104.5 million in cash from the unwinding of the related capped calls. The net impact resulted in cash outflows of $779.9 million, which is reflected in cash used in financing activities on our Consolidated Statements of Cash Flows.

Free Cash Flow

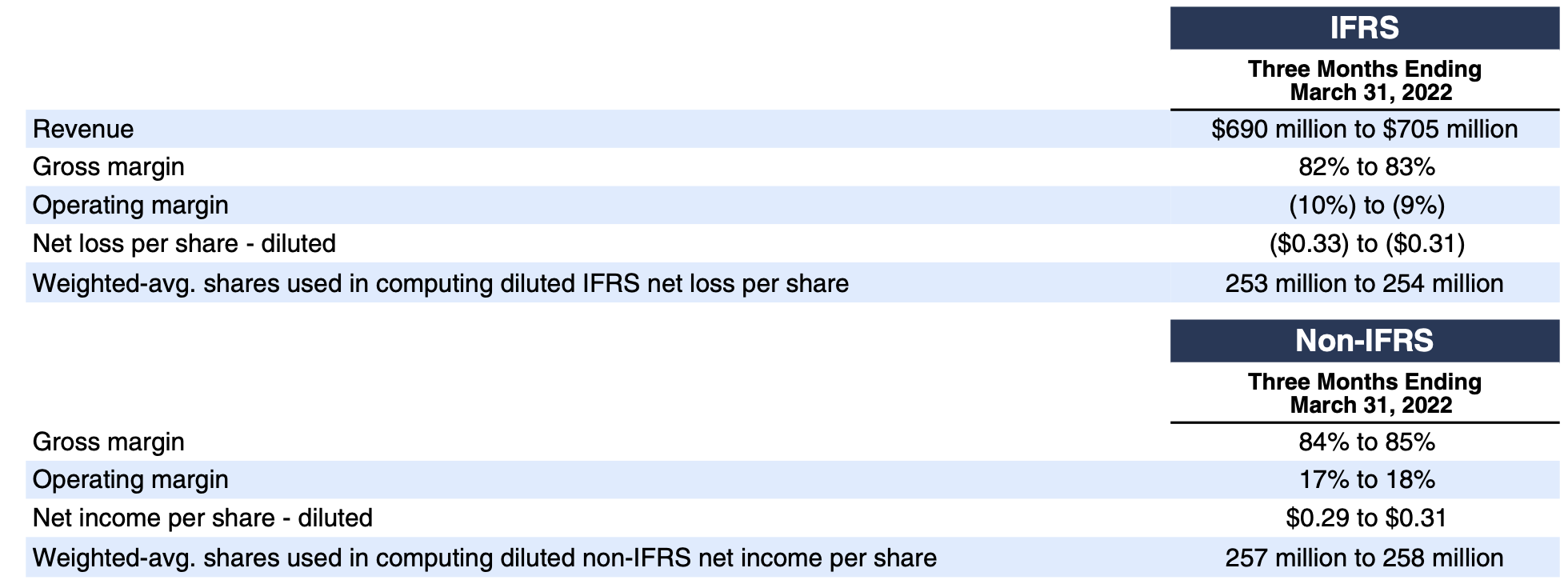

Financial targets

Fiscal 2022 outlook

Revenue

With the price changes to certain Data Center and Server products, and the end of upgrades for Server products both going into effect on February 15, 2022, we may see variability in total revenue as a result of customer purchasing behavior leading up to the effective date of these changes.

Recall, we observed unprecedented event-driven customer purchasing in Q3’21 driven by our announcement of the end of new Server license sales and price changes to our on-premises products. As a result, Q3’22 will likely be a tough compare from a year-over-year revenue growth perspective.

On migrations, we continue to believe we have a multi-year journey ahead of us and expect variability in our revenue growth as customers choose the timing of when to migrate to our Cloud or Data Center offerings.

In FY22, we expect to see the following trends:

Subscription revenue

- We now expect subscription revenue growth year-over-year to be approximately 50% for FY22, versus our prior expectation of mid-40s% growth.

- We expect our year-over-year subscription revenue growth rate to be lower in the second half of FY22 relative to the first half.

- Recall, our subscription revenue in Q3’21 benefited from a strong Data Center revenue growth rate, driven by accelerated demand resulting from the discontinuation of new Server license sales and customers purchasing ahead of both Server and Data Center price increases that went into effect during Q3’21.

