What in the world is FinOps, and why do we need it?

This practice can save you big – but only if you plan for it.

In 2020, cloud migration sped up by a factor of 24, according to McKinsey. Would you be surprised to learn there were a lot of factors driving that shift?

Due to COVID-19, companies needed to go remote fast and securely. They wanted to lift the maintenance burden off overworked IT teams. And, in the face of the year’s worldwide economic uncertainty, motivation to take advantage of cloud’s cost savings was running high.

Of course, that last goal isn’t quite as simple as just moving to the cloud. Finance teams that want to take advantage of migration’s cost savings need to put some governance best practices into place.

This practice is called FinOps (cloud financial management) – here’s how it works.

What is FinOps?

Simply put, the FinOps framework prescribes finance best practices for the cloud. It’s about optimizing cloud spend to get the most value for your company. This may include negotiating rates with your vendors, tracking and optimizing free trials, auditing licenses and use, and forecasting costs, among other financial management tactics.

As The FinOps Foundation puts it, “[FinOps] is the practice of bringing financial accountability to the variable spend model of cloud, enabling distributed teams to make business trade-offs between speed, cost, and quality.”

Why do we need it?

IT pros say they save an average of 20 percent when they move to the cloud. But those savings aren’t a given for all migrations. The companies reaping the greatest benefits are intentional about their financial planning and governance.

In other words, without a strong FinOps operation, your company may be paying for things it doesn’t need, tools no one is using, licenses that have been abandoned. Even with the inherent savings of cloud, your spending can balloon over time if you aren’t paying attention. The goal of FinOps is to prioritize ongoing optimization of your cloud costs, to make sure your teams are getting maximum value for minimal spend.

Without a strong FinOps operation, your company may be paying for things it doesn’t need, tools no one is using, or licenses that have been abandoned.”

5 FinOps best practices

1. Plan for FinOps before you migrate to cloud

As with all strategic planning, the best time to think about FinOps is before you migrate. This will help you not only plan for future cost optimization in areas like scaling and shadow IT, but also take advantage of current opportunities like free trials and bulk user pricing.

It also helps teams understand the difference between financial planning for on-prem and financial planning in the cloud.

For example: with on-prem, IT teams often purchase more seats/licenses than the business actually needs because they have to plan for growth, and adding licenses later can be a burdensome process. Most cloud providers allow you to purchase the licenses you need right now and add or subtract as your cloud usage evolves. Often, you can even often automate license renewals or expirations to align with your business (letting temporary contractor licenses expire at the end of their contracts, for example). In this scenario (and many others), cost management looks very different for on-prem vs. cloud.

2. Don’t sacrifice value for savings

When we talk about cost optimization, the first thing that comes to mind might be saving money. But that’s not really the point. The point is getting as much value as possible out of your spending. Which means FinOps isn’t about finding the cheapest options along the way; it’s about balancing those savings with their trade-offs.

For example: A FinOps analyst may recommend taking full advantage of a three-month free trial to save money. Or they may recommend moving onto a paid plan quickly in order to take advantage of additional features, support, and integrations – it all depends on context. For one company, the benefit of upgrading immediately may trump the cost savings of waiting out the free trial. For another company, the reverse may be true.

3. Calculate your actual costs

If FinOps is about financial accountability, a key step is understanding what you’re spending, both up front and on an ongoing basis.

This can be trickier than you’d think, especially for large organizations where siloed teams may not be communicating their spending at a granular level. Which is why calculating total cost of ownership (TCO) and return on investment (ROI) takes time, and should be factored into your timelines and budgets.

One of the key responsibilities of FinOps practitioners is not only calculating current TCO and ROI, but also forecasting future costs and doing regular audits.

4. Build FinOps into your organization as an ongoing practice

It’s easy to think of FinOps as a one-time strategic task, something the team needs to understand and plan for before you migrate. But the most successful companies don’t stop at the planning stage. They set clear, ongoing roles and responsibilities that keep costs under control in the long term.

This often includes regular audits and forecasting and making sure the FinOps team is involved in any major software decision-making processes.

5. Set clear responsibilities

Who’s responsible for FinOps in your organization? Will you have a dedicated professional? Someone embedded in your existing financial or cloud teams? What are their exact responsibilities? And who among your other teams will be tasked with providing them with the things they need?

In many cases, a move to the cloud frees up substantial time for your IT team and changes their roles, so those newly freed-up IT pros are a great place to start when thinking about who will keep up with your Cloud FinOps practices. Instead of babysitting servers, fixing bugs, and creating wonky workarounds in your on-prem software, admins have room to think strategically about cloud investment, track the tools teams are using across the organization, and make sure you’re getting the most out of your IT spend.