- For Data Center revenue, a portion is recognized up-front as subscription revenue in the period that the contract is signed, while the remainder is recognized ratably over the life of the contract.

- In addition, it is important to note that Q4’21 continued to see strong Data Center revenue growth, as it benefited from ratable revenue rolling off of our deferred revenue balance. Our deferred revenue balance also benefited from the event-driven purchasing observed in Q3’21, as noted above.

- For FY22, we expect our Cloud revenue growth rate to accelerate relative to FY21.

Maintenance revenue

- We expect our Server business to be a driver of any revenue variability in Q3’22. We also expect maintenance revenue to slowly contract over the remainder of FY22 as customers continue to migrate to our subscription products. In Q4’22, we expect maintenance revenue to decline to approximately $100 million.

Other revenue

- We expect Marketplace revenue, which is reflected in other revenue and the primary driver of this line item, to be approximately flat relative to FY21.

- Recall, Marketplace revenue will be impacted by the lowered Marketplace take rates on the sales of third-party Cloud apps which are designed to incentivize further Cloud app development.

- Marketplace revenue will also continue to see a year-over-year headwind from the accelerated, event-driven app purchasing in Q3’21 across Server and Data Center. Note that revenue on the sale of third-party Marketplace apps is recognized in the period the product is purchased.

- We expect quarterly perpetual license revenue, which is also reflected in other revenue, to be flat sequentially at approximately $10 million for Q3’22. As noted above, upgrades of existing licenses will no longer be offered after Q3’22, and as a result, we do not expect any further perpetual license revenue in Q4’22 or beyond.

Profitability

We expect to further ramp our hiring plans in the second half of FY22 and beyond. As noted above, hiring and the retention of our talented team is the key to Atlassian’s future. We will continue to hire talent from across the globe with the majority in R&D.

Our investments will focus on platform advancements, new Cloud features and products in each of our three core markets, and bolstering the ecosystem around us.

We expect the following in FY22:

- Gross margin will decline in FY22 relative to FY21 due to our investments to support our Cloud migrations and the shift from Server to Cloud. These investments include migration-focused personnel costs as well as increased cloud hosting costs.

- Operating margin is expected to decline as we continue to invest in innovation, hiring and retaining top-tier talent.

- Free cash flow is expected to see variability as a result of the business mix shift to the Cloud as well as the impact of any event-driven customer purchasing activity related to the price changes and end of Server upgrades. The reduction in operating margin in FY22 noted above will also impact our free cash flow margin in FY22.

The above trends reflect our commitment to our long-term strategy and the massive market opportunities in front of us that we are well equipped to tap.

Share count

We expect share-based compensation (SBC) expense to be significantly higher in FY22 versus FY21 as we invest in hiring and retaining our team. Recall that we report our financial statements in accordance with IFRS. SBC is recognized on a more front-loaded schedule compared to U.S. GAAP. SBC is also impacted by a number of variables each of which are inherently difficult to forecast. We are targeting approximately 1-2% share count dilution in FY22. Despite the expected increase in SBC expense in FY22, our comparable share dilution will still be ranked in the lower half of our peer company set.

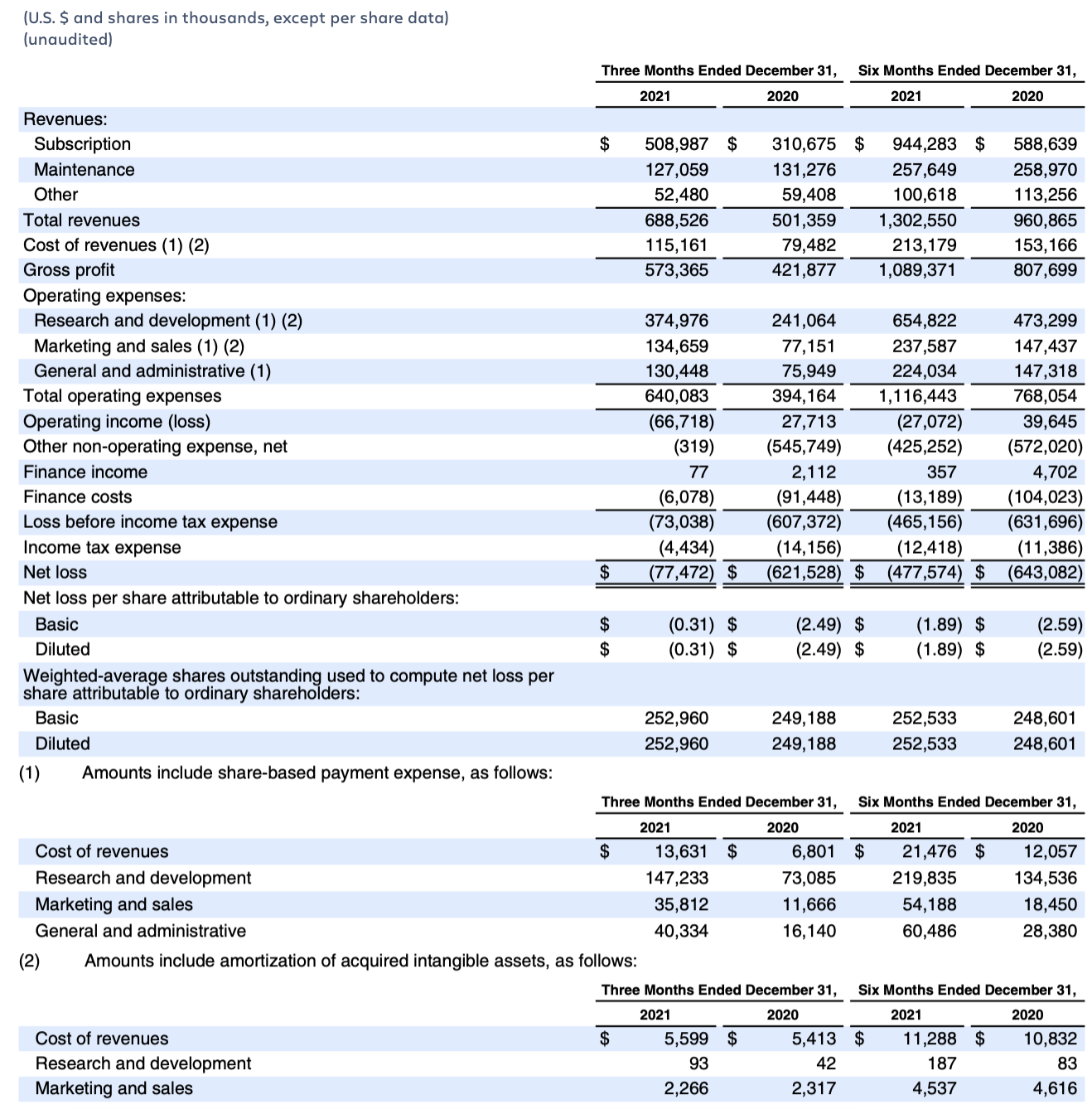

Consolidated statements of operations

Consolidated statements of financial position

Consolidated statements of cash flows

Reconciliation of IFRS to non-IFRS results

Reconciliation of IFRS to non-IFRS financial targets

Forward-looking statements

This shareholder letter contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, which statements involve substantial risks and uncertainties. All statements other than statements of historical fact could be deemed forward looking, including risks and uncertainties related to statements about our products, customers, anticipated growth, sustainability, Atlassian Marketplace, partnerships, acquisitions, strategic investments, outlook, technology and other key strategic areas, and our financial targets such as revenue, share count, and IFRS and non-IFRS financial measures including gross margin, operating margin, and net income (loss) per diluted share.

We undertake no obligation to update any forward-looking statements made in this shareholder letter to reflect events or circumstances after the date of this shareholder letter or to reflect new information or the occurrence of unanticipated events, except as required by law.

The achievement or success of the matters covered by such forward-looking statements involves known and unknown risks, uncertainties and assumptions. If any such risks or uncertainties materialize or if any of the assumptions prove incorrect, our results could differ materially from the results expressed or implied by the forward-looking statements we make. You should not rely upon forward-looking statements as predictions of future events. Forward-looking statements represent our management’s beliefs and assumptions only as of the date such statements are made.

Further information on these and other factors that could affect our financial results is included in filings we make with the Securities and Exchange Commission from time to time, including the section titled “Risk Factors” in our most recent Forms 20-F and 6-K (reporting our quarterly results). These documents are available on the SEC Filings section of the Investor Relations section of our website at: https://investors.atlassian.com.