As with anything in business, if nobody owns it, it’s going by the wayside – fast. Optimizing your spending matters – make sure everyone understands who is responsible for it.

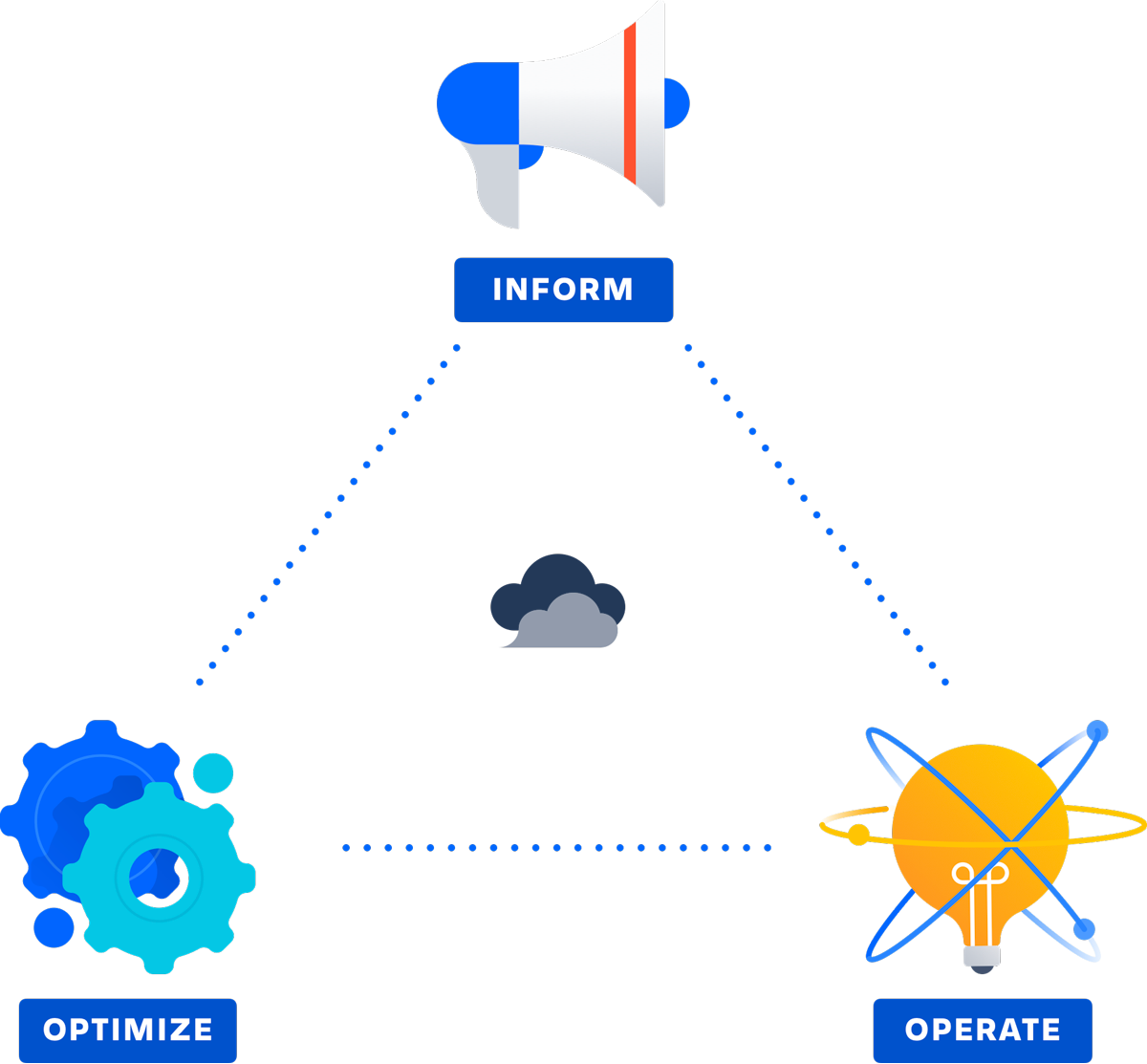

Inform, optimize, operate

FinOps teams typically describe their practice as a three-step cycle.

First, you inform your organization. This means getting visibility into all cloud spending (licenses, maintenance, IT time, etc.) and benchmarking it against internal goals and industry norms.

Next, you optimize. This phase involves ditching services or upgrades you no longer need, automating, rightsizing resources, and otherwise strategically analyzing your cloud spend.

Finally, you operate, continuously improving not only to cut costs, but also make room for innovation and efficiency.

This is not a one-and-done process. Top-performing teams don’t stay in the operate phase, but regularly return to the inform and optimize phases to keep improving.

Thinking about how to maximize value for your own migration? We’re offering server and data center customers up to 12 months to try cloud.