About non-IFRS financial measures

Our reported results and financial targets include certain non-IFRS financial measures, including non-IFRS gross profit, non-IFRS operating income, non-IFRS net income, non-IFRS net income per diluted share, and free cash flow. Management believes that the use of these non-IFRS financial measures provides consistency and comparability with our past financial performance, facilitates period-to-period comparisons of our results of operations, and also facilitates comparisons with peer companies, many of which use similar non-IFRS or non-GAAP financial measures to supplement their IFRS or GAAP results. Non-IFRS results are presented for supplemental informational purposes only to aid in understanding our results of operations. The non-IFRS results should not be considered a substitute for financial information presented in accordance with IFRS, and may be different from non-IFRS or non-GAAP measures used by other companies.

Our non-IFRS financial measures include:

- Non-IFRS gross profit. Excludes expenses related to share-based compensation and amortization of acquired intangible assets.

- Non-IFRS operating income. Excludes expenses related to share-based compensation and amortization of acquired intangible assets.

- Non-IFRS net income and non-IFRS net income per diluted share. Excludes expenses related to share-based compensation, amortization of acquired intangible assets, non-coupon impact related to exchangeable senior notes and capped calls, the related income tax effects on these items, and a discrete tax impact resulting from a non-recurring transaction.

- Free cash flow. Free cash flow is defined as net cash provided by operating activities less capital expenditures, which consists of purchases of property and equipment and payments of lease obligations.

Our non-IFRS financial measures reflect adjustments based on the items below:

- Share-based compensation.

- Amortization of acquired intangible assets.

- Non-coupon impact related to exchangeable senior notes and capped calls:

- Amortization of notes discount and issuance costs.

- Mark to fair value of the exchangeable senior notes exchange feature.

- Mark to fair value of the related capped call transactions.

- Net loss on settlements of exchangeable senior notes and capped call transactions.

- The related income tax effects on these items, and a discrete tax impact resulting from a non-recurring transaction.

- Purchases of property and equipment and payments of lease obligations.

We exclude expenses related to share-based compensation, amortization of acquired intangible assets, non-coupon impact related to exchangeable senior notes and capped calls, the related income tax effects on these items, and a discrete tax impact resulting from a non-recurring transaction from certain of our non-IFRS financial measures as we believe this helps investors understand our operational performance. In addition, share-based compensation expense can be difficult to predict and varies from period to period and company to company due to differing valuation methodologies, subjective assumptions, and the variety of equity instruments, as well as changes in stock price. Management believes that providing non-IFRS financial measures that exclude share-based compensation expense, amortization of acquired intangible assets, non-coupon impact related to exchangeable senior notes and capped calls, the related income tax effects on these items, and a discrete tax impact resulting from a non-recurring transaction allow for more meaningful comparisons between our results of operations from period to period.

Management considers free cash flow to be a liquidity measure that provides useful information to management and investors about the amount of cash generated by our business that can be used for strategic opportunities, including investing in our business, making strategic acquisitions, and strengthening our statement of financial position.

Management uses non-IFRS gross profit, non-IFRS operating income, non-IFRS net income, non-IFRS net income per diluted share, and free cash flow:

- As measures of operating performance, because these financial measures do not include the impact of items not directly resulting from our core operations.

- For planning purposes, including the preparation of our annual operating budget.

- To allocate resources to enhance the financial performance of our business.

- To evaluate the effectiveness of our business strategies.

- In communications with our Board of Directors and investors concerning our financial performance.

The tables in this shareholder letter titled “Reconciliation of IFRS to non-IFRS Results” and “Reconciliation of IFRS to non-IFRS financial targets” provide reconciliations of non-IFRS financial measures to the most recent directly comparable financial measures calculated and presented in accordance with IFRS.

We understand that although non-IFRS gross profit, non-IFRS operating income, non-IFRS net income, non-IFRS net income per diluted share, and free cash flow are frequently used by investors and securities analysts in their evaluation of companies, these measures have limitations as analytical tools, and you should not consider them in isolation or as substitutes for analysis of our results of operations as reported under IFRS.

About Atlassian

Atlassian unleashes the potential of every team. Our team collaboration and productivity software helps teams organize, discuss and complete shared work. Teams at more than 225,000 customers, across large and small organizations – including Redfin, NASA, Verizon, and Dropbox – use Atlassian’s project tracking, content creation and sharing, and service management products to work better together and deliver quality results on time. Learn more about our products, including Jira Software, Confluence, Jira Service Management, Trello, Bitbucket, and Jira Align at https://atlassian.com.

Investor relations contact: Martin Lam, IR@atlassian.com

Media contact: M-C Maple, press@atlassian.com